Weekly review: KSE-100 undergoes correction, sheds 294 points

Investors choose to book profits as political uncertainty looms.

Investors choose to book profits as political uncertainty looms.

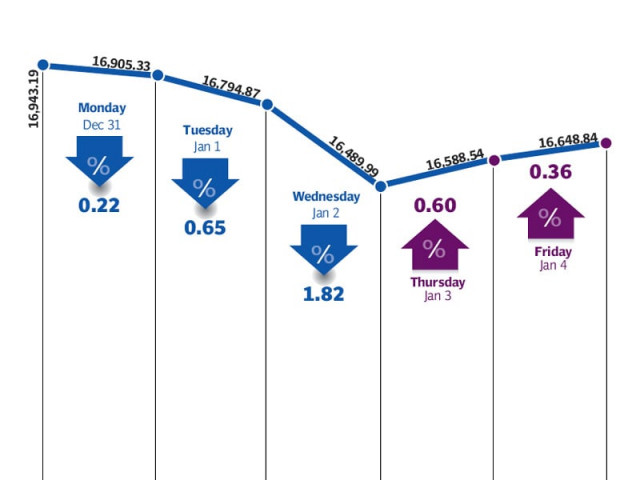

The index, which had seemed all set to creep past the 17,000-point milestone at the end of the previous week, took a U-turn and dropped sharply after investors chose to book profits on the back of impressive 49% growth in 2012.

The correction did not come as a huge surprise, as a similar trend had prevailed at the beginning of 2012 as well, when the KSE-100 received a battering in the first 10 days of January. However after that, there was no looking back as the market soared to unprecedented levels by the end of the year.

Profit-taking started since the beginning of the week and culminated with a massive slide on Wednesday when the KSE-100 lost 304 points (1.8%). The index then managed to recover in the final two sessions to close at 16,649 points.

Investors chose to be cautious due to uncertainty about political the scenario and also because of a lack of triggers. On the political front, uncertainty arose about the formation of caretaker setup and holding of general elections.

Attention also shifted towards macro-economic data, with the country’s foreign exchange reserves increasing by $430 million during the previous week, on the back of $688 million payments received under the Coalition Support Fund. However, investors remained wary as the reserves would have continued to decline if this payment was not received.

Inflation number for December also clocked in at 7.9%, remaining in the single digit. However, the number was up from the 6.9% inflation in November and may have dashed hopes of those expecting a further discount rate cut in the future. The discount rate currently stands at 9.5%.

The government also announced a hike of 6.14% in the price of natural gas during the week, and as a result, the inflation rate can be expected to go up in the coming months.

Furthermore, foreigners were again net sellers at the bourse and offloaded $2 million worth of equity during the week.

Activity at the bourse improved as average volumes rose by 7.4% to 148 million shares traded per day. Similarly, average daily value also increased by 10.5% to Rs3.41 billion, but remained low in absolute terms. Market capitalisation fell by 2% to Rs4.17 trillion.

With the earnings season all set to kick off from next week, investor focus will shift towards companies with high-dividend yields. However, the political situation can continue to be a dampener and investors will be keeping a close eye on those developments.

Winners of the week

Ghani Glass

Ghani Glass manufactures and sells glass containers. The company makes glass containers for pharma, food and beverage. Ghani Glass also manufactures float glass variations for commercial, domestic and

industrial use.

Pak Reinsurance

Pakistan Reinsurance Company offers reinsurance and risk management services in Pakistan.

Millat Tractors

Millat Tractors Limited assembles and manufactures tractors,

implements, and equipment.

Losers of the week

Hum Network

Hum Network operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Grays of Cambridge

Grays of Cambridge (Pakistan) is a holding company. The company, through its subsidiaries, manufactures and exports sporting goods, specialising in hockey sticks.

TPL Trakker

TPL Trakker is a vehicle tracking and fleet management service provider for markets in the Middle East and South Asian region. The company’s business is to supply GPS, GSM and satellite mobile asset tracking, management and information solutions.

Published in The Express Tribune, January 6th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ