Corporate results: Engro Fertilizers finishes the year in the red

According to BMA Capital, the company’s urea production fell 22% to 977,000 tons in 2012.

Gas closures continue to plague the fertiliser producer, reporting a loss of Rs2.9b

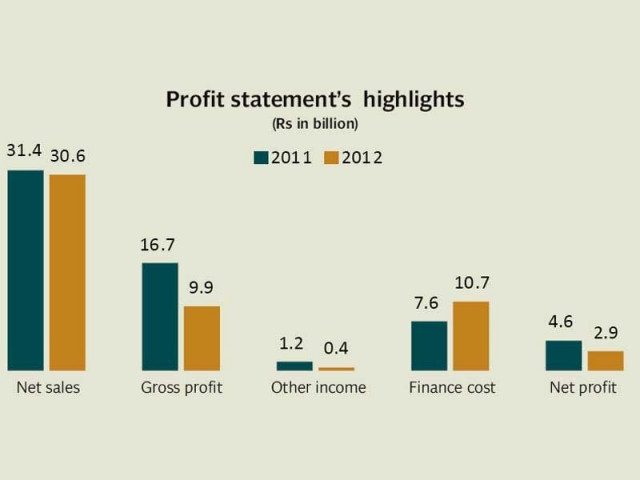

Engro Fertilizers, the Corporation’s unlisted but the highest profit making unit for many years, reported a loss for 2012 of Rs2.935 billion, primarily due to shutdown of the new plant. The fertiliser unit reported an astounding profit of Rs4.59 billion in 2011.

“The loss on an annual basis is mainly driven from the shutdown of the new plant. However, in the final quarter of 2012 the Enven plant operated at over 80% capacity, leading to significant efficiency gains and partially contributing towards the fertiliser company achieving breakeven in the quarter,” commented Farid Aliani, analyst at BMA Capital. This implied a fourth quarter profit of Rs0.043 billion for Engro Fertilizers.

The government decided to divert 202 million cubic feet of gas per day from the dedicated Mari field controlled by the Oil and Gas Development Company to the fertiliser plants on the Sui network.

Engro spent $1.1 billion for building its Enven plant on the Sui Northern Gas Pipelines network. Engro’s Enven is the world’s largest single-train ammonia-urea plant with a production capacity of 1.3 million tons per annum. Other plants on the network include Pakarab Fertilizer, Agritech Limited and the Dawood Hercules Fertiliser.

Among these plants, Enven plant received gas for only 45 days in 2012, Pakarab Fertilizers 100 days, Dawood Hercules 70 days, and Agritech 100 days, say industry insiders.

Engro Fertilizers’ net sales shrunk 2.5% to Rs30.626 billion during the year compared to Rs31.353 a year ago, mainly due to the fall in production. According to BMA Capital, the company’s urea production fell 22% to 977,000 tons in 2012. Though, the last quarter saw considerable improvement in production, clocking in at 270,000 tons, up 45% quarter-on-quarter, it was no match to the losses borne by the company throughout the year. Apart from enhanced production, urea sales also improved during the quarter, growing 76% to 345,000 tons, helped by bumper industry sales during the Rabi season.

Excessive gas curtailment besides gas infrastructure development cess (GIDC) also forced Engro Fertilizers’ margins to shrink to 32% for the year, squeezing from 53% in 2011. The company managed to make a gross profit of Rs9.9 billion, where the cost of sales incurred were Rs20.77 billion.

Though the GIDC has been declared illegal recently, the fertiliser producer paid the tax for the full year, which is Rs197 per million British thermal unit (mmbtu)and Rs50 per mbtu on feed and fuel gas on the fertilizer sector, according to a Topline Securities research note.

Financial charges grew 40% to Rs10.7 billion, the other big reason for pushing the company into the red zone. Engro Fertilizer had sought debt re-profiling and had not been replaying its banks loans since June, 2012.

Engro Fertilizers enjoys a 16% market share of the urea and the di-ammonium phosphate market.

The parent, Engro Corporation, is claiming Rs34 billion in damages from the SNGPL for breach of sovereign contract promising supply of gas to the diversified conglomerate’s fertiliser plant.

Published in The Express Tribune, February 9th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ