Lahore bourse to offer futures contracts

Financial product to be based on the KSE-30 Index.

Lahore bourse to offer futures contracts

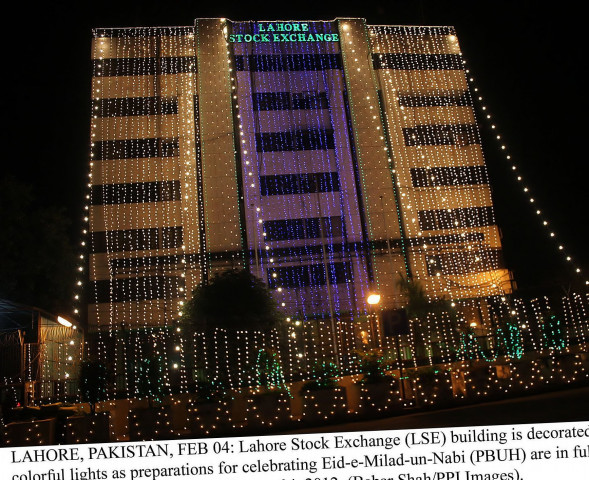

The Lahore Stock Exchange (LSE) will soon introduce futures products with underlying assets based on the Karachi Stock Exchange KSE-30 Index in the Stock Index Futures Contracts (SIFC) market.

Aftab Ahmed Chaudhry, Managing Director of the LSE said that the contracts on tradable benchmark indices are an agreement between two parties to buy or sell a standardised value of tradable sector index. He said that investors can use the SIFC on sector indices to take short or long positions in an entire sector, a cost effective approach. This product may be used as a hedging tool by those investors who have an investment portfolio of blue chip companies which constitute the KSE-30 Index. Responding to a question he said that a basket order window, a trade system allowing investors to place orders simultaneously, is being made available through the Lahore Automated Trading system, ULTRA to facilitate a efficient hedging mechanism for investors. He further stated that the exchange aimed to breathe new life into its stock market with the introduction of new futures contracts and other major financial derivative products.

KSE Marketing and Product Development General Manager Sani-e-Mehmood Khan gave a detailed presentation to the members of the Trading Affairs Committee on Modus Operandi of trading of the underlying KSE-30 Index in SIFC market segment at the LSE. A meeting of the Regulatory, Operations and Technology Services Division was also held where he explained legal, operational and regulatory aspects of the KSE-30 Index trading at LSE’s trading software.

He said that the KSE-30 Index would be started in two sectors; Oil & Gas and Banking. He explained modalities of the new product that would be traded. Speaking on KSE-30 Index, he said that sector index futures offers opportunities to investors to gain in specific sectors without buying scrip constituting the sector.

Elaborating on the details of trading of the KSE-30 Index in SIFC market, he said that the mark-to-market losses shall be collected on a closing trade day price basis by the exchange and profit shall be distributed on a futures expiry plus one day basis through the National Clearing Company of Pakistan with a cash settlement of Rs5 per index point movement. The settlement shall be concluded on maturity without any requirement of delivery. In the SIFC market, client level margining at 12.5% shall be required by the brokers to deposit in cash or bank guarantees. Circuit breakers shall also be applicable in case of a movement of 7.5% above or below of the previous day’s closing price.

Published in The Express Tribune, July 21st, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ