Weekly review: KSE-100 index rises 397 points as banking sector rebounds

Foreign buying and interest in OGDC also contributed to the gains

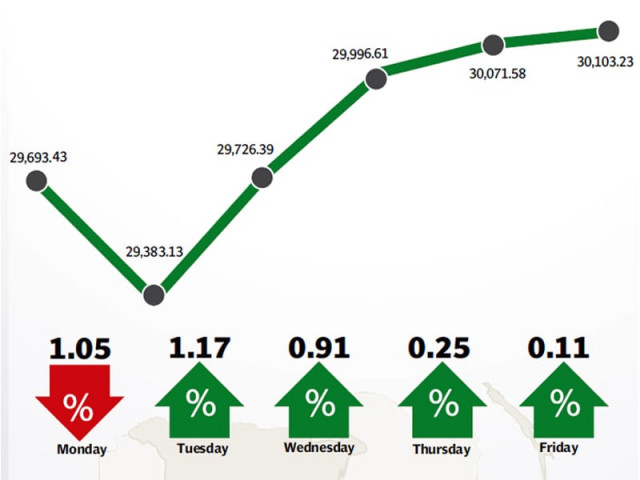

The stock market recovered losses from the previous week as interest in the banking sector resulted in the KSE-100 index again breaching the 30,000 barrier, climbing 397 points (1.3%t) to close at 30,103 on Friday.

The benchmark index has shifted between both sides of the 30,000-mark in recent weeks as political uncertainty has left investors unconvinced about the market’s future. However, activity in the banking sector along with foreign buying reignited the market resulting in the index closing firmly above 30,000 points at the end of the week.

The banking sector took centre stage following the revelation of inflation numbers for September which clocked in higher-than-expected at 7.68% as compared to 7% in August. With floods hitting the country, food inflation is expected to go up, further resulting in a higher CPI in the coming months, which in turn can prompt a hike in the discount rate.

During the week, the State Bank of Pakistan also announced that it would raise Rs1.4 trillion during the second quarter of the current fiscal year through PIBs and T-Bills. Banking sector stocks jumped on these developments with Habib Metropolitan Bank’s share price jumping 14% during the week. Similarly, Allied Bank Limited, National Bank of Pakistan, United Bank Limited and Habib Bank climbing 6.2%, 3.6%, 2.9% and 2.3%, respectively.

The week also saw a turnaround in the fortunes of the index heavyweight Oil and Gas Development Company as full details of its global depositary receipts (GDRs) issuance were revealed. The company’s stock had taken a beating in recent weeks amid rumours of the issue being offered at a significant discount to its current market price.

However, with the investor roadshow kicking off this week along with the announcement of firm dates for the GDR issuance, investor interest was rekindled and the company’s share price rose Rs4.2 and contributed 52 points to the KSE-100’s gains.

Foreign buying was another major positive for the bourse this week as foreigners purchased a net of $9.4 million worth of equity during the week. The statistic was significant as sharp dips were witnessed in foreign buying in the previous two weeks and the turnaround was a positive signal for local investors.

On the macro front, it was a mixed bag of news flows. On the positive side, the FBR reported that tax collection jumped 14% in the first quarter of the fiscal year and stood at Rs549 billion. On the negative side, the country’s foreign exchange reserves fell $94 million to $13.2 billion and the Pakistani rupee continued to depreciate against the greenback.

Average trading volumes fell 22.7% ahead of Eid holidays and stood at 119.5 million shares traded per day, while average daily values also fell 23.6% and were recorded at Rs6.40 billion. The KSE’s market capitalisation stood at Rs7.01 trillion at the end of the week.

Winners of the week

Habib Metropolitan Bank

Habib Metropolitan Bank Limited is a fully accredited commercial bank. The bank provides banking services to individual and corporate customers including personal loans, education loans, mobile banking, cash management services, short and long term financing, international trade, and savings accounts.

Pakistan Cables

Pakistan Cables Limited manufactures and distributes copper rods, wires, cables and conductors, aluminium profiles and anodised fabrications.

Dawood Hercules

Dawood Hercules Corporation Limited produces urea fertilisers. The company also produces anhydrous ammonia for manufacturers of soda ash, fructose, and other chemicals.

Losers of the week

Shifa International Hospital Limited

Shifa International Hospitals Limited establishes and runs medical centres and hospitals in Pakistan. The company’s clinical services include medicine, paediatrics, surgical, obstetric and gynaecology, dentistry, rehabilitation services and ophthalmology. Shifa also provides diagnostic services including specialised diagnostics, radiology and clinical laboratory.

Hum Network Limited

Hum Network Limited operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Murree Brewery

Murree Brewery Company Limited specializes in the manufacture of beer and Pakistan Made Foreign Liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Published in The Express Tribune, October 5th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ