President intervenes: Pakistan, Iran break deadlock over barter trade

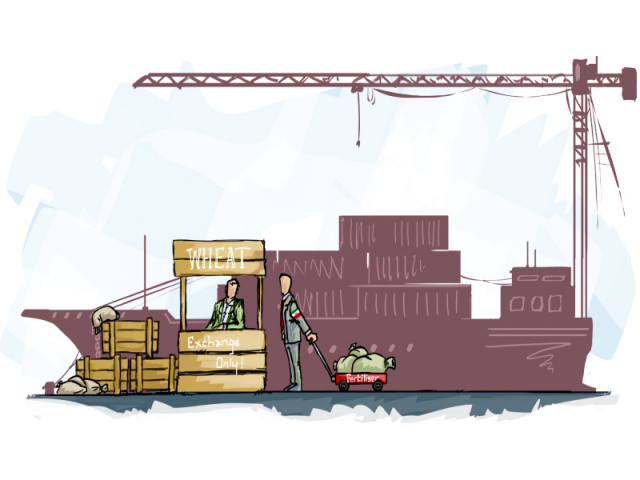

Tehran will import wheat after quality check, supply fertiliser in exchange.

Pakistan and Iran have broken the deadlock over barter trade as they have reached an understanding about export of wheat to Tehran following the intervention of President Asif Ali Zardari.

A high-level delegation, headed by Food Security and Research Minister Mir Israrullah Zehri who held talks with Iranian authorities in Tehran recently, has returned after successful negotiations. They have resolved issues related to quality and pricing, which became a major stumbling block in pressing ahead with plans to initiate barter trade, say sources.

Zehri handed over a letter of President Zardari to Iranian authorities, which called for resolving the issue of wheat import under barter trade, sources said.

Earlier, Iran had expressed dissatisfaction over quality of Pakistan’s wheat, which contained 0.3% karnal bunt (a fungal disease) as Tehran sought a commodity free of fungus.

During the talks, Pakistan’s team insisted that 0.3% karnal bunt was not harmful to human health. They pointed out that the internationally acceptable level was even higher at 1% and said Pakistan’s wheat was in line with standards applied in the United States and Europe.

Later, Iran softened its stance and reached an understanding about the import of wheat. The two sides had set the criteria and an Iranian team would conduct tests to check the quality of wheat, said officials of the food security and research ministry.

A mechanism for transporting wheat to Iran also came up for discussion. The two countries agreed that Iranian officials would check the quality of wheat at the Karachi Port before shipment.

According to the understanding reached, Pakistan will sell wheat at the price prevailing in the international market in July, though prices are going up. Three months ago, the two sides had set the price at $275 per ton, which was valid for two weeks only.

Earlier, talks on barter trade had deadlocked over Iran’s insistence on cash payment for urea supply to Pakistan and refusal to import wheat. “Now, Iran will export fertiliser in exchange for wheat import,” a government official said.

In February, then water and power minister Syed Naveed Qamar and visiting Iranian Deputy Commerce Minister Abbas Ghohadi had agreed that Tehran would import one million tons of wheat as well as 200,000 tons of rice. They also decided that wheat imports would start in two months.

In return, Pakistan would purchase iron ore from Iran for state-owned Pakistan Steel Mills, a financially-troubled industrial giant because of acute shortage of raw material and other problems. Pakistan also agreed to import fertiliser to meet domestic demand and arrest rising prices.

Published in The Express Tribune, July 20th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ