The week turned out to be a positive one for the Karachi course as smooth progression of democracy induced a wave of optimism coupled by governance decisions made by the incumbent government over terrorism and privatisation drive.

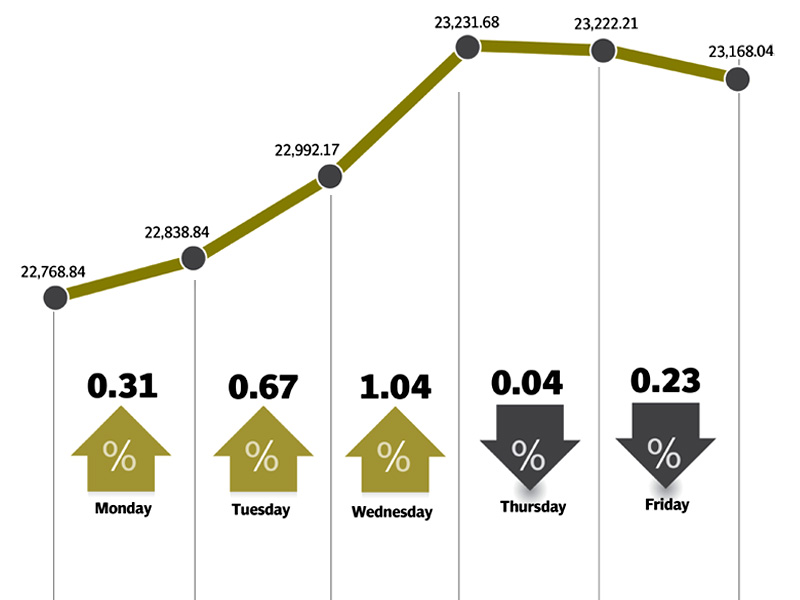

While uncertainty on the outcome of the monetary policy announcement, which was announced after the close of the week, slowed down gains, overall gains at the country’s biggest stock market continued upward momentum, climbing 1.8% over the previous with average volumes clocking in at 239 million shares, up 23% week-on-week. While foreign investment in the last two sessions witnessed an outflow of $5.6 million, on net-basis at the end of the week foreign investment was positive (net inflow) of $2 million, according to KASB Securities market review.

In the week, democracy achieved a landmark with new president, Mamnoon Hussain taking over from Asif Ali Zardari, which spurred a wave of confidence in the market. Moreover, measures undertaken by the Pakistan Muslim League – Nawaz government over terrorism stating “give a chance to peace” and reinitiating the privatisation programme by announcing a plan to privatise Pakistan International Airlines. However, nervousness set in on Friday, triggered by mix anticipation over the State Bank’s monetary policy decision. The central bank went on to announce a 50 basis points increase in the discount rate to 9.5%, which was against what the market was expecting.

On the macroeconomic front, international inflows for Pakistan jumped exponentially post re-entry to the International Monetary Fund (IMF) programme of $6.64 billion coupled with Asian Development Bank and Islamic Development Bank committing $245 million and $850 million respectively.

Pakistan received the first tranche from the IMF of $550 million helping the foreign currency reserves of the country tick up by $380 million to close at $10.37 billion for the week, spurring foreign investor confidence. Moreover, in the July to August 2013 period, remittances showed growth of 7% to $2.6 billion.

The energy sector was in the limelight throughout the week as tensions eased over a potential military strike by the United States and diplomatic options become the focus. Any tensions in Syria created a shortage in the global oil supply and prices shoot up. The exploration sector also had a great week as local explorers made major discovery announcements. Pakistan Petroleum seeks to benefit from a 40 million cubic feet per day (mmcfd) addition to the system from Latif gas field and Oil and Gas Development Company aims to add 350mmcfd in the next 18 months.

Going forward

The hike in interest rate may likely induce negativity in the equity market when it opens on Monday as an unchanged outcome was largely expected. However, the development bodes well for the banking sector, as pressure on spreads should ease, which is likely to lure investors.

In addition, the highly-leveraged cement sector may remain volatile as no clarity has emerged over resolution of conflicts between the All Pakistan Cement Manufacturers Association members.

Winners of the week

Pace Pakistan

Pace Pakistan Ltd develops real estate in both the residential and commercial sectors. The company develops and constructs shopping malls, supermarkets, and apartments.

Jahangir Siddiqui and Company

Jahangir Siddiqui and Company is an investment company offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

GlaxoSmithKline

GlaxoSmithKline Pakistan Limited manufactures and markets pharmaceuticals and animal health products.

Losers of the week

Colgate Palmolive

Colgate-Palmolive Pakistan manufactures and sells detergents, personal hygiene, and a variety of other products.

Javedan Corporation

Javedan Corporation Ltd manufactures Portland cement, blast furnace slag cement and sulphate resisting cement.

Hum Network

Hum Network operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Published in The Express Tribune, September 15th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ