Weekly review: KSE-100 rings in 2014 by crossing 26,000 points

Improvement in forex reserves and lower inflation aided the index’s growth.

Improvement in forex reserves and lower inflation aided the index’s growth.

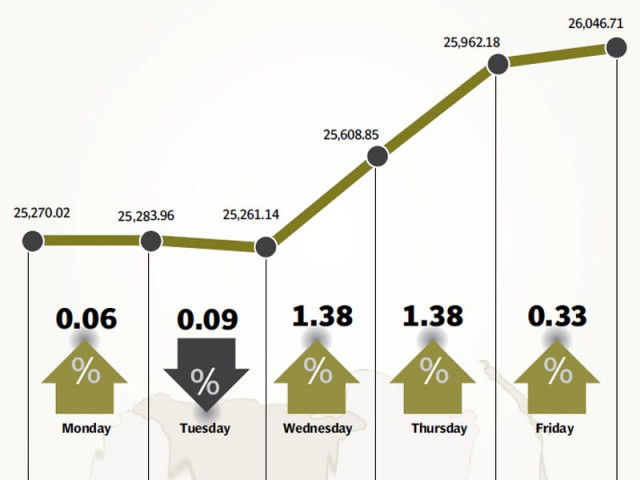

The stock market resumed its upward drive, following a brief correction in the previous week as the benchmark KSE-100 index shot up by 788 points (3.1%) to usher the New Year by shattering the 26,000-point barrier during the week ended January 3.

The week started off slowly with the index remaining static for the first two trading sessions of the week. However, all that changed with the turn of the year and the KSE-100 index shot up by 785 points (3.1%) in the final three sessions of the week to close at a new record-high of 26,046.

Investor sentiment saw a marked improvement on the first trading session of 2014 as trading volumes more than doubled over the preceding day. Improvements in the country’s macroeconomic position and an increase in the country’s foreign exchange reserves aided the index in reaching new heights.

The textile, cement and fertiliser sectors featured heavily this week as various news flows had a positive impact on these sectors. Second and third-tier stocks also performed strongly during the week, resulting in a 48% jump in trading volumes over the previous week.

The biggest positive surprise of the week was the Consumer Price Index (CPI) for the month of December 2013, which stood at 9.18%; well below market expectations. The news was a relief for investors who were fearful that double-digit inflation in the month of November would result in the State Bank hiking the discount rate in the monetary policy announcement of January 2014.

With inflation figures back in single digits, it has become less likely the central bank will increase the rate further and was welcome news at the bourse.

Further impetus was provided by an improvement in the country’s foreign exchange reserves which went up by $431 million to $8.52 billion. The appreciation of the rupee also provided confidence to investors regarding the macroeconomic health of the country.

Textile stocks continued to remain in the limelight as the GSP Plus status granted by the European Union went into effect from January 1, 2014. Nishat Chunian and Azgard Nine Limited were stand-out performers from the sector during the week.

[infogram url="" height="590"]

Cements also performed strongly on the expectation of a further hike in cement prices along with improved offtake figures. Fertiliser stocks also performed strongly mid-week following the government’s decision to impose the gas infrastructure development cess which led to all producers raising their prices by Rs178 per bag.

Foreigners were net sellers during the week and offloaded $6.7 million worth of equity during the week.

Average trading volumes shot up by 48.5% and stood at 272.3 million shares traded per day. Average daily value also improved by 25.7% and stood at Rs8.56 billion traded per day. The market capitalisation of the Karachi Stock Exchange stood at Rs6.25 trillion at the end of the week.

Winners of the week

JDW Sugar

JDW Sugar Mills produces and sells crystalline sugar. The company is located in Rahimyar Khan, and was formerly named United Sugar Mills Limited.

National Foods

National Foods Limited is a diversified food manufacturer. The Group’s products include recipe blends, dehydrated vegetables, pickles, salts, snack foods, desserts, and a number of health foods.

Azgard Nine

Azgard Nine manufactures and exports textile products such as denim fabrics, and apparel. The company also manufactures and sells urea and phosphatic fertilisers from its fertiliser plants.

Losers of the week

Shifa International

Shifa International Hospitals Limited establishes and runs medical centres and hospitals in Pakistan. The company’s clinical services include medicine, paediatrics, surgical, obstetric and gynaecology, dentistry, rehabilitation services and ophthalmology. Shifa also provides diagnostic services including specialised diagnostics, radiology and clinical laboratory.

Agriauto Industries

Agriauto Industries Limited manufactures auto, tractor and motorcycle parts. The Group’s products, which are sold to the OEM and replacement parts market, include gaskets, valves and sleeves, shock absorbers, camshafts, brake bands, hydraulic lift covers, steering boxes and transmission components. The Group operates in Pakistan.

Kohinoor Mills

Kohinoor Weaving Mills Limited manufactures, dyes, knits, and trades cloth and yarn.

Published in The Express Tribune, January 5th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ