Telecommunications: Is broadband internet going to lead the PTCL recovery?

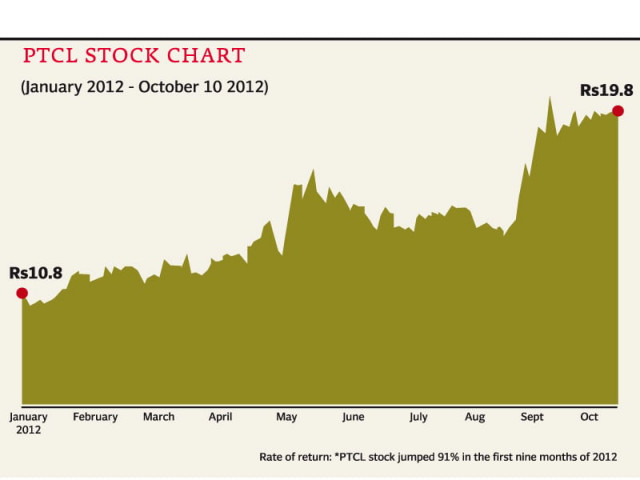

Stock has rallied 91% since January as investors see revenue streams diversifying.

Even as its core fixed-line business appears to be withering, the Pakistan Telecommunications Company (PTCL) appears to have a plan for a comeback. Far from being consigned to technological irrelevance, PTCL is innovating its way back to growth, and has already caught the attention of investors.

Although PTCL’s net income for the fiscal year ending June 30, 2012 declined by about 2.9% to Rs7.2 billion, what caught investors attention was the fact that revenues increased by 8.7% to Rs60 billion. This is the first time revenues have increased at all since 2007, and analysts are beginning to become optimistic about the company’s prospects for growth.

The company’s long-term earnings potential had been seen as declining, with only its cellular services subsidiary Ufone seen as having any growth potential. Ufone currently accounts for about 47% of the company’s consolidated revenues, a figure that is expected to go higher, according to Zoya Ahmed, a research analyst at BMA Capital, an investment bank.

Yet PTCL appears to be ready to stage a comeback, and is doing so in large part through diversification of its revenue streams as well as an increasingly effective adaptation of newer technologies, a phenomenon not often associated with a company that is still majority state-owned.

Ahmed, the BMA analyst, identified two major sources of PTCL’s turnaround: the growth in its broadband internet and cable television services, and its growth in data services and branchless banking services to its mobile customers.

“After several years of decline, PTCL’s fixed-line subscriber base grew by 2% in 2012, largely due to the fact that fixed-line is a prerequisite for its broadband internet services,” said Ahmed in a note issued to clients on Tuesday. “We project the share of the broadband segment in total revenues to climb to 25% by fiscal 2013, with an assumed subscriber base of 1.65 million.”

BMA Capital also projects that PTCL’s broadband internet subscriber base will continue to grow at an average rate of about 8.5% per year for the next three years.

Data and internet services also appear to be driving revenue growth at Ufone, PTCL’s wholly-owned mobile subsidiary. Mobile companies in Pakistan have typically seen small declines in their average revenue per user (ARPU) as they grow their predominantly prepaid subscriber base, but Ufone’s ARPU appears to have stabilised as more and more of its customers sign up for data services.

Having said that, there do appear to be at least a few challenges that the company will still need to navigate, though analysts appear to be optimistic about the management’s ability to weather them.

For instance, the company still has to pay about Rs6 billion to some of its redundant employees as severance pay. This payment is part of PTCL’s legacy from its days as a wholly state-owned company, when the government forced it to hire far more employees than it needed. Nonetheless, analysts at BMA Capital estimate that this one-time charge in 2013 will go on to save the company close to Rs1.1 billion per year from 2014 onwards, making it a worthwhile investment in the long-term profitability of the company.

Another key problem for the company is its international calling rates, which have increased significantly. Analysts estimate that the increase in international calling rates – which primarily affect people calling from abroad to Pakistani numbers – will accelerate the move by many customers to voice over internet protocol (VoIP) service providers like Skype.

Nonetheless, the market appears to like PTCL and has seen the stock rally by about 91% since January, with most of that rise coming in August and September. The stock closed at Rs19.80 in trading at the Karachi Stock Exchange on Wednesday, up 0.15% for the day.

Published in The Express Tribune, October 12th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ