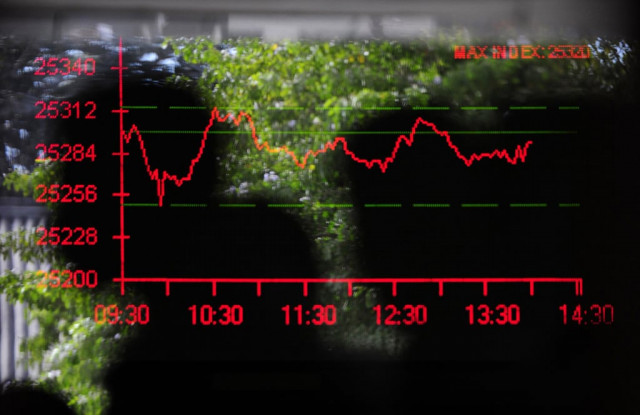

Market watch: Volatile index settles in the black

Benchmark KSE-100 index gains 1.6 points.

Trade volumes rose to 387 million shares compared with Monday’s tally of 295.6 million. PHOTO: AFP/FILE

The Karachi Stock Exchange’s (KSE) benchmark 100-share index rose 0.006% or 1.64 points to end at 29,095.77.

According to JS Global Analyst Mujaba Barakzai, the index witnessed another volatile session.

“Investors switched positions as compared to the previous trading session with major volumes witnessed in LaFarge Pakistan Cement Limited (LPCL) and Pace Pakistan Limited,” said Barakzai.

“Exploration and production sector remained lackluster with Pakistan Oilfields Limited and Oil and Gas Development Company (OGDC) closing in the red, down 2.0% and 1.7% respectively.

“Strong fundamentals of the cement sector attracted investor interest as LPCL was up 1.7% leading the list of volume leaders while Maple Leaf Cement Factory (MLCF) and DG Khan Cement also closed in the green zone,” said Barakzai, adding that the banking sector also remained strong with NBP closing above Rs60 while United Bank Limited and Habib Bank Limited closed on their upper locks.

Further, Barakzai concluded by recommending that investors should target banks and the oil and gas sector.

Meanwhile, Naveen Yaseen of Elixir Securities said that despite positive news over Moody’s hints of possible improvement in ratings outlook, hopes of Saudi oil facility on deferred payments and progress over 3G auction, marginal foreign outflow triggered intra-day profit taking amid local and foreign investors alike.

“At one end, oil names such as Pakistan Petroleum Limited (PPL PA -.3%) drove the index downwards as investors opted to book gains whereas, financials were the highlight of the day and remained buoyant on earnings excitement,” said Yaseen.

“Cements showed strength and reemerged in the session as news flow on price arrangement of manufacturers remains positive.

“Nishat Mills Limited (NML PA -3.5%) was a disappointment as it continued the downtrend upon Pakistani rupee appreciation while Engro Fertilizer (EFERT +1.2%) attracted investor attention over reported institutional buying,” said Yaseen.

“At current levels, while macros continue to generate excitement in Pakistan equities, foreign inflows persist to remain the key drivers,” said Yaseen, adding that oil names and financials offer strong investment opportunities whereas upcoming earnings season is likely to support the index at these levels which is expected to hover and remain volatile near 29k.

Trade volumes rose to 387 million shares compared with Monday’s tally of 295.6 million.

Shares of 361 companies were traded on Tuesday. At the end of the day, 151 stocks closed higher, 184 declined while 26 remained unchanged. The value of shares traded during the day was Rs15.8 billion

LaFarge Pakistan was the volume leader with 31 million shares, gaining Rs0.27 to finish at Rs13.95. It was followed by Pace Pakistan Limited with 30.5 million shares, gaining Rs0.11 to close at Rs5.19 and Jahangir Siddiqui Bank Limited (JS Bank) with 25.5 million shares, gaining Rs0.27 to close at Rs6.10.

Foreign institutional investors were gross sellers of Rs138.4 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, April 16th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ