Weekly review: Market undergoes correction amid uncertainty

Inflation figures and political uncertainty keep investors on the sidelines.

Inflation figures and political uncertainty keep investors on the sidelines.

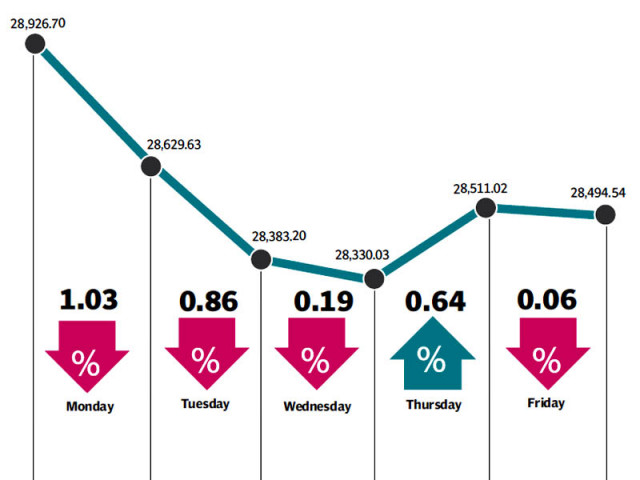

Lack of triggers resulted in subdued trading at the stock market as the benchmark KSE-100 index underwent a correction and fell 426 points (1.5 %) during the week ended May 9.

Uncertainty on the macroeconomic as well as political fronts led to investors staying on the sidelines, as average volumes fell 30% and the KSE-100 index closed in the red in 4 out of the 5 sessions of the week.

The week started off on a negative note as the market adjusted to the inflation numbers for April 2014, which were announced the preceding Friday. The CPI figure clocked in at 9.2%, up from the 8.5% figure from March 2014.

To add to the negativity, the International Monetary Fund insisted that the central bank should raise the discount rate to curb the rising inflation. The news came as a shock to investors who were anticipating a discount rate cut in the upcoming monetary policy announcement on May 16.

However, the possibility of a 50 bps rate cut remains as the country’s foreign exchange reserves continued to grow, crossing the $12 billion mark according to latest figures revealed by the State Bank of Pakistan. The monetary policy announcement is likely to have a significant impact on the market’s direction moving forwards.

The country’s political situation also had a negative impact on the market as the Pakistan Tehreek-e-Insaaf (PTI) planned to hold protests against election rigging on the first anniversary of the country’s general elections on May 11. Investors’ fears were allayed towards the end of the week after the party announced that they do not intend to derail the democratic process.

In sector specific news, the oil marketing sector came under pressure as the country’s circular debt again reached Rs300 billion. According to reports, Pakistan State Oil defaulted on its payments to suppliers and would suffer a penalty as a result.

The company’s share price received a battering earlier in the week but recovered eventually after news emerged that the Economic Coordination Committee would approve an increase in the margins of OMCs.

The fertiliser sector also suffered a torrid week after the ECC decided to divert gas from the sector towards power generation and the CNG sector. Gas supply from the Guddu power plant to Engro’s Enven plant was also ceased this month, resulting in the stock remaining under pressure throughout the week.

Despite the uncertainty and negative news flows, foreigners continued to be net buyers at the market and purchased a net of $5 million worth of equity. The direction of foreign flows in the coming weeks will be closely watched by investors.

Average daily volumes continued dropped sharply and stood at 140.6 million shares traded per day, down 30% over the previous week. Similarly, average daily values also fell 27 % and stood at Rs6.18 billion traded per day on average.

Winners of the week

Hum Network Limited

Murree Brewery Company Limited

Losers of the week

Atlas Honda

Pakistan Services

Published in The Express Tribune, May 11th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ