Government to set 4.4% economic growth rate target: Dar

Says they will try to eliminate circular debt in 60 days.

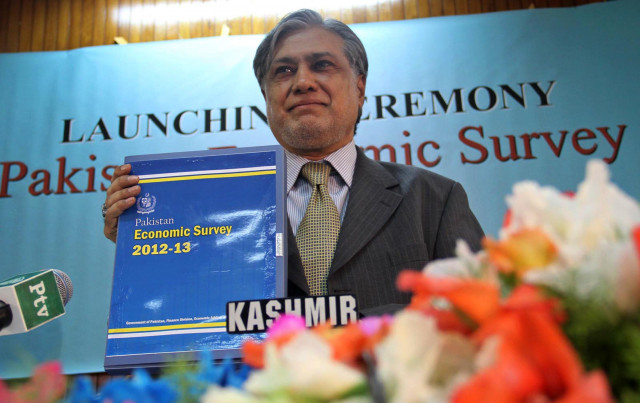

Finance Minister Ishaq Dar unveils the Economic Survey for 2012-2013. PHOTO: MOHAMMAD JAVAID/EXPRESS

"We have set the target for GDP growth rate at 4.4%percent," Dar told a press conference on the eve of a federal budget presentation in the new parliament.

The new government of Prime Minister Nawaz Sharif's Pakistan Muslim League-N faces a daunting array of problems ranging from an energy sector crippled by $5 billion of debt to dwindling foreign exchange reserves, all the while facing down a Taliban insurgency.

Dar said that the GDP growth rate in the current fiscal year ending on June 30 remained at 3.6% against a target of 4%.

He said that the fiscal deficit which had run to 4.7% would be curtailed by his government through "strict financial discipline".

Power crisis

The finance minister revealed that the government had bloated borrowing to Rs14 trillion by giving subsidy, bridging the budget gap and in trying to service the increasing circular debt.

“The rate at which the ministry of finance has taken on circular debt, it is not sustainable.”

For their plan to address the power crisis, Dar said that the new government will start by addressing the circular debt that stands at over Rs500 billion. They will also reduce line losses to reduce the cost of providing electricity.

"We want to do it in minimum possible period and just finishing off this debt will not solve the problem unless we reduce our line losses or thefts which were more than 30%."

The finance minister noted that non-payment of bills was also a major issue. “We will not only reduce it, but minimise it. We will try to resolve this problem of non-payments.”

He said an aggressive plan has been prepared to take the issue of circular debt head on and it would be eliminated within 60 days.

“We will need to address all the causes of loadshedding.”

Investment to GDP ratio

The Finance minister lamented that previous government had a very poor investment to GDP ratio and they aim to address this.

"We will bring the GDP back to 7%," Dar said. "We believe if the economy is revived, terrorism can easily be dealt with."

He said the outgoing government had borrowed extensively, even in violation of set rules.

"This is not sustainable," Dar continued. "You're not investing in dams, hydraulic projects or expressways and the rise in debt is self-servicing. This is also in direct violation of the public sector act."

The rise in borrowings will only end up being a burden for the future generations, he said.

Dilating about the overall debt, he said it is set to cross Rs14 trillion by the end of June, 2013. Giving a break up, he said that the debt had risen by as much as Rs7.5 trillion only in the past five years.

"We will tackle the debt situation head-on, so that the power crisis can be resolved," said Dar, though it was not going to improve in the short term. "Budgetary deficit was targeted at 4.7% but it would be around 8.5%."

Currently, the country is facing a shortfall of Rs350 million in tax recoveries. He said, the government will empower the tax recovery system with technology so that no one is able to evade tax illegally.

"We will devise a progressive budget," Dar said "and do away with the fiscal debt in two months."

"Our stance on inflation is that it should remain around 8%. We will try not to add to that."

Efforts will also be made to mitigate misuse of authority, to restore the confidence of investors, to hire new people on merit particularly in loss-making organisations such as PIA, Steel Mills etc. and to stay true to the plan chalked out by the Prime Minister Nawaz Sharif, Dar concluded.

Balance of Payments

The Finance minister, stressing on transparency, said that the country has a current account deficit of $2.9b while the State Bank has foreign reserves of just $6.2b.

The fiscal deficit, he said, stands at 4.7% of the GDP.

“It will be our endeavour to reduce this to 4% in the next three years.”

Public sector spending

Dar suggested that one of the major reasons for the structural collapse of the government is the lack of public sector spending and capital flight.

“We plan to increase public sector spending to Rs540 billion, and this will be by the federal government.”

He also promised that they will try to restore the confidence of investors. “People do not have confidence in us to do what we promise to do. We will try to address it and restore confidence of investors.”

3G licence

Dar said licenses for 3-G spectrum of mobile phone would be auctioned in a transparent manner in order for the mobile industry to grow further.

Fresh loans to pay old ones

Dar said that he had no option but to continue the old practice of getting fresh loans to pay old ones.

"There is no money to make heavy debt repayments by December and I think that in this situation, there is no harm in taking more loan to repay old debt," Dar said.

The country is still paying off an $11.3 billion International Monetary Fund loan from 2008. Analysts have said it will need to go back to the lender for more to stave off a balance of payments crisis.

The Economic Survey report can be downloaded here.

Correction: An earlier version of the article incorrectly noted some figures in dollar. The error is regretted.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ