SBP devising new microfinance strategy

SBP is working on a new microfinance strategy with a greater focus on inclusive financial services.

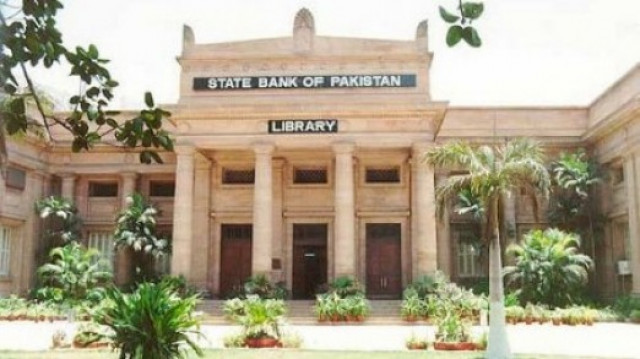

This was revealed by Acting Governor of SBP, Yaseen Anwar, at the Swiss Agency for Development and Cooperation Partnership for Microfinance Experience Sharing event here on Wednesday.

He said the new strategy will strengthen industry fundamentals by developing infrastructure required for sustainable and inclusive growth.

“The new strategic framework is intended to help the sector get back on its growth trajectory while stressing on new initiatives in the areas of deposit mobilisation, upscaling loan sizes, developing partnerships and encouraging successful provincial and regional Microfinance Banks and Microfinance Institutions (MFBs and MFIs),” Anwar said.

Inadequate deposit mobilisation is one of the main factors behind the stagnation, he said, adding that given the sector’s dependence on wholesale credit lines, rising interest rates created difficulties for MFBs/MFIs in terms of access to commercial debt.

He observed that growth in the microfinance sector that accelerated in 2007 and 2008 at an average rate of 43 per cent per annum has remained stagnant for one and a half years as the industry lacks the capacity to benefit from recent policy and support measures.

Noting the sector’s potential, he added, “the microfinance sector has come a long way from its humble beginnings which is reflected by the number of MFBs and overall outreach. However, given the fact that the sector caters to less than 10 per cent of the potential market, there is a need for better understanding of the underlying issues and a coherent policy response.” He said the next two years are likely to be a crucial period for individual institutions and for the microfinance industry as a whole. “This scenario will allow strong institutions to stand out,” he said and added that the critical success factors for organisations will be institutional dynamism, organisational structures and managerial capacity.

Recounting the several initiatives taken recently by the State Bank for promoting the microfinance sector, he said the SBP has facilitated legal amendments offering fiveyear income tax holidays and allowed home remittance business to MFBs, amongst provisions for flexibilities in collection systems, loan limits and borrowers’ income eligibility.

Anwar also mentioned that a Microfinance Credit Guarantee Facility (MFCG) worth £10 million is now in place. The facility is aimed at increasing wholesale funds for MFBs and MFIs.

He congratulated the Swiss Agency for Development and Cooperation (SDC) for successfully completing its partnership with State Bank of Pakistan and the leasing sector, and bringing the microfinance and leasing sectors together to share their experience of the partnership.

Published in The Express Tribune, August 19th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ