No bed of roses: Building up political will biggest challenge

Incoming government will face immediate challenges like dwindling forex reserves and a dismal tax collection ratio.

The challenges are not tough economically. The political will to address them is key. PHOTO: FILE

The fact that any new government that comes into power will face multiple challenges is quite obvious. It is no secret that the country faces multiple challenges on several fronts. Even if we don’t talk about the economy, there are issues like a depressing law and order situation, the less than adequate literacy rate and the equally dismal human rights situation.

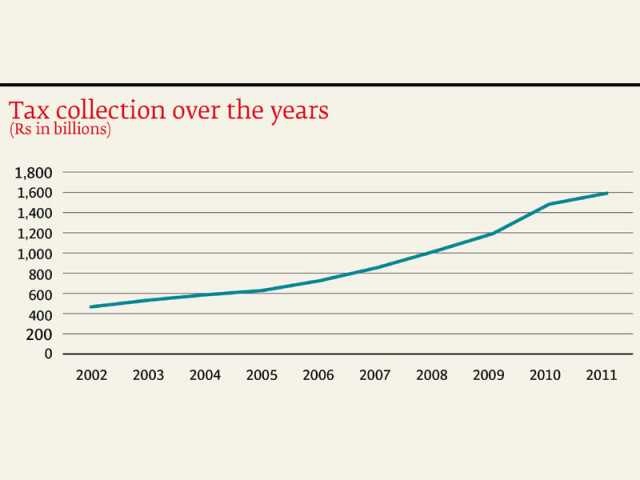

The picture is not very encouraging on the economic front either. Foreign exchange reserves have been declining, there is a looming balance of payments crisis and tax collection as a percentage of GDP has failed to grow.

So, any incoming government will have to get its priorities right if it hopes to get off to a flying start. Having said this, if there is enough political will, the government is not going to be taking over a country that is crippled or one that cannot be fixed.

There is no doubt that challenges exist. The biggest challenge will be to convince the IMF of giving Pakistan another package. There is no option but to go for this.

The winner of the elections will have access to just $6.7 billion of foreign reserves, compared to about $12 billion a year ago. And Pakistan needs more than that to avoid a balance of payments crisis.

So the first order of business will most probably be to try and convince the IMF to get back on board with a fresh package. This will not be any easy task though considering Pakistan’s dismal record with tax reforms, fiscal discipline and with power sector reforms, just some of the areas where the IMF feels we need to be making much better progress than we are.

So even if the IMF does agree to come back, the next challenge will be even bigger, that of good governance. The government will have to ensure that the stalled process of reforms is revived. This will involve measures like making the power generation and distribution companies more independent, doing away with subsidy and increasing power rates. And this might actually be the easiest of the measures that need to be taken

The next step will be much tougher. The government will have to commit itself to enhancing the tax base and tapping agriculture incomes as well. This will directly hit the political heartland of the country and will be a monumental achievement, if it happens. But it needs to be done if Pakistan is to rise from the abysmally low level where last year just 0.5% o the total population paid tax. The fact that Pakistan has one of the lowest tax-to-GDP ratios in the world is a big deterrent to financial assistance from foreign countries since their tax-payers demand to know their money is being directed to a country where people do not pay their due.

Then the power crisis is a very significant challenge. One the one hand the government needs to generate at least three million jobs a year, but it is in fact losing out on employment because of the power crisis that has hit industrial growth.

The challenges are not tough economically. The numbers suggest that while the situation is bad, it is not irreversible nor are the issues beyond recovery. The political will to address them is the key. This is perhaps the biggest challenge of all.

Published in The Express Tribune, May 13th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ