Corporate results: Lucky Cement profits jump half a billion

Robust growth stems from a billion rupees increase in revenue, cost-cutting.

Lucky Cement profits solidified at Rs2 billion in the first quarter of fiscal 2012-13, up 34% from Rs1.5 billion in the corresponding quarter last year.

The robust growth in profitability primarily stems from a billion rupees rise in revenues, improving gross margins and retention prices, austerity measures of the company to cut costs, lower coal prices plus savings from energy efficient measures, said BMA Capital Analyst Affan Ismail.

Revenues climbed 18% to touch Rs2 billion in the period under review. Better cement prices in the local market, up 11% from a year earlier, coupled with improvement in local dispatches remained the major driving force behind considerable increase in the top-line, says a BMA Capital research note.

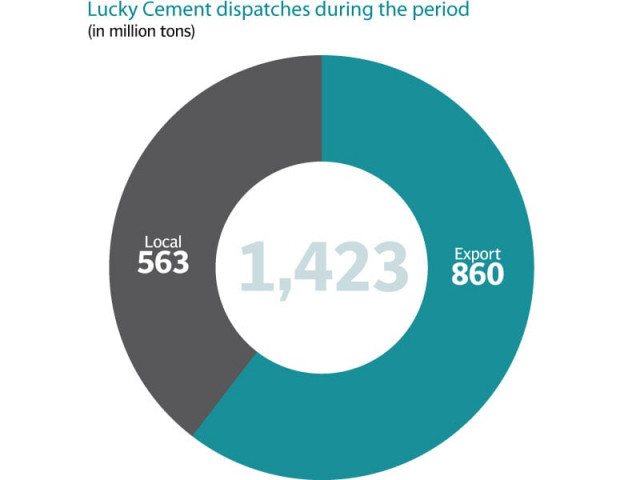

However, the cement manufacturer’s volumetric sales were down 1% at Rs1.42 million tons, suffering because of lower export demand. Local dispatches were higher by 5% to 860 million tons while exports were down 9% to 563 million tons. But the company was able to enhance its revenue considerably mainly on the back of higher prices in the local market and rupee depreciation boosted income from lower exports, according to Muhammad Sarfraz Abbasi, analyst at Summit Capital.

Resultantly, gross profit registered a massive rise of Rs33% to Rs3.87 billion.

Gross margins also improved to 43.75% – the highest in the cement industry – led by better retention prices and several austerity measures. Positive effect of energy expense cutting measures like conversion of coal-fired plants to tyre-derived fuel and refuse-derived fuel manifested into higher gross margins. The alternate fuels decreased demand of the more costly coal by 20%. Moreover, apart from robust retention level, considerable dip in coal prices, down 22% to $82.32 per ton, supported uptick in margins.

Operating expenses jumped 20% to Rs1.25 billion on the back of higher distribution costs over rising freight charges due to persistent increase in oil prices. On the other hand, financial charges went down 76% to Rs19 million as the cement producer is consistently loading off short-term and long-term debts from its balance sheet.

Cement manufacturers were among the most highly leverage sectors in the economy, and with successive interest rates cuts by the State Bank of Pakistan by over 200 basis points over the last quarter, the company was able to substantially cut down its finance costs.

According to the statements, the company had cash balance of Rs 3.3 billion as at September 30, 2012.

Going forward

Ongoing work on mega projects, higher retention prices, better volumes and persistent decline in coal prices is expected to bode well for the company and sector. Analysts believe that recent cut of 150bps in discount rate will help in terms of further improvement in local demand for cement as during the election year government will want to speed up all the development activities.

Lucky is also busy in its expansion plans as a consortium led by company bought a 75.8% stake in ICI Pakistan from Dutch paints giant AkzoNobel for Rs14.4 billion. The cement producer is also planning to set up a one million ton manufacturing in Congo under a joint venture project.

Lucky Cement Chief Operating Officer Noman Hasan believes that strong pricing scenario, sale of surplus electricity to Hyderabad Electric Supply Company and Peshawar Electric Supply Company and robust cash generation capacity amid lower debt will continue to remain the major value drivers for the company.

Published in The Express Tribune, October 26th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ