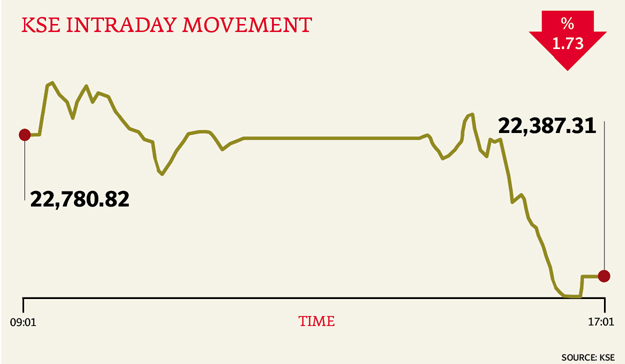

The Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 1.73% or 393.51 points to end at 22,387.31 point level.

“Late news of increase in minimum deposit savings rate led to panic selling in equities causing the KSE 100 index to fall 2.2% and close nearly 400 points down with most banking stocks closing at their lower circuit levels,” said Muhammad Raza Rajwani of Elixir Securities.

“It was an un-expected move by the central bank whereby it linked the minimum savings rate offered on saving deposits to the discount rate thereby affecting a 50bps increase. Initial estimates indicate it will shave earnings of banking companies by 6-12% with United bank (UBL PA -5.0%) being the least impacted and Bank Al-Habib (BAHL PA -5.0%) being the most” Rajwani said.

“The Karachi stock market witnessed fickle session with low volumes today as the KSE-100 index oscillated between 22,929 points (intraday high) and 22,316 points (intraday low level). However, after SBP’s announcement to increase in minimum savings deposit rates for all commercial banks to 6.5% from 6.0% the index shed 393 points to close the day at the 22,387 level,” Said Adeel Jafri of JS Global.

“As a result, most banks closed the day at lower circuit breakers. Fauji Cement (down 3.4%), DG Khan Cement (down 0.2%) and Maple Leaf cement (down 3.0%) still played on the conjecture of a cement price hike of Rs15 per bag to pass on higher power tariff costs.” Jafri adds

Trade volumes fell to paltry level of 163 million shares compared with Thursday’s tally of 193 million shares.

Shares of 326 companies were traded on Friday. At the end of the day 106 stocks closed higher, 195 declined while 25 remained unchanged. The value of shares traded during the day was Rs5.6 billion.

Bank of Punjab becoming the volume leader with 14.9 million shares losing Rs0.47 to finish at Rs11.83. It was followed by Telecard Limited with 10.5 million shares gaining Rs0.13 to close at Rs6.42 and National Bank with 10.3 million shares losing Rs2.08 to close at Rs51.88.

Foreign institutional investors were net sellers of Rs41 million, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, September 28th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ