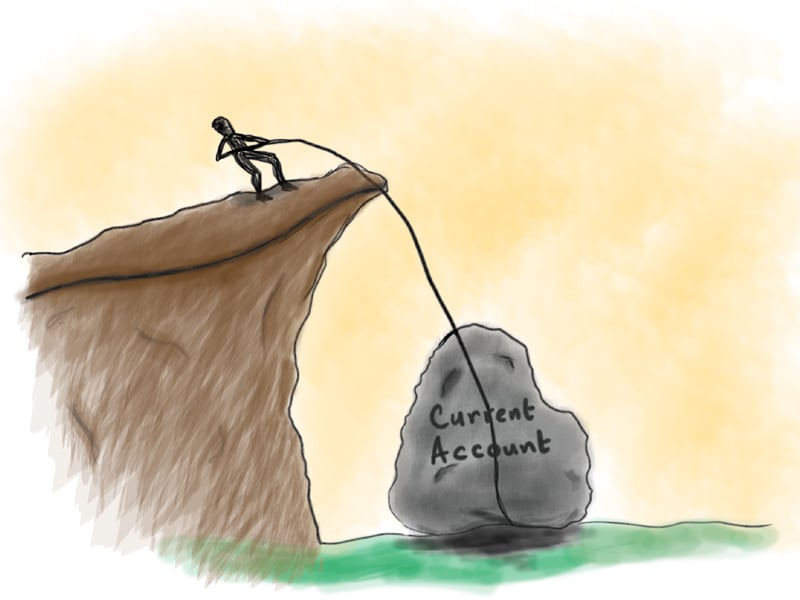

Pakistan’s current account deficit as opposed to a surplus of $439 million in the corresponding three-month period of last year, widened to $1.2 billion in the first quarter of fiscal 2014 (July-September), according to data released by the State Bank of Pakistan on Wednesday.

The data shows that the current account deficit in September alone was $608 million, up 7% compared to $569 million in August.

Talking to The Express Tribune, Standard Chartered Bank Senior Economist, Sayem Ali said that the cause of the widening current account deficit is increasing imports although a considerable pick-up was recorded in exports and remittances over the same period.

Compared to the corresponding period last year, Pakistan’s exports of goods amounted to $6.2 billion, up 1.3% in the first quarter of fiscal 2014. In contrast, Pakistan’s imports of goods increased 8.9% to $10.6 billion over the same period. “This is driven primarily by higher oil prices and rising energy demand in peak summer months that led to an inflated import bill,” said Ali.

The year-on-year increase in workers’ remittances was 9.1%, which remained $3.9 billion in July-September. The International Monetary Fund (IMF) had projected the current account deficit for fiscal 2014 at $1.6 billion in its September report, but the first-quarter figure indicates that the current account deficit will be significantly higher, Ali noted.

Although the government sought IMF assistance to forestall a balance-of-payments crisis, a widening current account deficit and large debt repayments have led to a sharp drawdown of the State Bank’s foreign exchange reserves.

“Besides this sharp decline, markets are concerned about the growing risk of rising global oil prices and Pakistan’s large external debt repayments on the horizon,” Ali added, saying that the rupee is under pressure due to depleting foreign exchange reserves.

Even after the release of the first tranche of the IMF loan, the SBP’s foreign exchange reserves remain weak at $3.9 billion as on October 10. “This is barely enough to cover one month of import payments,” he said, noting that it is the lowest level of reserves since the 2008 balance-of-payments crisis.

As on October 23, the rupee has declined 11% to Rs106.4 a dollar year-to-date. Ali said that the delay in the release of the next IMF tranche due in December will have serious implications for the balance of payments and the overall rupee outlook.

Talking to The Express Tribune, Global Securities research analyst Umair Naseer said the receipt of the Coalition Support Fund (CSF) of $322 million and loan disbursements under IMF’s EFF programme are expected to support the declining foreign exchange reserves of Pakistan.

“The United States has also promised further payments under CSF ($1.6 billion) in fiscal 2014, which can bring stability on the external front,” he said, adding that the expected inflows would remain key to external account stability, as Pakistan is scheduled to repay $2 billion to the IMF in the last three quarters of fiscal 2014 (November 2013-June 2014).

Pakistan has repaid approximately $900 million during the first quarter of fiscal 2014 against $417 million in the same period last year.

Published in The Express Tribune, October 24th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (7)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1727268465-0/Untitled-design-(42)1727268465-0-270x192.webp)

@Sexton Blake: US is an exception because it can pay for its imports in its domestic currency. Most countries including Pakistan are not similarly placed.

Also the issue with regards to fiscal deficit for Pakistan isn't that debt to GDP ratio is too high but rather that tax to GDP ratio is too low and does not provide adequate debt coverage. In this Regarss, comparison to Australia is not accurate.

Separately Pakistan has a balance of payment problem I.e. it does not have enough forex to pay for essential exports. With robust exports, Australia does not have that problem.

@Ashkenazi: Dear Ashkenazi, I basically agree with you, but Pakistan is not in such a bad financial mess if one cares to look at the problem rationally. A tiny country such as Australia has a debt of about 40 billion dollars, and the US has a debt of about 60 trillion dollars with unfunded liabilities of at least 200 trillion dollars, and both growing rapidly. There are also many other worrying examples such as Greece and Spain, This of course does not mean that Pakistan should be complacent, but it certainly has a long way to go before it catches up with some of the aforementioned basket cases.

@Ashkenazi:

Rubbish. IMF solution is to spend less, eliminate subsidies, increase taxes and make sure everyone pays there fair share - same as the rest of the World. If you want to blame someone for Pakistan's economic woes - quit blaming IMF and others - take a look in the mirror.

@Sexton Blake: Bravo, you are 100% correct. Why do these spineless rulers not have this vision? It is very encouraging for me to see people who know that interest-based debt will always lead to poverty. Always, always, always, no exceptions, because a simple rule is that a closed system cannot generate money out of thin air. However, USA is run on credits generated out of nothing by The Federal Reserve. Your solution to the imports is also very valid, but I disagree that research will take time. I am sure that there are pretty much wealthy people here who can buy companies already manufacturing the machinery from abroad. I am an engineer who has been part of an analysis done to estimate how much we can cut down our imports. The answer is down to 10%-20% Excavation in KP and Baluchistan is enough to cover Pakistan's oil needs for a long time. But alas, our rulers are spineless and they are not allowed to develop the country due to foreign pressure. After all, a thriving Muslim nuclear state is a serious threat to all enemies. Shame on PML-N voters for knowing the truth and yet again voting for those who have proven themselves worthless and continue to do so even now. My people are too busy siding with parties and false sense of loyalty though their true alliance should be with the nation and not a flag drawn by corrupt elite. Pakistan needs a revolution to cleanse itself of all the monarchies, and all of us need to be a part of it!

When you say it quickly everything appears OK. However, I would really like to see a detailed list of Pakistan imports, exports, and interest payments. The alternative is to do research, but this is time consuming. It is fairly common knowledge that the US Reserve Bank combined with the New York bankers and the large industrialists is a giant Ponzi scheme, but we do not get a lot of detail in regard to Pakistan. Obviously, the IMF appears to be part of the Ponzi scheme. Whenever the IMF appears on the scene jobs just seem to disappear, and the economy of the receiving country generally becomes worse and worse. Of course, the receiving country gets all the blame.

IMF solution: Get more into crippling debt.