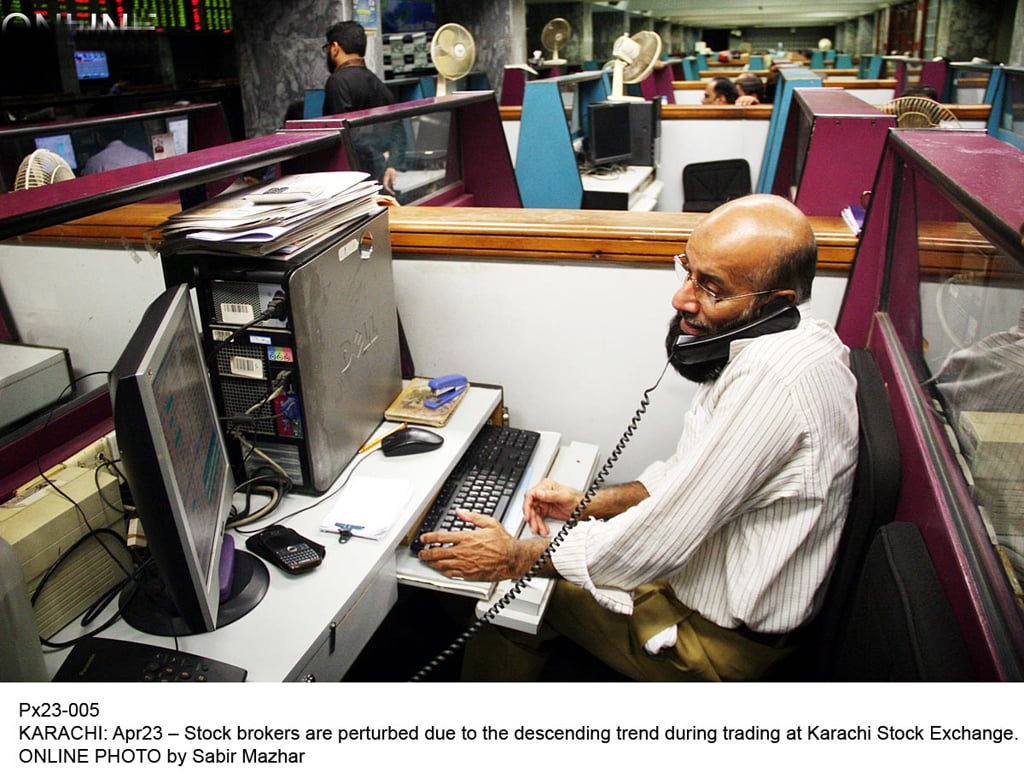

The Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 1.63% or 474.65 points to end at 28,717.19 point level.

Elixir Securities analyst Harris Ahmed Batla said the bourse lost ground on reported institutional selling. “The market fell below 29,000 with the state funds rumoured to be most active,” said Batla. “This was a result of the energy sector receivable pile up and media reports suggesting cash flow issues. Pakistan State Oil (PSO) -5% came in the line of fire hitting lower price circuit.

“Below than estimated first quarter 2014 earnings at Rs1.12/share for Engro Fertilizers (EFERT) -3.75% not only put the stock under pressure but also pulled along Engro Corp. (ENGRO ) -3.9%.”

Batla believed that financials attempted to weather broader market moves on reported foreigners buying. “However, they caved in as bears gained control with United Bank (UBL) -4.2% attracting volumes.”

Volumes recorded their highest level of the week and were dominated mostly by retails plays to the likes of Lafarge Cement (LPCL) -.2% , Maple Lead Cement (MLCF) -2.5% and Jahangir Siddiqui Co. (JSCL) -5.6%, added the analyst.

Trade volumes rose to 277 million shares compared with Tuesday’s tally of 191 million shares.

Shares of 370 companies were traded in total. At the end of the day, 107 stocks closed higher, 241 declined while 22 remained unchanged. The value of shares traded during the day was Rs13.9 billion

LPCL was the volume leader with 19.78 million shares, losing Rs0.03 to finish at Rs13.67. It was followed by Maple Leaf Cement with 17.7 million, shares losing Rs0.77 to close at Rs30.16 and Jahangir Siddiqui and Company with 14.5 million shares, declining Rs0.71 to close at Rs12.00.

Foreign institutional investors were net buyers of Rs845 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, April 24th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1730196361-0/BeFunky-collage-(82)1730196361-0-165x106.webp)

1732623521-0/bitcoin-(1)1732623521-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ