Sector overview: Property prices arrested in the wake of turmoil

Real estate sector affected by political unrest, revised tax rates.

One probably does not realise it but the effects of a protest such as the one in Islamabad are profound.

It has been a topsy-turvy year for PML-N with persistent load-shedding crippling the country and the tussle with the opposition unsettling the government.

The protests in Islamabad have also presented challenges to the real estate sector, affecting prices in various trading housing schemes. The budget for the ongoing fiscal year also levied additional taxes on sale and purchase of property, forcing buyers to be cautious. Several experts waited with bated breath, expecting the market to pick up after Eid, but so far, that has not been the case.

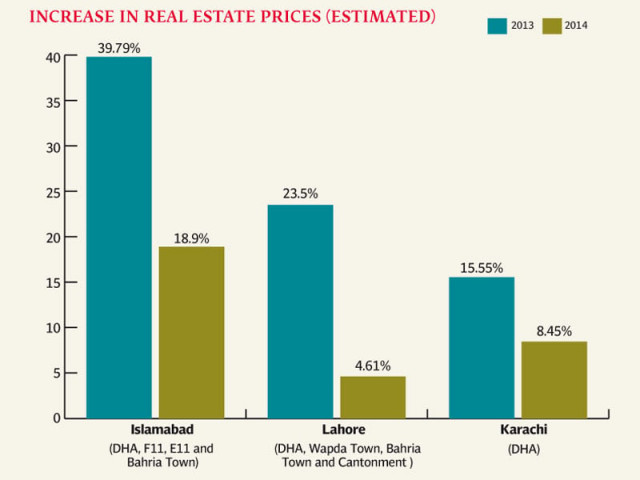

Property values, which rose rather sharply in 2013, have now slowed down during the first half of calendar year 2014.

With these conditions shaping the landscape, the recent sit-ins – staged by Imran Khan-led PTI and Tahirul Qadri’s PAT – continue to threaten the economic progress of Pakistan including its real estate sector.

According to zameen.com, a property portal, nearly every notable locality in Lahore, Karachi and Islamabad showed rapid gains in the first half of 2013.

Looking at Islamabad alone, the price of a one-kanal plot rose 39.79% in hot investment spots like the DHA Islamabad, F11, E11 and Bahria Town. However, in the first half of 2014, only an 18.9% increase has been observed.

Popular locations in Lahore like DHA, Wapda Town, Bahria Town and Cantonment witnessed a rise of 23.5% in the first half of 2013 but only an increase of 4.61% was witnessed during the first half of 2014

Similarly, in DHA and DHA City Karachi, the average price increase in the first half of 2013 was 15.55%. However, average prices rose only 8.45% during the comparative period in 2014, according to zameen.com.

Ghani Estate Chief Executive Officer Nawaz Ghani said the budget announced by the government has affected the real estate sector. “It has definitely affected buying and selling of property. Even though prices are steady, the new rates of taxes have hardly left any buyers in the market.”

In this year’s budget, the government levied an adjustable advance tax to be collected on the purchase of immovable property at the rate of 1% for compliant taxpayers and 2% for non-compliant ones. Properties worth less than Rs3 million, however, were exempted from this tax.

However, in the larger scheme of things, the real estate sector of Pakistan is still performing consistently. Numbers from the property markets across Pakistan are a sign of the country’s resilience.

“Our research indicates that the property sector seems to be weathering this latest storm well,” said Zeeshan Ali Khan, CEO and Co-Founder of Zameen.com.

Published in The Express Tribune, August 21st, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ