KSE-100 index climbs 1.7% amid increasing foreign inflows

The stock market maintains its upward momentum supported by the increase in foreign purchasing during the week.

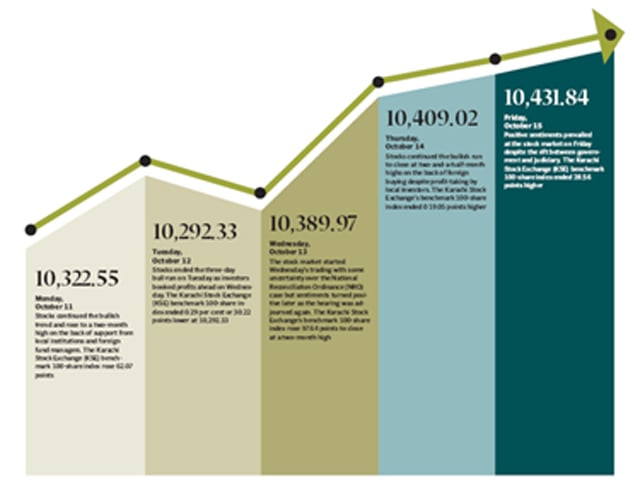

The benchmark KSE-100 index managed to climb by 1.7 per cent to 10,432 points by the end of the week.

Foreigners have shown renewed interest in the last couple of weeks as there has been a net inflow of $28 million from foreign buyers. Although inflows declined by almost 50 per cent over the previous week to $9.69 million, they proved to be the biggest stimulant to the market which is starved of positive news flows.

Pakistan’s stock markets have been trading at relatively low valuations compared with regional markets like India and offer potentially very high returns to foreign investors. The security situation of the country has been the biggest hindrance to increased foreign inflows in the country’s bourses.

The market has managed to climb 5.2 per cent over the last three weeks and investors are looking for triggers to maintain this upward momentum. However, with little news on the margin financing product and with few positive numbers on the macro front, the market has lacked the all-important triggers and has been relying on stock-specific news flows and foreign inflows for its climb.

Political news was at the forefront again during the week as the judiciary was set to announce the previously-delayed National Reconciliation Ordinance verdict on October 13. The decision had kept investors on the sidelines as volumes remained relatively lower in the opening sessions of the week.

However, the concerns were put to rest as the judiciary again postponed the verdict and resulted in a return of activity to the market. The market climbed by 1.4 per cent in the last three sessions of the week as a result.

Stock-specific activity was led by the textile sector, which has been provided a boost by the recent announcement of the European Union for a waiver of tariffs on 75 products, most of which are textile goods. Nishat Mills Limited, the country’s biggest manufacturer of textile goods, climbed 3.2 per cent during the week.

The oil and gas sector was also on the move as the government revised well-head gas prices during the week. Furthermore, Pakistan Petroleum Limited, the largest producer of gas in the country is set to announce its first quarter results next week and climbed 3.4 per cent during the week.

There was little to cheer about on the macro front as inflation numbers for the month of September posted a bleak picture. The Consumer Price Index (CPI), the basic measure of inflation, rose by 15.7% year-on-year. If inflation numbers remain this high, further monetary tightening in the form of higher interest rates can be expected from the central bank in next month’s policy announcement.

Average daily volumes remained relatively flat and declined by two per cent to 89 million shares per day. The last two weeks have shown much improved volumes but overall the daily turnover still remains at a low level compared with earlier in the year.

Total market capitalisation of the KSE rose by 1.4 per cent to Rs2.87 trillion by the end of the week.

What to expect?

The KSE-100’s recent rally has brought a new life into an otherwise dead market. There have been few positive news flows and political fragility and the security situation of the country continue to play on investor’s heads.

Investors have patiently awaited news on the margin financing product and it is high time that the product is implemented on the market. Furthermore, companies will begin announcing their first quarter’s results from next week, which can trigger some activity in the market.

Published in The Express Tribune, October 17th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ