Investing in silver: A smart move in the current global economic scenario

Multiple factors indicate that silver prices will appreciate in the coming months.

Many articles on silver that you will come across will talk about demand and supply of the metal without addressing the underlying fundamentals that drive it. The hybrid nature of silver as a half-precious and half-industrial metal makes its story slightly more complicated than other commodities.

Considering this dual nature of silver, and to understand what influences the price of this commodity, it is important to examine the factors that dictate the demand of industrial raw materials and the prices of precious metals. Since recent data paints a bullish picture for both, the smart investor should consider an investment in silver. Let us consider why:

The recent fall in silver and gold prices is being seen by some as a long-term weakness in silver as a commodity. However, in the greater context – wherein equity markets across North America and Europe have recently seen a downtrend – this weakness in gold and silver can be attributed to margin calls in hedge fund portfolios, whereby investors have been forced to liquidate other positions (such as in commodities) to maintain margin requirements.

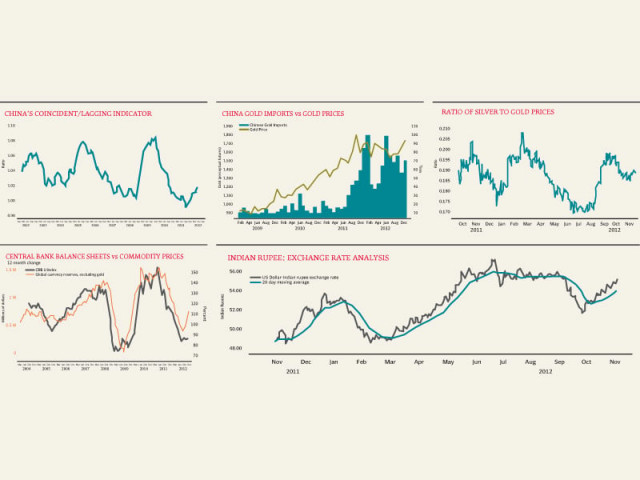

China is the biggest importer for copper and industrial metals, and it is impossible to make a case for an improvement in industrial raw material prices without a corroborating improvement in Chinese manufacturing and infrastructural development. Graph 1 is a coincident/lagging indicator for China, which picks up as coincident indicators (ie: industrial production, personal income) outpace lagging indicators (changes in the consumer price index and labour cost per unit). This is seen as an indication that an economy is in recovery mode. As China picks up its manufacturing activity, its demand for raw materials will push up global prices of industrial metals, including silver.

As a precious metal, the price of silver has historically been strongly interlinked with any supply and demand changes for gold. Apart from being the largest consumer of industrial raw materials, China is also the largest buyer of gold worldwide. Graph 2 represents Chinese imports of gold, and shows its positive correlation with the global price of gold. Chinese gold imports surged to 70 billion tons in September this year. If annualised, this represents 30% of all gold produced outside of China (China is also the largest producer of gold). This whopping surge in the year-to-date gold imports for China has surpassed the official gold reserves of India (another major buyer of gold). As long as China continues to import gold at this rate, we will continue to see a surge in gold prices worldwide, which will also affect the prices of gold.

When discussing silver in the context of gold, it is also important to look at the silver-to-gold ratio (silver prices divided by gold prices), which appears to be rolling over (in Graph 3) after a period of consolidation similar to the July-August 2012 period. This implies that for a unit change in gold prices, the increase in silver prices will now be proportionally larger.

Global currency reserves, excluding gold (central bank balance sheets), have had a historic relation with global commodity prices, as can be seen from Graph 4. Globally, central banks have broadly started increasing their balance sheets with zero interest rate policies and bond purchases in the US. This increases the inflation expectations of investors, and they will soon shift their wealth into tangible assets, which makes a strong case for commodity prices to follow.

On the other hand, India – which is one of the largest importers of gold after China – has recently seen a devaluation of its rupee against the dollar, which makes it more expensive for Indians to buy gold in the international market, as can be seen in Graph 5. However, Indian Prime Minister Manmohan Singh recently announced to his cabinet that $1 trillion must be invested in infrastructure in the country, which will ultimately support the Indian rupee and help improve gold demanded by India. Secondly, China and India have also agreed to a bilateral agreement under which China will invest into Indian infrastructure, helping decrease the China-India trade imbalance, which is currently in favour of China. This will mitigate India’s concerns for an ever-present trade deficit, and also be supportive of greater gold imports.

Having examined the various underlying factors that will dictate silver prices in the near term, barring a global economic shock, the metal seems to be a pretty good investment for anyone looking to augment their wealth. I would recommend a ‘buy’ stance on silver, as long as China continues to buy gold and central banks continue to ease their monetary policy, and holding it till the second quarter of 2013 at least.

THE WRITER IS AN ACCOUNTING AND FINANCE GRADUATE FROM LUMS AND CURRENTLY WORKS AT A GLOBAL MACRO HEDGE FUND

Published in The Express Tribune, December 3rd, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ