Pakland Cement: The story of Tariq Mohsin Siddiqui

Pakland Cement was established in 1980 by Tariq’s father Senator Mohsin.

Before stock investors began their love affair with DG Khan, Maple Leaf and Lucky, there was an entity called the Pakland Cement. Mian Mansha, Sayeed Saigol and Ali Tabba were preceded by Tariq Mohsin Siddiqui.

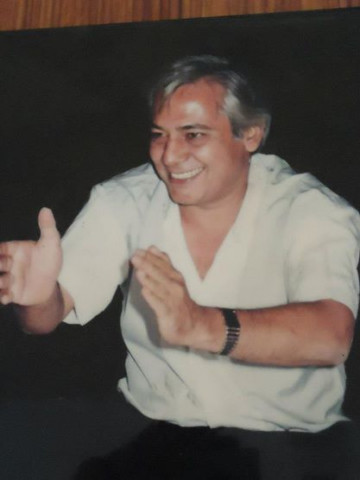

The corporate world in Pakistan seems to have forgotten about Tariq who passed away in 2009 but, little over a decade ago, he as the chairman and chief executive officer (CEO) of Pakland Cement was labelled the bankers’ sweetheart.

Given their history, it was no surprise that when the company defaulted on its loans, 45 CEOs at various banks and leasing companies came together like jilted lovers in what was then Pakistan’s largest corporate debt restructuring.

Tariq’s meteoric rise to being one of the top businessmen and his ability to take on established businesses was a repeated tale in corporate circles.

An eccentric, uncompromising and, at times outrageous man, Tariq began his career journey from the Pakistan Air Force. He quit shortly. At home, he did not see eye-to-eye with his father – Senator Mohsin Siddiqui - and left home in the 1970s.

Maybe that was the turning point and the entrepreneur inside him needed that.

Tahir A Khan, CEO at Interflow Communications and widely believed to be Tariq’s lone confidant, recalls how Tariq began his journey.

“Real estate was his first venture,” recalled Tahir. “Some of his friends had a large tract of land but they didn’t know what to do with it. Tariq convinced them to use it for a housing project.”

Tahir, who was working for Paragon Advertisements at the time, was approached by Tariq for a possible promotional campaign. “I had a full-page advertisement printed for Saadi Town in Jung. It cost Rs50,000.”

Soon, the result was there for everyone to see. A few days later, people lined up to book plots in Saadi Town, located near Malir Cantonment. “Tariq made the first Rs10 million of his life in one day.”

The Cement Prince

Pakland Cement was established in 1980 by Tariq’s father Senator Mohsin, who was a lawyer by profession. It was a time when most cement factories were managed by the State Cement Corporation and government officials obliged supporters with permits for new projects.

Production lagged behind demand and there was need for projects in the private sector.

General Ziaul Haq’s government issued permission to three projects including Cherat, Fecto and Pakland. Barring Pakland, the other two were backed by known business groups.

How exactly Senator Mohsin got close to the ruling circle remains unclear. But he was a fairly established lawyer who enjoyed ties with a few generals and was also associated with Dalmia Cement.

With a nameplate capacity of 567,000 tons per day, Pakland started production in 1984, becoming the first of the three sanctioned projects to take its product to the market. Located just outside Karachi near Port Qasim, its ordinary Portland cement and sulphate-resistant cement immediately captured Pakistan’s largest market.

From the start, key decisions were taken by Tariq, M H Mistry and Mian Muhammad Abdullah.

It was the country’s first dry-cement process plant, which consumed less fuel than the rest based on wet-processes. It was a state-of-the-art plant with a computerised quarry monitoring system and Ferguson’s financial management controls.

A colony with school, mosque and other facilities was also established. Each graduate engineer was hired for Rs10,000 — 25% over the prevailing market rate.

The company was listed on the stock exchange in 1988 with market capitalisation of Rs800 million. In the next five years, capitalisation rose 212% to Rs2.5 billion. Between 1991 and 1993, pre-tax profit increased 126.2% on a compound annual basis. Pakland was one of the best performing stocks.

This happened despite a setback in 1990. Senator Mohsin, affiliated with the then Mohajir Qaumi Movement (MQM), was gunned down near the party office as he headed there after attending an annual general meeting. The murder remains a mystery but people term it a case of mistaken identity.

The incident did not slow down Tariq. Boasting a company that was generating cash and posting profits, he aimed to be the biggest. He then decided to be a part of the privatisation process of 1992.

The cement journey begins … and ends

Pakistan’s cement industry is divided in two regions. In 1992, Mustekhum, DG Khan Cement, Fecto, Cherat and others were feeding markets in Punjab and Khyber-Pakhtunkhawa. Zeal Pak, Attock, Pakland and others catered to demand in Sindh and Balochistan.

The year was a watershed for the industry. Some of the business families that were condemned by Zulfikar Ali Bhutto as robber barons resurfaced now. Tariq Saigol bought D G Khan, Mian Mansha became owner of Maple Leaf and Sikandar Jatoi got Zeal Pak, the country’s largest cement maker with a capacity of over 1 million tons.

Tariq Mohsin Siddiqui was the highest bidder for DG Khan Cement, which the Saigols eventually bought for Rs1.9 billion.

“We didn’t have political clout like the others,” said a former company official who was part of the bid. “I remember how we booked seats of the entire business class in a 737 aircraft and took bankers to New York for a road show.”

Government refused to share details of Tariq’s bid. “Under the Privatisation Commission (Confidentiality and Secrecy of Documents) Regulations 2003, sharing of information in respect of DG Khan Cement is not allowed,” the commission said in an emailed reply.

From 1991 to 2000, cement production increased by only 30% from 7.7 million tons to 10 million, with most of it coming from new projects like Pioneer (1994) and Lucky (1996) in the north.

As a matter of fact, consumption dropped in the southern market during that period as construction was stalled during the military crackdown on MQM, which retaliated with crippling strikes.

“There was a time when Zeal Pak was selling its entire output in the north,” says Badruddin Fakhri, who worked with Pioneer for over two decades. But the high transportation cost left the south uncompetitive.

Sales shot up after 2001 on the back of economic growth and foreign demand. In the next 10 years, production would jump 170%, from 10 million tons to 27 million. Exports would begin and companies would make billions. But, by then the Cement Prince had faded.

In 1984, Pakland was financed by a loan of 128 million francs from the National Development Finance Corporation (NDFC), which along with PICIC and Bankers Equity, financed industrial projects.

“It was making so much money that we didn’t even know what to do with it,” said N H Mistry, who worked at Pakland for over 20 years. “Tariq had plans to go big — really big. He sent me and others around the world to look for investment avenues.”

In 1992, Pakland was in the final stages of setting up a paper mill. It was also the first company to seriously consider the potential of cement exports. “We had even bought some land in Chittagong and work on a jetty also started,” said Mistry.

Besides paying off the loan, the company was aggressively investing in capacity enhancement as well.

Everything was in control. Or so it seemed.

Up until the mid 90s, construction of roads and other development projects necessitated imports. But as capacity was added, cement makers vied to protect their geographical markets.

Tariq might not have succeeded in getting DG Khan but he and his team knew the importance of having a plant in the north. In 1993, they took a bold step, a business decision ahead of its time. It was the same move which a few years later would make Lucky Cement a cash cow.

The government had offered a sales tax holiday in Hattar Industrial Estate, located in Haripur district to encourage industrial development. Pakland mobilised initial funds, hired consultants and went ahead.

“No one had a footprint in both regions. We were on our way to become the biggest,” said Mistry. “The idea was to focus on exports and bring cement from the north if there was a gap in Karachi.”

Pakland invested Rs800 million in Saadi. Civil works and basic engineering was undertaken by local contractors, giving it a cost-advantage over competitors, who were also expanding production.

But, by the time the plant and machinery from Romania reached port, government revoked the sales tax exemption, disturbing the entire financial projection.

If this was not enough, a well-known politician made demands for bribe. When Tariq refused, every conceivable problem was created for the project. Roads were blocked, locals were instigated against contractors and, finally, a firing incident that claimed 11 lives made matters worse if they were not already.

Tariq’s friends and associates advised him to pay the bribe. “He could have easily paid to shut the opposition. But he was willing to go down instead of doing business the way politicians wanted,” said a former colleague.

The delay in completion of Saadi snowballed into problems for Pakland as well.

Pakland was investing heavily to add another production line at its existing plant at Dhabeji. It was aiming to become the biggest by mid 1996 with a capacity of over 1 million tons.

Initially, Tariq had also targeted 1996 as the year when production from Saadi would begin.

As problems mounted, the target date was extended to the second quarter of 1997. The deadline kept overshooting every year after that.

While the plant did not generate revenue, interest was piling on the loans. It was a financial trap from which only the shrewdest or well-connected businessmen could rise.

The credit-related problems were obvious in financial statements. In just six months to June 1996, obligations under finance lease soared 475%, from Rs83 million in the previous year to Rs478 million.

During the same period, it borrowed Rs580 million to complete work on Saadi. Repayment of some loans like the Rs250 million from a syndicate of Citibank, Standard Chartered, Askari and others had already started in November 1995. Saadi was still six years from actual production.

In 1996-97, the time period, originally marked as completion for the project, turned out to be tough on financial institutions as well as economies in the Far East were in a crisis.

Commercial banks were least interested in long-term projects. On the other hand, the government had limited the role of development financial institutions, a decision which in the coming years almost stalled industrial expansion.

“We needed money to complete work but options were limited. In 1997, the stock market crashed. We couldn’t list Saadi. After that there was little we could do,” said Mistry.

Role of the leasing and modaraba companies

With money and running finance being causes of concern, a huge role was played by the leasing and modaraba companies. Al-Zamin Leasing, Askari Leasing, Atlas Lease, First Crescent, Ibrahim Leasing, Lease Pak, Long Term Venture Capital Modaraba, Dawood Leasing, Orix Leasing, Paramount Leasing among others were included in the list.

By that time Pakland’s running finances were completely stopped and it was forced to reschedule total loans of Rs4.829 billion in 2001 — 50 banks and other financial institutions were in the list of lenders. Saadi was still not completed.

The biggest lenders included National Development Finance Corporation, National Development Leasing Corporation, Al-Faysal Investment Bank, Standard Chartered, Faysal Bank, Askari Leasing and Union Bank.

Everyone was ready to give him money in the good days.

But now, each one of them was now forcing Tariq to liquidate Pakland.

“Bankers doubted if he could manage the company but it seemed they conveniently ignored the reasons that added to all the liability,” Mistry said. “The reasons were external and political.”

The way Pakistan’s financial system started to operate from the mid 90s became an important contributor to not only Pakland’s demise but others as well.

“Commercial banks had little interest in long-term project financing. However, in any case, you don’t lend long term on current deposits,” said a former Securities and Exchange Commission of Pakistan (SECP) official.

The major chunk of Pakland’s debt came from state-owned development financial institutions, which were slowly being wrapped up by the government as it paved the way for private banks.

Nepotism and political lending increased non-performing loans of these organisations but there was no alternate for investors like Tariq who were not part of any ‘baradri’ to secure financing from elsewhere.

So the situation was ideal to exploit. The paid up capital of leasing companies was Rs200 million but their exposure was two or three times the amount. They borrowed from banks and then leased assets aggressively to defer taxes.

Pakland was paying rentals on a monthly basis, which had bloated its finance cost to unmanageable proportions. Pressure mounted to pay back the money but no one could foresee the growth in cement industry that was about to happen.

It’s no coincidence that out of the dozens of leasing firms only eight have survived and just three are actually making money.

Tariq sold his personal assets – an apartment in London, another one in Paris – to salvage Pakland. This is when desperation set in to keep the credit lines open.

One particular case related to this financial dilemma has caught everyone’s attention. Through another company, Tariq owned a 6,650 square yard-plot located along Main Shahrah-e-Faisal near Drig Road. In 1999, Military Lands and Cantonment had priced it at Rs399 million, according to court filings.

Since he needed the cash, Tariq sold the plot to a bank for Rs35 million under a buyback arrangement, which specified that the property would be returned once the outstanding loan is settled. Instead the bank laid claim over the property. The case is still pending.

As delays in project enhancement piled interest over the company, working capital lines were choked. The largest rescheduling of loans in Pakistan’s history was finalised on September 4, 2001. The debt was to be repaid over the next nine years.

Banks also agreed to give an additional financing of Rs150 million to complete Saadi and the second line at Pakland. But this installment never took place and the company was run on a lifeline of small working capital injections until it was bought off in 2004.

Management

Almost every senior cement industry official has heard at least one story. The Express Tribune took particular care in verifying the following information from three firsthand sources.

The usual time for Tariq to come to office was 2:00pm. “And then he would stay in office till late,” said Mistry. “It wasn’t a problem for the older lot but junior executives couldn’t stand staying in office till 11 in the night because that is when Tariq left.”

A handsome man who was always immaculately dressed, his heart was mighty too. For two consecutive years, he sent 500 people for Hajj – all expenses paid by him.

His management style was not just different, it was unique. As a matter of policy, everyone in office was required to spend some time in the sunshine. It was ‘mandatory’ to wear Shalwar Kameez on Fridays and casual on Saturdays.

A dysfunctional family also took toll on Tariq. Out of the five siblings, one brother and the only sister committed suicide.

Tariq himself believed he was poisoned. His paranoia reached such a level that a servant remained with him all the time to taste tea and food for a sign of poisoning.

Farewell

After losing substantial wealth, his peace came in 2004. Financial institutions were seeking liquidation of Pakland and some groups were waiting to buy the company cheaply.

Somehow, Yousuf Dewan, the scion of the Dewan Mushtaq Group, got hold of the development. The two met and the deal was sealed. Yousuf bought Pakland for Rs1.1 billion including all its debt.

Tariq went into seclusion, cutting himself off after cancer got hold of his health. He died entrusting his entire wealth to the Pakland Trust for charitable purposes.

Published in The Express Tribune, March 31st, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ