Foreign Direct Investment dropped by almost 50%

Foreign Direct Investment in Pakistan has dropped by almost 50 per cent in the first nine months of the Fiscal Year-2010.

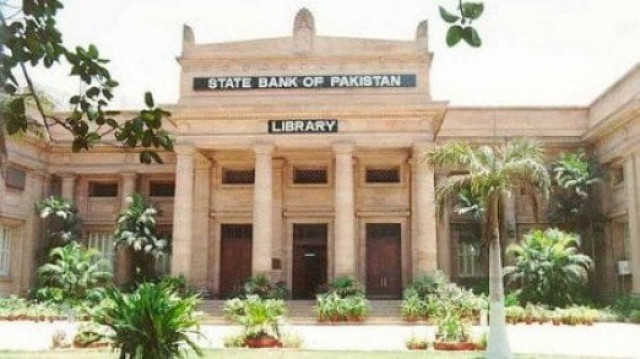

Investment in the period ended March 31 fell to 1.5 billion dollars from three billion dollars compared to the same period in Fiscal Year 2009. The latest figures have been released in a statement by the State Bank of Pakistan's Karachi head office.

SBP says global funds sold a net 182.6 million dollars worth of Pakistani stocks. Last fiscal year's sales of stocks was 957.5 million dollars.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ