Indian aviation face huge hurdles to meet potential: IATA

SpiceJet and Jet Airways, India's second-biggest carrier, swung to profit in the most recent financial quarter.

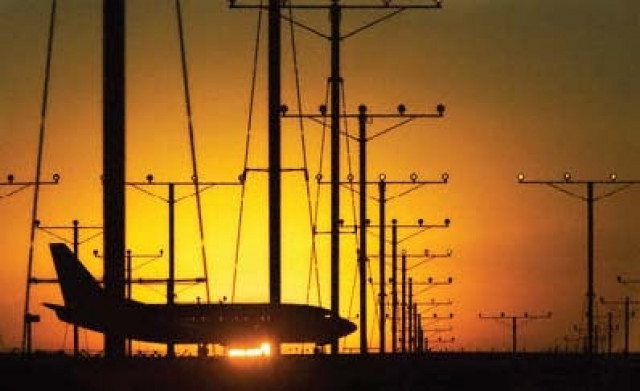

India's airline sector was once vaunted as a symbol of the country's economic vibrancy. PHOTO: FILE

India's combined passenger numbers shrank by 2.1 percent last year compared with global growth of four percent, according to industry figures.

The country of 1.2 billion people, most of whom still travel using the vast rail network, "is a great potential market", said International Air Transport Association (IATA) chief Tony Tyler.

"But to realise that potential, some huge issues must be overcome," he said, referring to its dilapidated airport infrastructure, high operating costs and expensive fuel.

India's airline sector was once vaunted as a symbol of the country's economic vibrancy. But its fortunes have tumbled amid over-expansion, inadequate infrastructure, cut-throat fare competition, expensive fuel and other costs.

"Globally, fuel averages a third of an airline's cost. In India it accounts for 45 percent. And on top of that India imposes a service tax" which goes against international aviation rules, Tyler told a seminar of industry executives in New Delhi.

"Running an airline is a tough business and operating in India presents bigger challenges than most other markets," Tyler added.

But he said some progress was being seen in the sector after it lost a combined total of close to $2 billion in the previous financial year.

While Kingfisher Airlines, controlled by liquor tycoon Vijay Mallya and once India's second-largest carrier, has been grounded since last year due to a cash crunch, the biggest airline, no-frills IndiGo, is profitable.

Smaller rival SpiceJet and Jet Airways, India's second-biggest carrier, swung to profit in the most recent financial quarter.

Importantly, India's government "deserves congratulations" for opening up the airline sector to vital foreign investment, allowing overseas carriers to buy up to 49-percent stakes in their Indian peers, Tyler added.

Reports have abounded about possible alliances between local carriers and international airlines since India eased the investment regulations last September.

Jet has said it is in discussion with Abu Dhabi-based Etihad Airways, with media reports saying the Indian carrier could sell up to a 24 percent holding for some $300 million.

Also, the Foreign Investment Promotion Board has cleared a plan by no-frills Kuala Lumpur-based airline AirAsia to own a 49 percent stake in a joint venture with the steel-to-tea Tata group and private investor Telestra.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ