While small players get squeezed, textile’s big guns are doing just fine

Government continues supplying gas to the biggest companies, at the expense of small businesses.

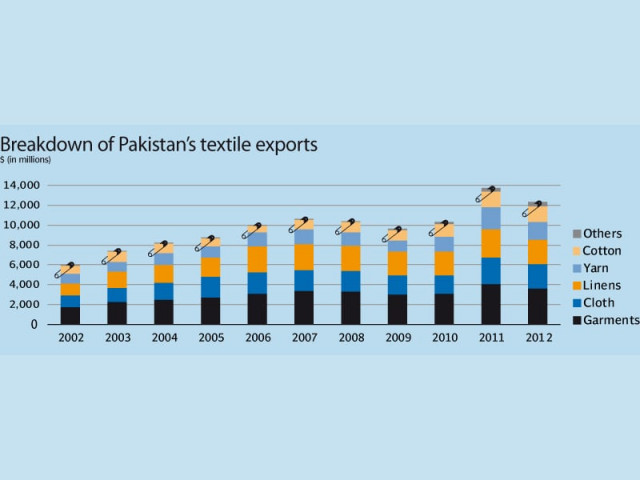

The energy crisis has hit Pakistan’s textile industry badly, but not all textile companies are hurt: the largest players are doing just fine, relying on a combination of the advantages of their economies of scale but also government-sanctioned privileges not available to smaller industrial players.

At least part of the reason why the bigger companies are doing better than the smaller ones appears to be the natural advantages that come with being a larger player, such as having a vertically integrated business model.

Kamal Yousaf, CEO of the Kamal Group of Industries, a textile conglomerate based in Faisalabad, says that part of his group’s advantage over smaller rivals in their ability to harness synergies within the group. The weaving, processing and dyeing, garment manufacturing, and trading arms all work as a unit, helping the group weather price hikes in raw material or other issues.

The Nishat Group, meanwhile, benefits from the fact that it owns the fourth-largest bank in the country – MCB Bank – allowing it to avoid cash flow issues and raise capital for efficiency improvement projects. Nishat Textile, therefore, never has a problem in paying wages to its employees and was able to raise Rs1 billion to invest in a 6.2-megawatt power generation unit that runs on biomass. Electricity produced in this manner is expected to be about 6% more expensive than that provided by the grid, but is far more reliable at a time when Punjab’s industry is especially hampered by severe power outages that last several hours a day.

And many larger textile mills are able to purchase large stocks of raw materials that insulate them from price shocks. More than half the cost of producing a piece of clothing is often still the cost of cotton, even for some of the largest players.

Yet at least part of the advantage appears to be built in by the government. One of the biggest reasons why larger textile mills, particularly in Punjab, have been able to do well is that most have installed captive power plants that – despite operating at one-third the efficiency of the grid’s power station – are getting gas supplies to produce power at a marginally lower cost than what they would get from the grid.

However, these captive plants have been getting gas even at the expense of the rest of the grid, meaning that even while the largest and richest textile exporters save a few pennies on their production costs (power accounts for 3% of all costs for the larger firms), all of Punjab is going through massive power outages because the power plants that supply electricity to ordinary citizens and smaller industries are getting less gas, sometimes even no gas.

Meanwhile, smaller textile players have less reliable power from the grid, a supply that is made more intermittent by the fact that the fuel for the grid’s power goes to their larger textile rivals. At the same time, banks charge the smaller players higher interest rates, since they are viewed as bigger risks for not having their own captive power supply.

“The smaller guys cannot afford to run their factories on diesel generators,” said Muzammil Aslam, managing director at Emerging Economics Research.

Giving out gas connections to larger, politically connected textile companies was a policy first initiated by the Musharraf administration in the early part of the 2000s. Former president Pervez Musharraf had a mistaken belief that Pakistan’s gas reserves were plentiful, and therefore his administration gave out government-guaranteed gas supply contracts to the largest textile companies, which now continue to reap the benefits even as their smaller competitors struggle, with some even going out of business and laying off their entire workforce.

(With additional reporting by Shahram Haq in Lahore)

Published in The Express Tribune, August 27th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ