Weekly review: Oil slump drags KSE-100 below 30,000 points

Declining crude prices and global equity sell-off impacted the market.

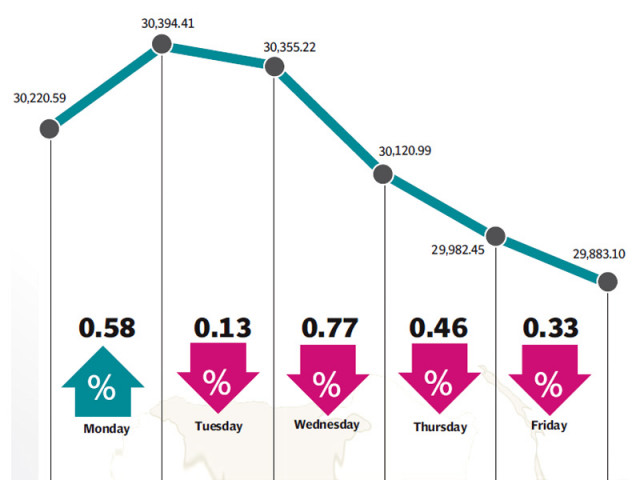

The stock market took a beating this week as a slump in global oil prices took its toll on the index heavyweight oil and gas sector, resulting in the KSE-100 index falling 275 points (0.9%) during the week that ended on October 17.

The benchmark index fell below the 30,000-point barrier and ended the week on 29,883. With the global economy slowing down, a widespread equity sell-off was witnessed in the Asia-Pacific region which the local bourse could not evade.

Oil prices were the biggest culprits in the market’s bad fortune as global crude prices hit multi-year lows during the week. The price of Brent crude fell $4 on Tuesday alone and pushed its price to $85 per barrel from its high of $115 in June 2014.

The impact of this sharp decline was felt worldwide and Pakistan was not an exception as a sell-off was witnessed in the heavyweight oil and gas sector. The decline in the Oil and Gas Development Company’s share price alone contributed 136 points to the index’s fall.

It was followed by price decline in the stocks of Pakistan Petroleum Limited, Pakistan Oilfields Limited and Pakistan State Oil, which cumulatively contributed 184 points to the index’s decline.

Equity markets in the entire Asia Pacific region took a beating as a result with concerns about the state of the global economy. Foreigners continued to be net sellers at the bourse and offloaded equity worth a net $9 million during the week.

The latest macroeconomic data did not help matters as the country’s trade deficit shot up 45% year-on-year to $6.5 billion for the first quarter of the current fiscal year. However, there was some positive news on the remittances side which grew 19.5% in the same period and stood at $4.69 billion.

After months of delays, it also emerged during the week that the International Monetary Fund will conduct the fourth review of the Extended Fund Facility and club it with the fifth for a total of $1.1 billion before December 2014. The receipt of the IMF loan tranches, if they occur, should help control the depreciation of the rupee against the dollar moving forward.

The corporate earnings season for the quarter kicked off this week with Pakistan Telecommunications announcing lower-than-expected earnings, resulting in its share price falling by 7%. The earnings season will continue for the next two weeks and will be looked at closely by investors.

Average trading volumes shot up 23.6% and stood at 216 million shares traded per day, following the holiday lull in the previous week. Similarly, average trading values were also rose by 31% and stood at Rs9.6 billion per day. The KSE’s market capitalisation stood at Rs6.95 trillion at the end of the week.

Winners of the week

Bata Pakistan

Bata Pakistan Limited manufactures and sells rubber, leather, and microlon sandals and shoes.

JDW Sugar

JDW Sugar Mills Limited produces and sells crystalline sugar. The company is located in District Rahim Yar Khan, and formerly named United Sugar Mills Limited.

NetSol Technologies

NetSol Technologies Limited provides information technology solutions and services. The company’s services include custom software development, technology outsourcing, systems integration, application development, and business intelligence consulting.

Losers of the week

Pakistan State Oil

Pakistan State Oil Company Limited specialises in the marketing and storage of petroleum and related products. The company also blends and markets lubricating oils.

Pakistan Telecommunication Company Limited

Pakistan Telecommunication Company Limited provides fixed line domestic and international telephone services, telex, telegraph, fax and leased circuit services in Pakistan. The company owns all public exchanges, the nationwide network of local telephone lines, principal long distance transmission facilities and international telephone gateways in Pakistan.

Hum Network Limited

Hum Network Limited operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Published in The Express Tribune, October 19th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ