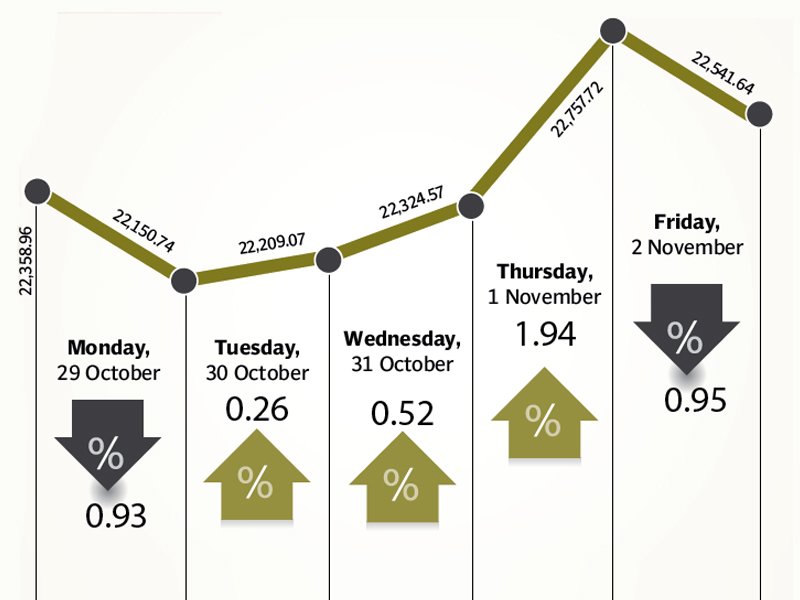

The budget, which includes several concessions for businesses along with a promise to end circular debt within 60 days, was welcomed by both businesses and investors alike and triggered a fresh wave of buying at the Karachi bourse.

However, with the market already at high levels, profit-taking was recorded in the last session of the week, especially in the energy and power sector, after it emerged that the resolution of circular debt will come with certain conditions for companies.

The market rose sharply following the budget announcement on Wednesday, climbing 433 points (1.9%) as rumours about the imposition of tax on inter-corporate dividends, hikes in excise duty on cement and sales taxes on milk and sugar proved to be false.

The finance minister also announced in his budget speech that the corporate tax rate would be slashed by 5% over the course of five years, declining by 1% each year. He also announced that circular debt will be eliminated in 60 days and would lead to a decline in load-shedding by 25-30% in the near term.

The government also increased the general sales tax by one percentage point to 17%, in an effort to boost revenues; it also set new tax slabs for salaried individuals. Furthermore, it plans to conduct 3G auction to generate $1.2 billion and also to recover $800 million from UAE-based Etisalat for the sale of the Pakistan Telecommunication Company.

The finance minister also revealed plans to reengage with the International Monetary Fund and take a new loan on improved terms to settle the existing debt and avert a balance of payments crisis, as the country’s foreign exchange reserves stand at dangerously low levels.

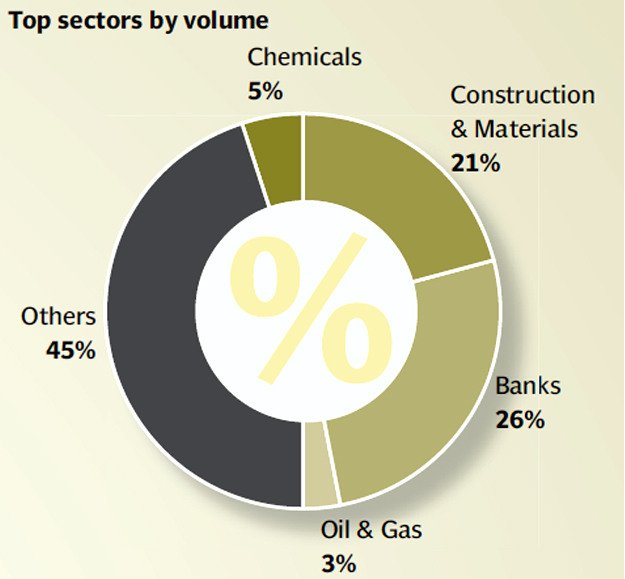

In sector-specific news, the cement sector was in the limelight, as manufacturers increased the price of cement by Rs25-30 per bag immediately after the budget to pass on the impact of increased GST to consumers. Cement companies made gains, with DG Khan Cement and Lucky Cement rising 7.8% and 6.4% respectively during the week.

The energy and power and banking sectors experienced selling towards the end of the week largely due to foreigners, who offloaded their stakes in these sectors. Foreign flows turned negative, following weeks of inflows, which indicates that a correction may soon follow.

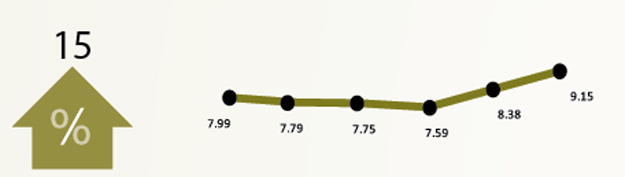

Average trading volumes fell sharply by 28% from last week and stood at 371 million shares per day, while average daily value dropped 21% to stand at Rs10.13 billion. Market capitalisation increased 1.3% to Rs5.46 trillion by the end of the week.

Winners of the week

Lafarge Pakistan

Lafarge Pakistan Cement Company Limited manufactures and sells cement.

TPL Trakker

TPL Trakker is a vehicle tracking and fleet management service provider for markets in the Middle East and South Asian region. The company’s business is to supply GPS, GSM and satellite mobile asset tracking, management and information solutions.

Hum Network

Hum Network operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Losers of the week

Murree Brewery

Murree Brewery Company specialises in the manufacture of beer and Pakistan Made Foreign Liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively.

Pak Services

Pakistan Services is the holding company for Pearl Continental Hotels, which constructs, operates and manages hotels. The group also owns a number of smaller companies that provide rent-a-car, travel arrangements and tour packages.

Feroze 1888 Mills

Feroze 1888 Mills manufactures and sells a wide range of cotton towels and fabrics.

Published in The Express Tribune, June 16th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1731655243-0/BeFunky-collage-(61)1731655243-0-165x106.webp)

Dates mentioned in title graph are of October and November