This, according to analysts, indicates that overall economic recovery is still in its nascent stages.

Large Scale Manufacturing numbers grew visible, showing an uptick in the private sector. Its offtake increased to Rs29b in the first quarter of the current year.

Excess liquidity continues to be parked in investments. Deposits jumped by 2.3 per cent in line with improving Net Domestic Assets and provisions rose by 13.5 per cent.

Excess liquidity continues to be parked into investments

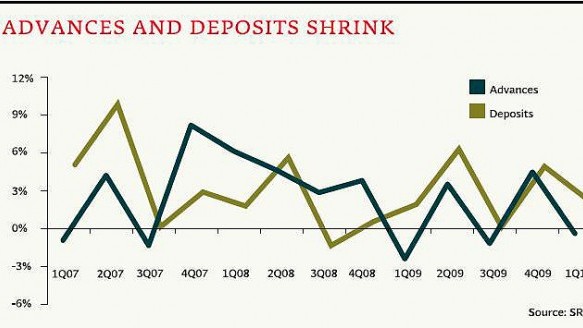

The industry grew 2.3 per cent in the first quarter of 2010, more than that in the same period in 2009 and 2008, when base deposit grew by 1.9 per cent and 1.8 per cent respectively. The jump is attributable to Net Domestic Assets, which increased by Rs28.7b (2.3 per cent) in the first quarter of 2010.

Investments up 3.7% to Rs1.7trn

Banks continue to direct excess liquidity from the growing deposits towards investments which rose 3.7 per cent to Rs1.7t ($20.2b) in the first quarter of 2010. A cautious lending strategy coupled with stricter requirements has led banks’ managements to adapt such an approach, according to JS Global, analyst, Mustafa Bilwani.

Gross advances decreased 0.5 per cent and provisions were up nine per cent. Advances dipped by 0.5 per cent to Rs3.2t ($38.7b), in contrast to deposit performance.

This was better when compared to a drop of 2.5 per cent in the first quarter of 2009, though not good when compared to the jump of 6.1 per cent seen in the first quarter of 2008, said Bilwani.

High interest rates and stringent lending procedures have contributed to the dismal advances performance in the first quarter of the calendar year.

Provisions on the other hand rose by Rs25b in the period, which could hurt earnings in first quarter of 2010.

Total flow of credit to private sector in FY10 stands at Rs138b as of March 27, 2010. However, an encouraging pick up is being witnessed in offtake to the private sector which increased by Rs29bn in the first quarter of 2010.

1723278472-0/BeFunky-collage-(4)1723278472-0-165x106.webp)

1732530440-5/Copy-of-Untitled-(85)1732530440-5-270x192.webp)

1732525382-0/Express-Tribune-(10)1732525382-0-270x192.webp)

1732523977-0/Copy-of-Untitled-(82)1732523977-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ