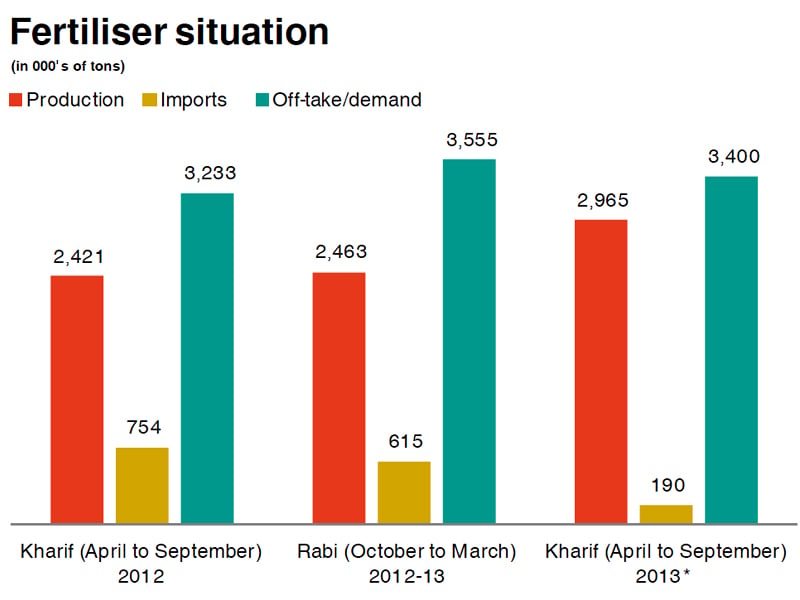

Despite large amounts of urea imports, farmers in Sindh – a province with significant share in Pakistan’s agriculture produce – say they are facing urea shortages that have affected agriculture output in the Kharif season and possibly the upcoming Rabi season.

Although local fertiliser industry officials are satisfied with current fertiliser reserves in the country, they fear the country may have to import more urea for Rabi season by the end of the year.

“The urea shortage is at its peak these days though its scarcity has been affecting different crops throughout the Kharif season,” President Sindh Abadkar Board Abdul Majid Nizamani told The Express Tribune.

Nizamani said many a time imported urea takes time in reaching markets, and as a result crop production takes a hit. This year too, the government was late in importing the commodity as a result of which various crops have been affected in the last four months.

Another grower, Sharfuddin Shah from central Sindh informed The Express Tribune that there have been more water shortages this year compared to last year that has hit the crops more than urea shortage.

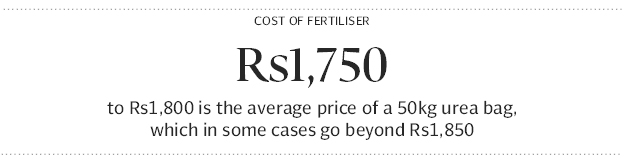

But Shah also added that in many cases retailers are demanding an additional Rs50 to Rs100 on each 50kg bag of fertiliser. On average a 50kg urea bag costs between Rs1,750 to Rs1,800, and in some cases beyond Rs1,850.

Fertiliser producers

However leading fertiliser makers look satisfied with the current stocks of fertiliser in the country.

“Once imports are taken into account, there is no shortage of fertiliser in the country,” Engro Fertilizer said in an email response.

After the recent tenders and imports are considered there is sufficient stocks of fertiliser in the country, the company said. But Engro also believes that the country may need more imports for the Rabi season by the end of year.

Like other fertiliser makers, Engro says further urea import will be at a significant cost to the country, and that with the capacity available in the country it may be more economical to provide gas to installed plants in the country.

Pakistan has sufficient capacity to take care of the entire demand of the country, said officials at Engro Fertilizer, but due to gas curtailment to fertiliser plants, domestic production was significantly lower and the country imports fertiliser at significant cost to the country.

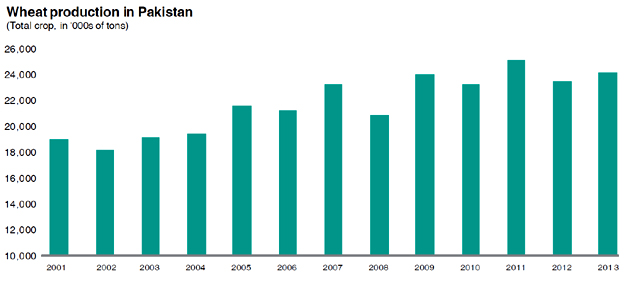

According to the company, annual fertiliser demand in Pakistan is about 8.2 million tonnes in which the share of urea is approximately 5.7 million tonnes while Diammonium phosphate (DAP) demand is around 1.3 million tonnes and others hover at 1.2 million tonnes. Industry officials said that the annual demand of fertiliser is growing at a rate of 2%-3%.

The Trading Corporation of Pakistan (TCP) floated different tenders for urea imports in recent weeks. TCP’s last tender was awarded on August 6, 2013. The TCP floated different tenders for a total of 300,000 metric tonnes of urea assigned to it by the Economic Coordination Committee of the Cabinet. It also said that it would float more tenders if government gives new directives of importing urea.

Published in The Express Tribune, August 19th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1714478350-0/ojwilson-(4)1714478350-0-270x192.webp)

-(1)1714378140-0/AliAminMaryam-(4)-(1)1714378140-0-270x192.webp)

1714370039-0/ojwilson-(1)1714370039-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ