Fiscal responsibility: All parties want to raise taxes, none wants to say how

PPP has best revenue collection plan.

While there is much wasteful spending that needs to be cut out, the bulk of the problem lies in the fact that not enough Pakistanis pay their taxes. DESIGN: JAMAL KHURSHID/ SAMRA AAMIR

Almost every political party in Pakistan has addressed the question of government finances, but considering how important this area is, virtually no party has a comprehensive plan on how to actually get the government to a point where Islamabad can pay its bills without borrowing quite so heavily from any pile of money it can lay its hands on.

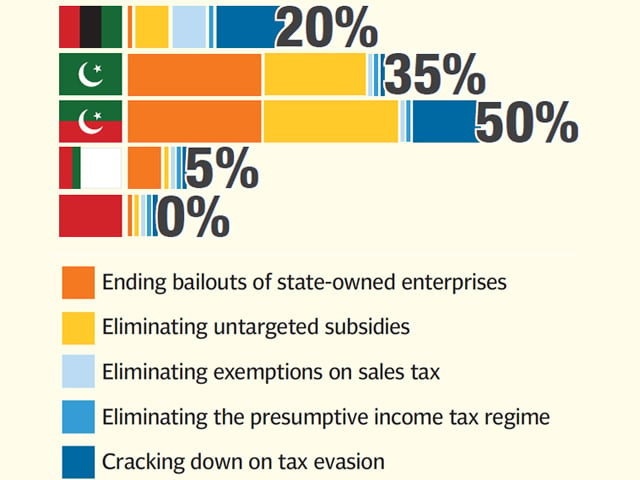

In our analysis, we have come up with five criteria for judging the depth of a party’s plan to restore fiscal balance. Of these five, two relate to expenses – eliminating untargeted subsidies and ending the bailouts of state-owned companies – and three relate to raising revenues: eliminating exemptions on sales taxes, ending the presumptive tax regime, and credibly cracking down on tax evasion.

This set of criteria is deliberately tilted towards the revenue side because we believe that Pakistan does not really have an expenditure problem. Total government expenses as a percentage of the total size of the economy hover around the 16% mark, by no means an extravagant figure. Hence, while there is much wasteful spending that needs to be cut out, the bulk of the problem lies in the fact that not enough Pakistanis pay their taxes.

And it is this revenue side that is most disappointing. Every single party manifesto examined by The Express Tribune had the exact same target: total government revenues should hit 15% of the gross domestic product. But while every party appears to believe this, hardly any of them offer any specifics on how they would achieve this target.

On this score, the record of the PML-N leaves a lot to be described. They were initially awarded some points for suggesting methods of cracking down on tax evasion, but their manifesto includes proposals for so many new tax exemptions that we felt compelled to deduct points for that, leaving the PML-N with a net score of zero in each of the three revenue-related criteria for achieving fiscal balance.

The PTI offers perhaps the boldest and most difficult reform: making the Federal Board of Revenue an independent organisation, a proposal that is likely to result in much resistance from the civil service. It did not specify where it would raise taxes, however. The most detailed revenue-raising plans, ironically, came from the one national party that has no section on fiscal affairs in its manifesto: the PPP.

The former ruling party proposed utilising the database of potential tax evaders it constructed towards the close of its time in office to begin cracking down on tax evaders. It also proposed eliminating the distortionary exemptions in the sales tax code, though it did not name any specific ones and one several occasions failed to push through such reforms while it was most recently in office.

On the matter of ending the Rs400 billion annual bailouts of state-owned companies, the ideological divide amongst the parties was once again in play. The pro-business PML-N’s solution was to introduce professional management structures in these companies in preparation for privatisation. The PTI, meanwhile, wanted to create an independent holding company that would oversee government investments and would be managed outside the influence of government officials or elected representatives. The PPP also wants to retain government ownership of these companies.

On matters relating to the government’s money, the political manifestos of the ANP and MQM were not entirely silent, but included no major substantive proposals.

Published in The Express Tribune, May 6th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ