For Attock Group, refinery wing grows, petroleum, exploration drag profitability

Attock Refinery and Cement see significant rise in earnings; Petroleum and POL close lower.

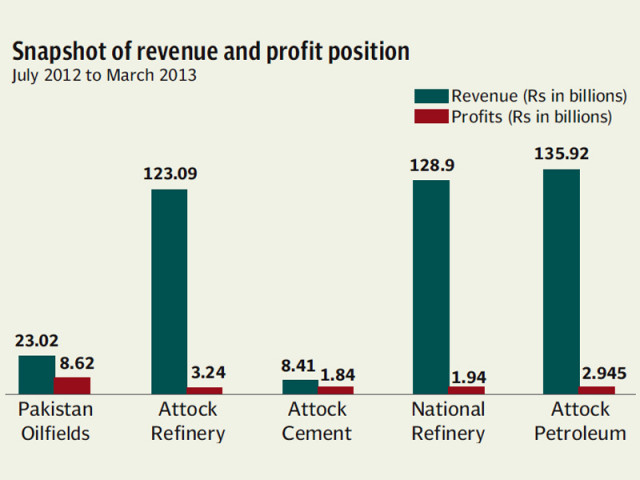

Attock Petroleum’s (APL) profits fell 3.5% to Rs2.945 billion in the first nine months of fiscal 2013 compared to Rs3.148 billion in the corresponding period of last year.

Attock Group – the sole vertically integrated oil conglomerate of the country – announced earnings for all of its listed subsidiaries on Tuesday, where its exploration and petroleum wings saw their earnings fall and Attock Refinery grow in the first nine months of fiscal 2013. Moreover, Attock’s cement subsidiary’s profits soared 170% in the period.

According to the notices sent to the Karachi Stock Exchange, none of the announcements were accompanied by any payouts.

Petroleum wing

Attock Petroleum’s (APL) profits fell 3.5% to Rs2.945 billion in the first nine months of fiscal 2013 compared to Rs3.148 billion in the corresponding period of last year.

Sales of the oil marketing company after deducting sales tax, however, grew 5.8% to Rs117.24 billion during the period backed by favourable product pricing.

“With restricted volumetric growth, higher cost became a drag on the company’s profitability,” said Ayaz Ahmed of Topline Securities.

Operating expenses, which stood 89% higher at Rs1.126 billion, due to APL’s expanding retail network led the decline in the bottom-line.

APL’s energy product sales were up a meagre 3%, while Asphalt – a key contributor to earnings – was adversely affected by lower demand in the country.

The company also seems to be trapped in the circular debt cesspool, as finance costs jumped 33% despite consistent interest rate cuts by the central bank due to late payment charges.

On a brighter note, gross profits turned out to be 6% higher at Rs3.93 billion, primarily attributable to higher margins on petroleum products and significant inventory gains during the nine-month period.

Going forward, if APL becomes successful in acquiring Chevron Pakistan, which operates under the Caltex brand name in Pakistan, it will acquire a distribution network complementary to its own channels therefore expanding the reach and the market share of the company. While a bid price has not yet been announced, analysts expect Chevron to accept bids between Rs15 billion and Rs17 billion.

Exploration wing

Softening oil and gas production from operated fields as well as higher financial charges and lower other income from subsidiaries dented Pakistan Oilfield’s earnings, which fell by 7.6% to Rs8.62 billion during the period from Rs9.33 billion in the corresponding period of the preceding fiscal.

Moreover, Arab Light Crude also declined slightly in the period, averaging at $109.6 per barrel, hurting the bottom-line.

Increasing production from Makori East during the third quarter of fiscal 2013 was not able to offset decline in production from maturing fields of Pindori and Pariwali, pulling the nine-month profits lower. Cumulative oil production from Makori touched 7,500 barrels per day in March 2013.

Revenues also registered a decline of 3% to Rs21.424 billion, on the back of 4% and 16% lower oil and gas production respectively from maturing fields.

Operating costs spiked by Rs756 million to Rs5.48 billion due to ongoing work at joint venture fields and Pariwali-7. Moreover, exploration costs also jumped four times to Rs1.13 billion on account of higher seismic activity as the company did not book any dry well, whereas decline of 16% in other income to Rs1.72 billion is due to reduced dividend announcement from associates.

Refinery wing

For the Attock Group, its refinery subsidiary – Attock Refinery – was the silver lining as the company’s profits grew 24% to Rs3.24 billion as margins improved for the refinery.

A Topline Securities analyst says that growth in earnings stems from better refinery operations and other incomes.

Gross refining margins improved by 40 basis points to 1.8% during the nine-month period as gross profit grew 44% to Rs2.3 billion compared to Rs1.57 billion in the corresponding period of last year.

Income from core-refinery operations stood at Rs1.94 billion, up a staggering 89% from last year, whereas income from non-refinery operations i.e. dividend from associated companies declined 18% due to reduced dividend income from National Refinery and Attock Petroleum, both of whom reported adverse performance for the nine-month period of fiscal 2013.

National Refinery, on the other hand, saw its profits shrink 10.5% to Rs1.94 billion against Rs2.16 billion in the same period last year despite a growth in revenues for the company.

Sales grew a modest 2% to Rs128.9 billion, but squeezing margins resulted in gross profit shrinking to Rs3.45 billion compared to a gross profit of Rs3.89 billion in the corresponding period.

Although the company recorded lower distribution expenses and other operation expenses, its administrative expenses were higher and other income were upward sticky, thereby restricting any gains during the year.

Cement wing

Attock Cement announced its earnings on Monday, which were driven mainly by higher cement prices during the nine-month period as profits grew 69% to Rs1.48 billion.

Yousaf Rahman, analyst at Global Securities, believes that the growth in profitability attributable to higher cement prices. Cement prices averaged Rs438 per bag against Rs402 in the corresponding quarter of 2012.

Published in The Express Tribune, April 17th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ