Weekly review: KSE-100 hits record high despite macro concerns

The index breached 25,000 points before profit-taking clipped its gains.

The index breached 25,000 points before profit-taking clipped its gains.

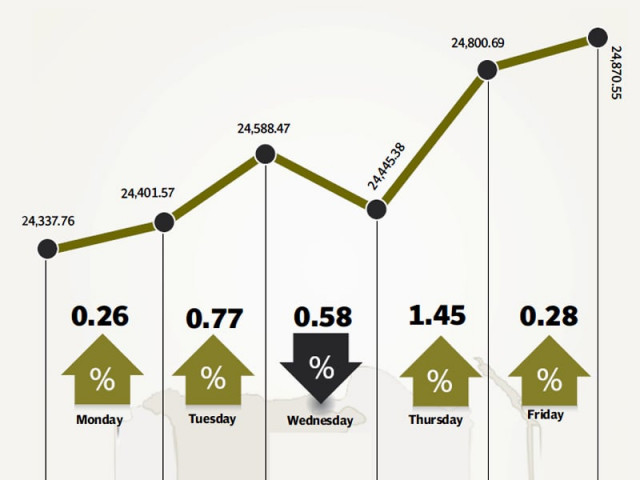

The stock market continued its relentless upwards march this week despite several macroeconomic concerns, as the benchmark KSE-100 index rose by 454 points (2.3%) to close at a new record-high of 24,870 points.

The index managed to breach the crucial 25,000 points barrier during intra-day trading on Friday before profit-taking resulted in the index receding to 24,870 points by the day’s closing.

To put things in perspective, the Karachi Stock Exchange has risen by 41.7% during 2013 and has come all the way up from 16,107 points in January to its current level in December 2013. It has been one of the best performing stock exchanges in the world.

The index’s gain was surprising, given the revelation of several macroeconomic figures which pointed towards the fragile state of the country’s economy.

Inflation figures for the month of November 2013 clocked in at 10.9% and above market consensus. The increase in inflation is likely to prompt the State Bank of Pakistan to adopt a conservative approach and raise the discount rate further, after a 50 basis points hike in November.

The country’s foreign exchange reserves are also in the doldrums as they dropped by $557 million to $8.34 billion, according to the latest figures by the State Bank. The central bank’s forex reserves now stand at only $3.04 billion, meaning it will not be able to support a full month of the country’s import bill.

To make matters worse, Etisilat was unlikely to pay the government $800 million it owes for the purchase of its stake in Pakistan Telecommunication Communications Limited (PTCL) due to ongoing property disputes.

The precarious position has forced the government to request the United States for an early disbursement of the Coalition Support Funds amounting to $900 million. However, it is unlikely that an early disbursement will be made as tensions between the two governments remain over the issue of drone strikes.

Despite the prevailing issues, the market was upbeat and closed in the green in four out of the five trading sessions of the week. Foreigners contributed, too, as they were net buyers of $6 million worth of equity during the week.

Investor sentiment was also helped by impressive growth figures for the oil and fertilizer sectors. Oil sales were up 14% year-on-year during the month of November. Similarly, urea off-take for the month was up by 62% year-on-year resulting in heavy buying in both sectors.

Average trading volumes shot up by 45.6% and stood at 194.3 million shares traded per day. Average daily value was also up by 47.9% and stood at Rs10.47 billion traded per day. The market capitalisation of the Karachi Stock Exchange crossed Rs6 trillion during the week.

Winners of the week

Bata Pakistan

Bata Pakistan Limited manufactures and sells rubber, leather, and microlon sandals and shoes.

Hum Network Limited

Hum Network, Ltd. operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Siemens Pakistan

Siemens Pakistan Engineering Company Limited manufactures, installs, and sells electronic and electrical products. The Company develops products for industries that include energy, industry, communications, information, transportation, healthcare, components, and lighting.

Losers of the week

Pak Services

Pakistan Services Limited is the holding company for Pearl Continental Hotels (Private) Limited, which constructs, operates and manages hotels.

Agritech Limited

Agritech Limited produces fertilizer in Pakistan. The company offers urea and Single Super Phosphate fertilizer and is also involved in importing and selling of DAP.

Attock Cement Pakistan Limited

Attock Cement Pakistan Limited manufactures and sells cement. ACPL, part of the Pharaon Group which, in addition to investment in cement industry, has diversified stakes in Pakistan mainly in the oil and gas, power and real estate sector.

Published in The Express Tribune, December 8th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1724319076-0/Untitled-design-(5)1724319076-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ