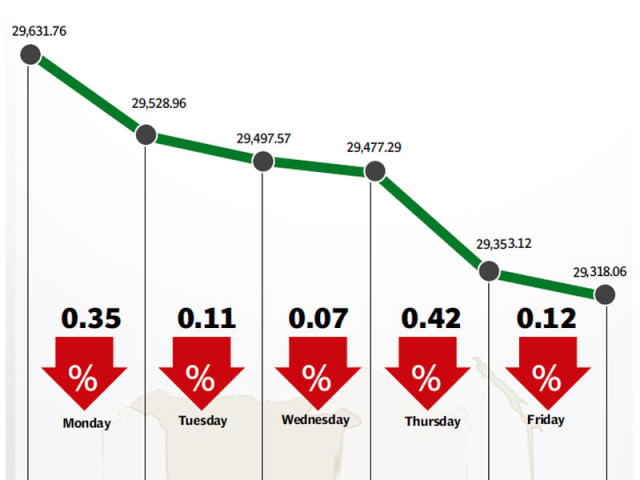

Weekly review: Index sheds 302 points as trading volumes plummet

Delay in monetary policy announcement and lack of triggers contribute to the fall.

The stock market wore a deserted look as lack of triggers kept investors sidelined and resulted in the benchmark KSE-100 index falling 302 points (one percent) during the week ended July 11.

Trading volumes fell sharply, as the shortened Ramazan timings coupled with a lack of positive news flows meant that average trading volumes stood at just 59.5 million shares traded per day, down by 44% over the previous week.

Volumes fell to a 23-month low on Wednesday, with only 39 million shares being traded at the bourse. The low number served as a stark reminder of the bleakest days of the KSE when volumes fell to extremely low levels during the Capital Gains Tax saga.

Investor sentiment was also hurt by the State Bank of Pakistan (SBP) delaying the monetary policy announcement July 12 to July 19. It is largely expected that the SBP will maintain status quo in this announcement, especially after the International Monetary Fund (IMF) highlighted that monetary tightening was required to curtail growing inflation numbers.

Another contributing factor for the index’s lacklustre performance was the decline in foreign participation. Foreigners were net buyers of equity worth $8.2 million during the week. However, this number was down almost 50% compared to the $15.4 million net buying in the previous week.

On the macro front there were quite a few positives, but failed to make an impression on the market. The country’s foreign exchange reserves shot up by $647.6 million and stood at $14.64 billion, according to the latest SBP figures. The boost mainly came from the receipt of $556 million from the IMF under the extended fund facility.

Remittances for the month of June 2014 clocked in at $1.5 billion, as compared to $1.2 billion for the same period last year. Total remittances for fiscal year 2014 stood at $15.8 billion, up 13.7% from a year ago.

In corporate news, it emerged that the government had finalised plans to complete the privatisation of the Oil and Gas Development Company by September 2014. The news comes on the back of a successful SPO of Pakistan Petroleum Limited and can be expected to keep OGDC’s stock in the limelight in the coming months.

On the other hand, Pakistan State Oil’s receivables continued to grow and stood at Rs181 billion according to latest figures. The government has shown unwillingness to bridge the financing gap to the company and could result in a default on its debt obligations to international suppliers.

The decline in daily volumes was surpassed by the decline in average trading values during the week as activity was biased towards second and third-tier stocks. Average daily value clocked in at a paltry Rs2.7 billion per day during the week. The market capitalisation of the Karachi Stock Exchange stood at Rs6.90 trillion at the end of the week.

Winners of the week

Pakistan Services

Pakistan Services Limited is the holding company for Pearl Continental Hotels (Private) Limited, which constructs, operates and manages hotels. The group also owns a number of smaller companies that provide Rent-A-Car, travel arrangements and tour packages.

Shezan International

Shezan International Limited manufactures and sells juices, beverages, pickles, preserves, and flavorings which are all derived from fresh fruits and vegetables.

Arif Habib Corporation

Arif Habib Corporation Limited is a holding company. The company holds interests in the securities brokerage, investment and financial advisory, investment management, commercial banking, commodities, and private equity, cement and fertiliser industries.

Losers of the week

Allied Bank Limited

Allied Bank Limited is a full service bank with a focus on retail banking. The bank offers a wide range of financial products and services, including deposit accounts, foreign currency accounts, demand finance, and online banking services.

Jahangir Siddiqui & Company

Jahangir Siddiqui and Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

TPL Trakker Limited

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centers and offices located in Pakistan and elsewhere throughout the world.

Published in The Express Tribune, July 13th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ