Weekly Review: Investors cautious as index hovers at record highs

Rupee continues to slide against dollar as foreign exchange reserves decline.

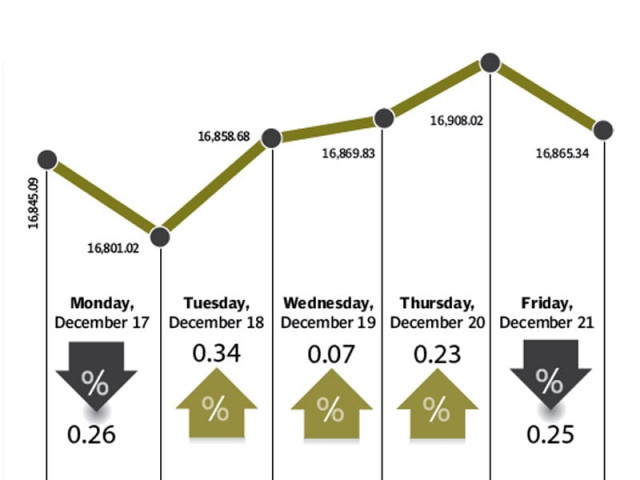

The market failed to capitalise further on the cut in the discount rate announced by the State Bank, and was also held back by a persistent depreciation in the rupee against the dollar. The KSE-100 index traded in a narrow range of 180 points, while the 17,000 points psychological barrier continued to remain elusive.

The State Bank of Pakistan had slashed the discount rate by 50 basis points to 9.5% over the previous weekend. However, the index was largely unaffected by the decision, as the rate cut had already been factored in by investors: evidenced in the index climbing 600 points (3.7%) over the last 30 days.

The absence of any positive triggers other than the discount rate cut was also a major factor in the market’s lacklustre performance. The only other news of note was that textile exports for the first five months of the current fiscal year were up by 7.8% to $5.4 billion.

The higher export numbers helped in reducing the country’s deficit. However, this was the only positive news on the macroeconomic front, as the persistent slide in the rupee continued, while the country’s current account slid into a deficit from a surplus during November.

The rupee hit an all-time low of Rs98.14 against the dollar in the inter-bank market on Monday: it looked set to breach the Rs100-to-a-dollar mark, before the State Bank intervened and managed to shore up the slide. The country’s foreign exchange reserves, meanwhile, dipped to $13.2 billion during the week, triggering fears that the central bank would be unable to sustain its interventions in the money market for long.

The country’s current account was another sore point during the week, as it slid from a surplus in the first four months of fiscal 2012, to a deficit of $365 million for the five-month period ended November 2012. However, the macroeconomic situation is likely to improve during January, as the government is expected to receive another $688 million from the US as part of the Coalition Support Fund.

Activity at the bourse picked up slightly, as average daily volumes were up 2% to 138 million shares traded per day. However, most of this activity was restricted to speculative stocks, as the KSE-30 index (of blue chip companies) contributed to only 25% of the total volumes traded at the bourse.

Average daily values fell 4% to Rs3.5 billion traded per day, despite the increase in volumes. The market capitalisation of the KSE increased 0.4% to Rs4.23 trillion by the end of the week.

Winners of the week

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. It manages call centres and offices in Pakistan and elsewhere throughout the world.

NIB Bank

NIB Bank Limited is a commercial bank operating in Pakistan.

Rafhan Maize

Rafhan Maize Products Company produces corn oil, industrial starches, liquid glucose, dextrin, gluten meals, and other corn related products. The company also produces a wide range of co-products such as gluten feeds, meals, and hydrol.

Losers of the week

Grays of Cambridge

Grays of Cambridge (Pakistan) is a holding company. The company, through its subsidiaries, manufactures and exports sporting goods, specialising in hockey sticks.

Murree Brewery

Murree Brewery Company specialises in the manufacture of beer and Pakistan Made Foreign Liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

JDW Sugar

JDW Sugar Mills produces and sells crystalline sugar. The company is located in Rahim Yar Khan, and was formerly named United Sugar Mills Limited.

Published in The Express Tribune, December 23rd, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ