Economic situation: Nothing to cheer about

Debt servicing to increase when repayments to IMF start next year.

As the impact of increase in electricity charges and petroleum product prices to be seen in November, coupled with the effect on prices due to floods and the expected implementation of Reformed General Sales Tax (RGST) regime, inflation is expected to remain on the higher side during fiscal year 2011, said Crosby Securities Deputy Head of Research Fatima Anis.

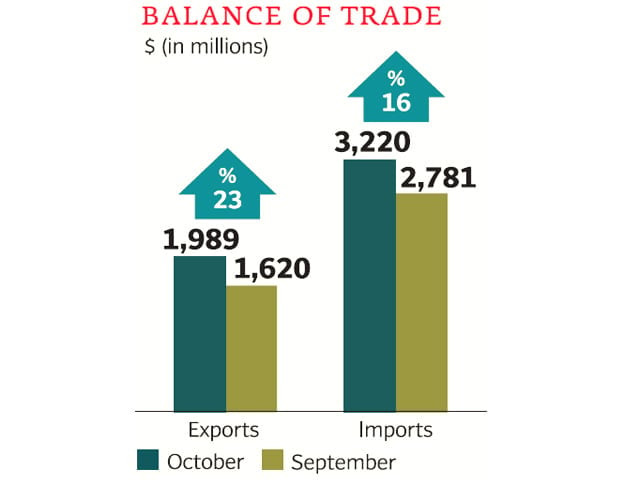

Balance of trade weakens

Exports have increased by 19 per cent against a rise in imports of 16 per cent during the first four months (July-October) of fiscal 2011, widening the trade deficit by 12 per cent to $5.08 billion against the previous year’s $4.54 billion.

Crude oil prices have increased by almost 11 per cent on average, being one of the significant components of the increase in imports, said Anis. With debt servicing bill on the rise, the current account deficit is also set to widen, pointed out Anis.

Record high remittances

Remittances continue to register record high levels of $3.5 billion during the first four months of fiscal 2011 compared with $3.09 billion in the same period last year, with the country continuing to depend more on these to keep the current account deficit afloat.

Foreign direct investment weakened by 28 per cent during the period under review, which indicates lack of confidence of investors mainly due to security and political issues in the country.

Going forward, with repayments of the International Monetary Fund standby loan to start from fiscal year 2012, the amount of debt servicing would increase further, pressuring foreign reserves and the current account deficit, said Anis.

On an overall basis, Pakistan is still treading on fragile grounds economically with various leakages hindering the path towards economic stabilisation, coupled with estimated $10 billion in losses inflicted by recent floods, said Anis.

Inflation is on the rise along with government borrowings while the economic managers are struggling to keep the fiscal deficit at the minimum. With monetary policy review due at the end of November, the SBP can again go for another 50-basis-point increase in the wake of all the above challenges, concluded Anis.

Published in The Express Tribune, November 20th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ