Market watch: Index ends in red as inflation figures disappoint

Benchmark KSE-100 index falls 291.50 points.

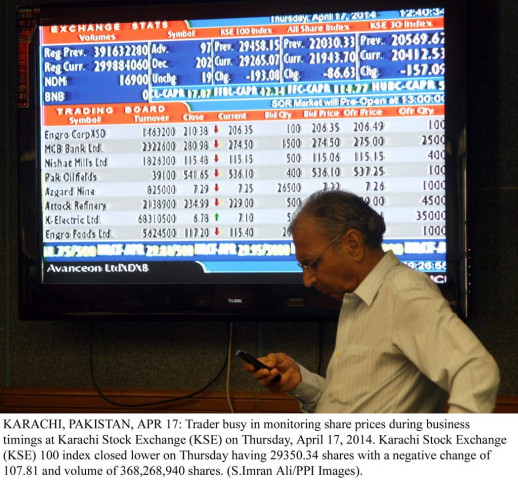

Trade volumes fell 182 million shares compared with Friday’s tally of 190 million shares. PHOTO: PPI/FILE

The Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 1.01% or 291.50 points to end at 28,629.63.

According to Naveen Yaseen of Elixir Securities, Pakistan equities closed the first day of the week in red as Consumer Price Index(CPI) inflation numbers for April that were announced on Friday disappointed investors and hopes of benchmark rate cut in coming policy announcement was set aside.

“Financials that led the recent gains were the victim of profit taking with United Bank Limited (UBL PA -4.7%) hitting lower price limit, trading SPOT T+1 on Rs2.5/share cash dividend,” said Yaseen.

“Pakistan State Oil (PSO PA -3.2%) was also the day’s loser along with other energy names (such as Pakistan Petroleum Limited) as media reports suggest energy sector circular debt is hitting new highs.

“Reported foreign selling in Nishat Mills Limited (NML PA -4.7%) pressured the stock to hit its lower price limit during the day as stronger rupee and lower spinning margin will dent textile earnings,” said Yaseen.

“Cements gave in to broader market direction despite news of increase in retail prices in southern region with DG Khan Cement (DGKC PA -.4%) and Lafarge Pakistan (LPCL -2%).

“Politics will possibly gain more attention in days ahead as few opposition parties plan demonstration over the weekend, protesting against rigging in last year’s election,” concluded Yaseen, adding that investors should expect lacklustre trading with locals eyeing foreigners’ activity and likely staying sidelined till policy announcement due mid this month.

Meanwhile, JS Global analyst Ovais Ahsan said that the market delved into negative territory reacting to IMF’s statements in the print media hinting at the agency pushing for an increase in interest rates to counter rising inflation.

“Star performance credit were taken by Packages Ltd (+5%) as the company announced the setting up of a subsidiary to manage its real estate projects which will unlock a lot of hidden value in the company,” said Ahsan.

Ahsan concluded saying that market direction will remain highly sensitive to foreign portfolio flows as a larger flight of capital from the bourse will induce a broader sell off.

Trade volumes fell 182 million shares compared with Friday’s tally of 190 million shares.

Shares of 351 companies were traded on the first trading session of the week. At the end of the day, 88 stocks closed higher, 245 declined while 18 remained unchanged. The value of shares traded during the day was Rs8.09 billion.

Summit Bank Limited was the volume leader with 27.6 million shares, gaining Rs1.00 to finish at Rs4.41. It was followed by Lafarge Pakistan with 10.3 million shares, losing Rs0.29 to close at Rs13.78 and Adamjee Insurance Company Limited with 8.4 million shares, declining Rs0.34 to close at Rs48.15.

Foreign institutional investors were net sellers of Rs129 million during the trade session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, May 6th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ