Weekly Review: KSE hits all-time high as bulls continue rampage

Optimism about the IMF bailout and corporate earnings fueled the market across 23,000-point level.

Optimism about the IMF bailout and corporate earnings fueled the market across 23,000-point level.

The market’s surge has been fueled by investor optimism with regards to the government’s successful negotiations with the International Monetary Fund (IMF) for a relief package of at least $5.3 billion, besides anticipation of strong corporate earnings seasons for the quarter ended June 30.

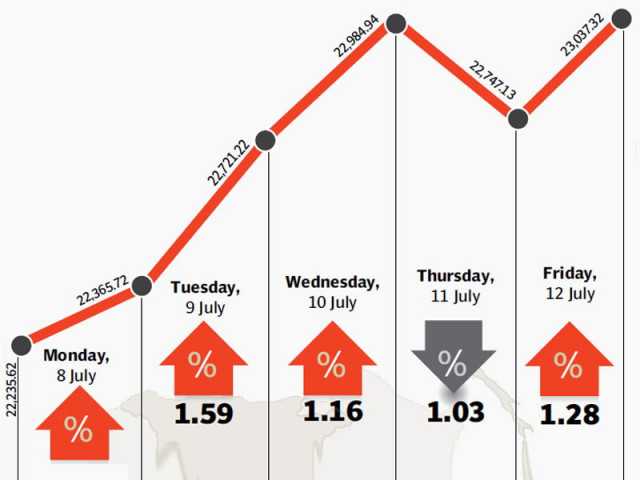

The KSE-100 index, after witnessing a correction in June, has climbed sharply over the last two weeks by gaining more than 2,000 points or 9.5%, and now stands at 23,037 points, at a new record high.

The market closed in the black in all but one of the five trading sessions of the week. The gains continued to pile up despite shorter trading sessions for the latter half of the week, following the start of the holy month of Ramazan.

Despite the country’s foreign exchange figures declining on a week-on-week basis, investors remained confident that the government’s successful negotiations with the IMF for the bailout package will be enough to avert a balance of payment crisis. Foreign exchange reserves declined to $10.5 billion, according to data released by the State Bank of Pakistan.

Investors are also confident that the companies will post solid earnings growth for the quarter ended June 30 as future outlook remains strong, particularly for the all-important energy sector, after the government delivered on its promise and partially relieved the sector of the circular debt crisis.

On the macroeconomic front, remittances continued to grow in the month of June and were recorded at $1.2 billion, a growth of 4.2%. For the fiscal year 2013, total remittances stood at $13.92 billion, a growth of 5.6% year-on-year.

Sector-wise activity was also strong during the week, with the banking, fertiliser, cement and energy sectors leading the way. Banks gained across the board on rumours that the government is likely to cut the minimum deposit rate of 6% in the light of monetary easing over recent months.

The fertiliser sector was also in the limelight with Engro Corporation being the star performer as it emerged towards the end of the week that the Ministry of Petroleum and Natural Resources had decided to divert 60 million cubic feet per day (mmcfd) of gas from Guddu power plant to Engro’s plants for fertiliser production. The stock gained 23% during the week.

The cement sector also gained following rumours of a hike in cement prices, while the energy sector also performed decently as petroleum companies were subject to foreign buying during the week.

Trading volumes managed to sustain their previous levels and stood at 263 million shares traded per day on average. Average daily value, however, shot up by 30% to Rs12 billion per day reflecting higher interest in blue-chip stocks. The market capitalisation of the KSE rose 3.8% to Rs5.6 trillion by the end of the week.

Winners of the week

Engro Corporation Company

Engro Corporation produces fertilisers, polyvinyl chloride resin, and industrial automation products, develops electricity generating plants, produces dairy foods, and operates a liquefied petroleum gas and liquid chemical terminal.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Attock Refinery

Attock Refinery Limited, a subsidiary of the Attock Oil Company, specialises in the refining of crude oil.

Losers of the week

Pakistan Services

Pakistan Services is the holding company for Pearl Continental Hotels (Private) Limited, which constructs, operates and manages hotels. The group also owns a number of smaller companies that provide rent-a-car, travel arrangements and tour packages.

Pace Pakistan

Pace Pakistan Ltd develops real estate in both the residential and commercial sectors. The company develops and constructs shopping malls, supermarkets, and apartments.

Pakistan Cables

Pakistan Cables Limited manufactures and distributes copper rods, wires, cables and conductors, aluminium profiles and anodised fabrications.

Published in The Express Tribune, July 14th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ