Corporate results: International gateway boosts PTCL’s earnings by a billion

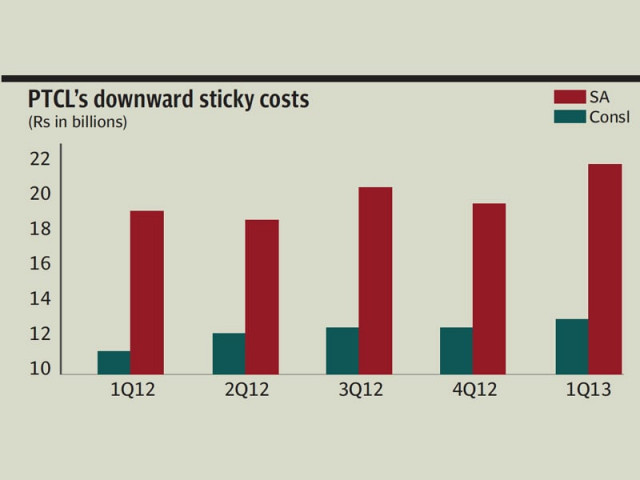

Despite downward sticky costs, telecom giant opens the season for the sector with a bang.

PTCL announced profit of Rs3.3 billion for the first quarter of 2013, up 37.5% from Rs2.4 billion in the corresponding quarter of 2012.

Pakistan Telecommunication Company (PTCL) opened the results season for the telecom sector, showing a growth in profits derived from higher call rates under the international clearing house regime, however downward sticky costs limited profitability.

Under the ICH, all incoming international traffic had to be handled through a centralised gateway, which was supposed to be operated and maintained by PTCL. Long-distance international operators had to share revenues for international incoming traffic based on their respective market share with fixed termination charges.

When ICH became effective on October 1, the calling rates for overseas Pakistanis rose phenomenally – almost two to three times, benefitting LDI operators.

PTCL announced profit of Rs3.3 billion for the first quarter of 2013, up 37.5% from Rs2.4 billion in the corresponding quarter of 2012, according to a notice sent to the Karachi Stock Exchange. The announcement was not accompanied by any dividend payout, thus failing to create excitement among traders at the Karachi bourse.

On a sequential basis, the story was totally different as profits were lower by 65% due to absence of one-timers – reversal of Rs1.5 billion voluntary separation scheme (VSS) and lower effective tax rate availed in fourth quarter of 2012.

The announcement was below market consensus also, where lower gross margins pulled the earnings down. Since revenues were in line with expectations, downward sticky costs contributed negatively, said Ayub Ansari, deputy head of research at AKD Securities.

Furthermore, loss of international calls to Pakistan to other substitutes such as voice over internet protocol and grey traffic from an average 750 million minutes per month in fourth quarter of 2012 to 600 million minutes per month also contributed to limited earnings.

Revenues grew 13.9% in the quarter to Rs32.18 billion compared to Rs28.26 billion in the corresponding quarter of 2012, which is directly attributable to the increase in international incoming rates to 8.8 cents per minute.

Gross margins were up by just 0.68 percentage points to 35.5% despite a jump in revenues as the telecom operator’s cost of services went up by 12.7% mainly due to rising costs of Ufone – PTCL’s wholly-owned cellular subsidiary.

PTCL’s selling and marketing expenses shrunk 2.2% to Rs1.99 billion during the period under review. On the contrary, finance costs grew 34% to Rs1.07 billion.

PTCL’s stock hit its lower circuit during trading on Monday at the KSE to close at Rs20.17 as the results announcement was below market consensus unaccompanied with any payouts.

Outlook

Going forward, uptick in long distance international minutes will be the key driver for PTCL as higher prices under the ICH regime will continue wielding results for the whole sector and not only just for PTCL, which controls 50% of the market.

“Any dip in the stock of price of PTCL is an excellent opportunity to buy as the telecom sector prepares to announce ICH-laden results for the January to March quarter,” said Zoya Ahmed, analyst at BMA Capital.

Published in The Express Tribune, April 16th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ