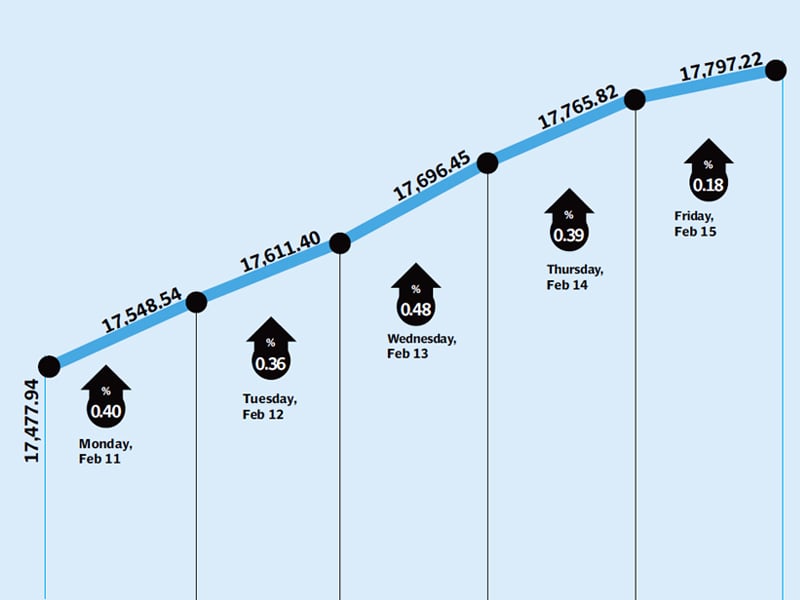

Bullish investors held sway over the stock market throughout the week, pushing the stock market towards uncharted territory as the benchmark Karachi Stock Exchange (KSE)-100 index gained another 320 points (1.8%) to close at a new record high of 14,797 points during the week ended February 15.

Strong corporate earnings and the relative calm in the political arena led to greater investor participation in the market, as the index continued its impressive month-long rally. Having crossed the 17,000 point barrier just two weeks ago, the index now has its sights set on the historic 18,000 points benchmark.

Telecom was again the preferred sector for investors, as Pakistan Telecommunication Company Limited (PTCL) was to announce its quarterly results during the week. The buildup lived up to the hype, as PTCL announced a staggering 497% growth year-on-year in its quarterly income.

This was largely due to the implementation of the International Clearing House for incoming calls earlier on during the year. However, the move was trashed by the judiciary and the gains are likely to be a one-off thing. It has been reported by KASB Securities that international incoming calls have declined substantially after the implementation of the ICH, and this is likely to hurt telecom revenues in the long term.

Also in the spotlight was the automobile industry, as monthly car sales jumped 50%, with the Indus Motor Company leading the way with a 127% month-on-month increase in car sales, followed by Pak Suzuki Motors, which saw car sales increase 17% over the previous month. Indus Motors and Pak Suzuki stocks closed the week up 10 and 4.7% respectively.

The oil and gas sector was also in the limelight on expectations of an announcement of higher marketing margins for oil marketing companies, and also due to higher global oil prices. The Oil and Gas Development Company was the biggest beneficiary, and climbed 6.6% during the week.

Politics was relegated to the backburner as Swiss courts said that cases against President Asif Ali Zardari cannot be reopened. Furthermore, the Supreme Court also rejected a petition filed by Dr Tahir ul Qadri calling for the reconstitution of the Election Commission of Pakistan.

Another major development towards the closing of the final trading session of the week was that of the Abu Dhabi Group reportedly signing a deal with property tycoon Malik Riaz for an investment of $45 billion for projects in Karachi, Lahore and Islamabad. The news is likely to provide a solid boost to the market in the coming week.

Average daily volumes declined slightly by 7.4% to 270 million shares traded per day. This activity, however, was focused more towards blue-chip stocks. As a result, average daily values climbed 19.4% to Rs6.81 billion per day. The market capitalisation of the KSE increased 1.9% to Rs4.46 trillion by the end of the week.

Winners

National Foods

National Foods is a diversified food manufacturer. The group’s products include recipe blends, dehydrated vegetables, pickles, salts, snack foods, desserts, and a number of of health foods.

Netsol Technologies

Netsol Technologies provides information technology solutions. The services include custom software development, technology outsourcing, systems integration, application development, and business intelligence consulting.

Nishat (Chunian)

Nishat (Chunian) manufactures and sells yarn and fabric. The company operates spinning, weaving, dyeing, and finishing units.

Losers

KESC

The Karachi Electric Supply Company is a privately-owned power producer, which transmits and distributes electricity.

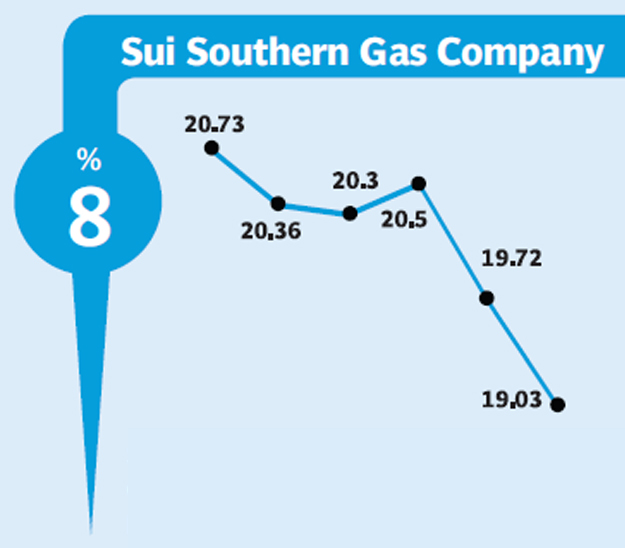

Sui Southern Gas Company

Sui Southern Gas Company transmits and distributes natural gas and constructs high pressure transmission and low pressure distribution systems. The company’s transmission system extends from Sui in Balochistan, to Karachi in Sindh.

Bankislami Pakistan

Bankislami Pakistan attracts deposits and offers Islamic banking services. The bank offers mortgage and automobile loans, lease financing, wealth management services, and letters of credit and guarantee.

Published in The Express Tribune, February 17th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ