Weekly Review: KSE-100 closes the week flat after profit-taking

Index climbed as high as 23,871 points before slipping down.

Index climbed as high as 23,871 points before slipping down.

The index has climbed almost 39% since the start of 2013, with the bulk of the gains coming in the last three months. With the corporate earnings season kicking in, the market seemed poised to reach new heights in the coming weeks.

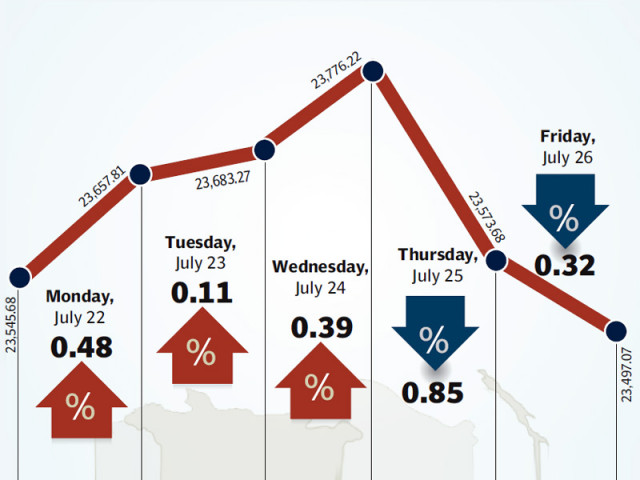

It did appear, at first, that the KSE-100’s juggernaut run will continue throughout the week as the index rose 1.5% in the first three trading sessions to hit an all-time high of 23,946 points. However, profit-taking in the final two sessions of the week, pulled the index down to 23,497 points at the close of the week.

The week started on a positive note with the confirmation of the increase in the amount of the International Monetary Fund’s package to $6.5 billion, with speculation that it will be further increased to $7.5 billion. It also emerged that the Asian Development Bank and the World Bank will also provide $500 million budgetary support loans to the country.

The news was welcomed by investors as the country’s foreign exchange reserves continued to slip downwards and perilously close to the $10-billion threshold after a decline of $299 million to close at $10.2 billion, according to latest figures released by the State Bank of Pakistan.

Continuously depreciating rupee was also a source of concern as the currency shed 2.5% against the greenback in July 2013 so far. With the spread between the interbank and open market rates considerably high, further volatility is expected in the coming weeks.

Earnings announcements during the week were also disappointing as Fauji Fertilizer Bin Qasim and Askari Bank announced their results for the first half of 2013. Both results were below expectations, particularly for Askari Bank Limited which reported a loss of Rs4.7 billion.

However, investors remained optimistic about prospects for the cement and energy sectors as both sectors witnessed increased buying/accumulation during the week. Cement stocks, in particular, were the star performers of the week, gaining 6.9% week-on-week.

Pakistan Telecommunication Company (PTCL) again performed strongly and climbed 10.1% after the news that its parent company Etisalat was considering buying out Warid Telecom from the Abu Dhabi Group. A merger will make Ufone – PTCL’s wholly-owned subsidiary – one of the largest networks in the country.

Trading volumes bounced back sharply during the week, rising 39.5% to stand at 302 million shares traded per day on average. Similarly, average daily values were also up 24% and stood at Rs12.22 billion traded per day. The Karachi Stock Exchange’s market capitalisation stood at Rs5.74 trillion at the end of the week.

Winners of the week

Attock Cement

Attock Cement Pakistan manufactures and sells cement and related products. The company is also part of the Pharaon group, which in addition to investments in the cement industry also owns interests in the oil and gas sector.

Fauji Cement

Fauji Cement Company manufactures and sells cement.

Attock Refinery

Attock Refinery, a subsidiary of the Attock Oil Company, specialises in the refining of crude oil.

Losers of the week

United Bank

United Bank provides commercial banking and related services. The bank offers a wide range of banking and financial services, including brokerage services.

Askari Commercial Bank

Askari Commercial Bank provides commercial banking services. The bank has branches in Pakistan, Azad Jammu, Kashmir and Bahrain.

Grays of Cambridge

Grays of Cambridge (Pakistan) is a holding company. The company, through its subsidiaries, manufactures and exports sporting goods, specialising in hockey sticks.

Published in The Express Tribune, July 28th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ