Distribution channels: Why McLeod Road is beginning to like bancassurance

As interest rates come down, banks look for new sources of revenue

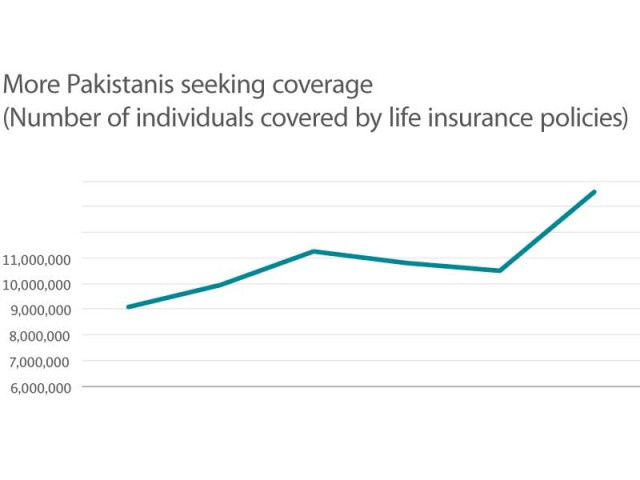

Many bank customers may not have noticed this, but a lot more Pakistani banks offer life insurance than did about four years ago. As interest rates come down, commercial banks are relying more and more on fees and commissions for their revenues. And nothing generates more commissions than life insurance.

The post-2008 era has been good to the banks. Their regulator was lenient in how they could take provisions for the bad lending of the Musharraf boom years. And as a new government took office, Islamabad’s appetite for debt appeared to know no limits. With inflation and interest rates high, the difference between what the banks could charge their (government) borrower and what they needed to pay out their depositors – the net interest margin – grew to record levels, allowing banks to rake in easy profits.

But that game appears to have run its course: interest rates are coming back down and the central bank is forcing them to pay more to their depositors. And so the banks need a new source of revenues. Since interest rates are largely controlled by the State Bank of Pakistan, the new source of revenue needs to be something independent of the regulator.

Enter life insurance

While net interest income is rightly seen as the primary source of banks’ revenue, it is not their only source. There are several non-interest-based revenue sources, such as transaction fees charged to clients, or brokerage fees or commissions earned on financial products sold. It is this last category that life insurance fits in rather neatly into, because no financial product generates more commission than life insurance.

Take, for example, a typical unit-linked life insurance policy. This is the most common form of life insurance in Pakistan (with a market share of well over 80%) since it has a significant investment component and is seen as a substitute for a pension plan. There is nothing that a bank can sell that is more lucrative than this type of policy because at least 75% of the first year of premiums paid by the policy holder go directly to the bank as their sales commission.

The sales commission decreases substantially for the second year of premiums and is zero thereafter, making it still a reasonable value for money for the customer over the long run, but earns the bank that hefty bit of revenue for the first year.

There are no precise figures available for exactly how much of the banks’ revenues is currently being derived from this source. According to the State Bank of Pakistan, in 2011, all fees, commission and brokerage charges earned the banks about 10.6% of their aggregate Rs450 billion in revenue. As net interest income comes down over 2012 and beyond, that proportion is likely to rise, and bancassurance – the life insurance policies sold by banks on behalf of insurance companies – is likely to play a key role in that rise.

In a sense, banks are returning to the model of business that they had during the Musharraf years, when they were far less reliant on lending activity and sought all sorts of other revenues, encouraging them to innovate and offer a wider range of financial services to their customers. In 2003, when interest rates were close to their all-time low, non-interest-based income formed about 41% of total bank revenues.

Not all banking innovation is good, of course. The invention of credit default swaps (CDS) and collateralised debt obligations (CDOs) caused the US housing crisis to ravage the entire global financial system. But forcing the banks to think about their customers’ needs – and not treating them as just a machine that yields deposits to be lent out to the government – probably a healthy trend.

Published in The Express Tribune, October 22nd, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ