Corporate Results: MCB Bank profits a modest 7% higher than last year

Bank declares a cash dividend of Rs3 per share, taking total payouts in 9MCY12 to Rs10.

MCB Bank has recorded 7% growth in profits of Rs16.67 billion for the first nine months of calendar year 2012 (9MCY12), against Rs15.51 billion in the same period of the preceding year. The profit translates into earnings per share of Rs18.13. The bank also declared a cash dividend of Rs3 per share, taking cumulative payouts during 9MCY12 to Rs10 per share.

Major highlights of the announcement include a 5% decline in net interest income due to lowered benchmark interest rates and relatively higher funding costs due to the enhanced minimum payable interest limit on savings accounts. The State Bank, in recent monetary policy announcements, has tightened banks’ margins in order to push them toward greater lending to the private sector.

The bank also recorded a steep 98% decline in provisioning expenses to Rs54 million, likely due to improving asset quality, according to Shajar Research’s Head of Research Umer Pervez.

Another analyst had a different opinion. “Last year the bank incurred nearly Rs2.5 billion in provisioning expenses related only to advances (out of total provisioning of Rs2.7 billion). This time, overall provisions stood at a mere Rs54 million, thanks to restricted lending and provision reversals following the sharp cut in interest rates which have improved the paying capability of borrowers,” noted Farhan Mahmood from Topline Securities.

The bank also recorded a 14% increase in non-interest income, and controlled its non-interest expenses to limit their growth to only 5%. Non-interest income increased due to a 15% growth in fee, commission and brokerage income received by the bank, and a further 46% growth in dividend income on its investments. On the other hand, interest expenses rose 24%, on account of a higher number of interest bearing deposits and the enhanced minimum interest rate payable on them, Muhammad Farhan Malik from Summit Research pointed out.

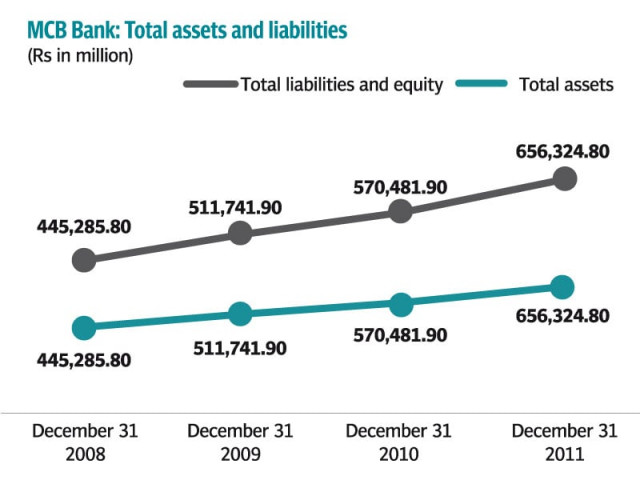

Raza Jafri from AKD Securities and Umer Pervez from Shajar Research said they believed that MCB still has sizable unrealised capital gains, and that the sequential growth in its liabilities (primarily due to borrowing and interest carrying deposits) had most likely been channelled into government securities.

On a sequential basis, MCB’s earnings have, however, declined by 6% as compared to the previous quarter. Over the previous quarter, although the bank recorded reversals in provisioning expenses worth Rs345 million, it also received lesser dividend income and increased losses on its investment portfolio to post a profit of Rs5.35 billion, lower as compared to Rs5.68 billion in the preceding quarter.

Other results

Fatima Fertilizer: 137% was the increase in profits to Rs4 billion during the nine months of 2012 from Rs1.694 billion on the back of reduction in distribution costs due to lower fertiliser off-take, marketing expenses, decrease in finance costs due to debt repayments, cut in interest rates and lower effective tax rates at 11.4%.

Attock Petroleum: Rs18.7 was the company’s earning per share, up 18% during July and August 2012 from Rs15.9 recorded in the corresponding period last year. The growth in earnings primarily stemmed from enhanced gross margins, higher other income.

Published in The Express Tribune, October 18th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ