Weekly review: KSE-100 sheds 304 points despite Friday recovery

Political deadlock led to sell-off, uncertainty persists.

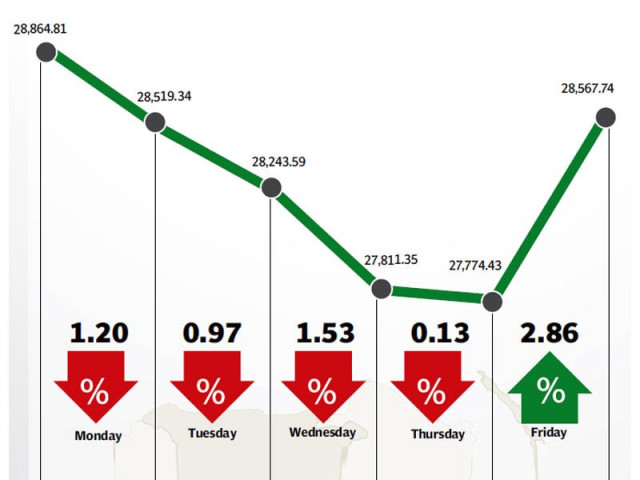

The stock market suffered another torrid week as the ongoing political deadlock entered its third week resulting in the benchmark KSE-100 index falling 304 points (1.1%) during the week ended August 29.

Investors remained on the sidelines as the political impasse showed no signs of coming to an end. With both protesting parties vehemently demanding the resignation of the prime minister, fears grew that the military or the judiciary would intervene resulting in a radical change in the political landscape of the country.

The government for its part decided to engage the protesters by negotiations but stood firm against the demand for the PM’s resignation. The index plummeted more than 1,000 points in the first three sessions of the week, falling below the 28,000-point barrier as a result.

However, towards the end of the week, the government held talks with the Chief of Army Staff, General Raheel Sharif and requested him to mediate between them and the protesting parties. The decision to appoint the army as the mediator was received with excitement at the bourse resulting in a recovery of 793 points on Friday. The KSE-100 index ended the week at 28,567 points.

The political situation also continued to take its toll on foreign buying as net buying stood at $8.5 million for the week. That brought the total net foreign buying in the last 3 weeks to $14.2 million. The number paled in comparison to the $22 million net inflow during the first week of August.

The country’s deteriorating foreign exchange reserves position didn’t help sentiments as reserves dropped $344 million to $13.6 billion, according to the latest State Bank of Pakistan figures. The week also saw the receipt of $371 million under the Coalition Support Fund which should help shore up reserves in the short-term.

With the country’s reserves declining, the rupee became volatile and continued to lose value against the US dollar, touching Rs103 per dollar at one point during the week, before the SBP’s intervention which resulted in the exchange rate falling below Rs102.

The ongoing corporate earnings season failed to make an impact on the market, despite solid earnings announcements from Pakistan Petroleum Limited, Indus Motor and K-Electric.

The cement sector received a battering during the week as the South African Trade Commission began investigations against Pakistani cement exporters over allegations of dumping cheap cement in the country. Lucky Cement, the country’s largest cement exporter, fell 11% during the week and contributed 103 points to the KSE-100’s decline.

Trading volumes remained dismal as investors adopted caution. Average daily volumes fell 4.4% and stood at 119 million shares traded per day, while average daily values also fell 3.7% to Rs6.33 billion per day. The KSE’s market capitalisation stood at Rs6.72 trillion at the end of the week.

Winners of the week

K-Electric Limited

K-Electric Limited is a power producer, which transmits and distributes electricity.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Grays of Cambridge

Grays of Cambridge (Pakistan) Limited is a holding company. The company, through its subsidiaries, manufactures and exports sporting goods, specialising in hockey sticks.

Losers of the week

Lucky Cement

Lucky Cement Limited manufactures and sells cement. The company’s cement brands include Lucky Gold Brand, Lucky Brand and Lucky Star Brand. Lucky Cement’s main plant site is located at Lucky Marwat in Khyber-Pakhtunkhwa.

Hum Network Limited

Hum Network Limited operates satellite television channels. The Company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Sui Southern Gas Company

Sui Southern Gas Company Limited transmits and distributes natural gas, and constructs high pressure transmission and low pressure distribution systems. The Company’s transmission system extends from Sui in Balochistan to Karachi in Sindh.

Published in The Express Tribune, August 31st, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ