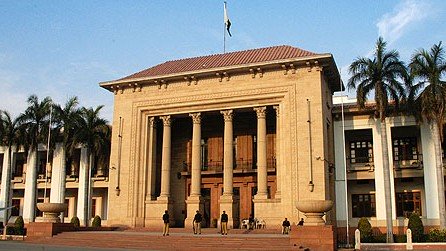

The Punjab Finance Bill 2014 was passed in the Punjab Assembly on Tuesday amid a boycott of the proceedings by the opposition. The government also managed to pass several other bills, including one pertaining to the establishment of a provincial security council to tackle terrorism.

Passage of the Punjab Finance Bill 2014 marked the completion of the process for adopting the annual provincial budget. Two other bills: Bab-i-Pakistan Foundation Bill, 2014 and the Management and Transfer of Properties by Development Authorities Bill, 2014, were also passed.

The treasury also presented a Schedule of Authorised Expenditures for the year 2014-15.

Law minister Rana Mashhood introduced five ordinances which were forwarded to select committees. Two of the ordinances seek to amend the Punjab Local Government Ordinance. The other three ordinances forwarded to the committee are: the Punjab Registration of Godowns Ordinance, 2014; the Punjab Strategic Coordination Ordinance, 2014; and the Punjab Overseas Pakistanis Commission Ordinance, 2014.

Leader of the Opposition Mehmoodur Rashid said the opposition had boycotted the proceedings because their views on the budget had not been heard by the government.

Finance Act 2014

The Finance Act includes several taxes for the rich. Houses in the Cantonment and on Walton Cantonment built over two kanals or more would be taxed from Rs250,000 per kanal to Rs2 million. For houses built over eight kanals or more, the tax is Rs300,000 per kanal. In divisional headquarters, district and cantonments in the district divisional headquarters, the tax for two kanals or above is Rs200,000 per kanal and Rs250,000 per kanal for houses built on eight kanals or more. The rate of tax for two kanals or more in the remaining areas and cantonments is Rs150,000 and Rs200,000 for houses built on eight kanals or more.

The annual token tax on 1,300cc vehicles and above has been doubled. An annual tax has also been announced for imported vehicles of 1,590cc and above. The annual rate of tax for imported vehicles between 1,590cc to 1,990cc engine capacity is Rs20,000. Rs25,000 tax has been announced for vehicles exceeding 1,990cc engines capacity and Rs35,000 for vehicles with engine power exceeding 2,990cc.

The Finance Act has also increased stamp duty on immoveable property by one per cent. The payment of stamp duty on transfer of immovable property has been increased from 2 per cent to 3 per cent and the registration fee slashed from 1 percent of the property value to Rs500 or Rs1,000, depending on the value of property.

The government revised the valuation list of properties under the Punjab Urban Immovable Property Tax Act 1958 after 13 years. The list will be enforced to help in assessing and collecting property tax with effect from July 1.

The government has witnessed growth in sales tax collection over the last two years. The Finance Act includes 10 new services that are to be taxed now. These include special workshops, repair and maintenance, indenting brokerage, call centres, lab services (other than pathological and diagnostic testing of patients), physical fitness services, laundry and dry cleaning services, cable TV, TV/radio programme production and print media advertisements (reduced rate of five per cent). The act says that this would bring equity to the sales tax base and harmonise the service tax system of Punjab with other provinces.

Provincial Security Council

The Punjab Strategic Coordination Ordinance 2014 was promulgated and notified on June 9, 2014. It aims to establish the Provincial Security Council and the Punjab Strategic Coordination Board.

The ordinance states that it is expedient to establish an institutional mechanism to take effective measures to counter terrorism, formulate security and counter-terrorism policy and deal with ancillary matters. There will be a provincial security council chaired by the Punjab chief minister. The council will approve the provincial security and counter-terrorism policy, review and monitor coordination among security and criminal justice agencies, approve actions to be taken by security and justice sector agencies and supervise the provincial strategic coordination board. The board will assist the council in formulating a provincial security and counter-terrorism policy and monitor compliance.

The speaker adjourned the session until Wednesday morning.

Published in The Express Tribune, June 25th, 2014.

1731570357-0/elon-musk-(1)1731570357-0-165x106.webp)

-(1)1717678110-0/Kendrick-(1)-(1)1717678110-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ