Flash flooding the economy

Analysts have been able to formulate some crude estimates of the effect of the floods on the country.

Concerns are that the flood will damage installations like refineries, power providers, cement and fertiliser plants. However infrastructure losses for power transmission and distribution, banks and telecommunication sector remain to be seen. Industry representatives are assuring analysts that this will not have any major impact, though the infrastructure has taken a hit and the supply from these installations will be affected for some time.

KASB Securities analysts estimate that their predicted GDP growth of four per cent could be affected by as much as 20 to 30 basis points. While the CPI, an indicator of inflation with food weighing in at 40 per cent, will feel the impact of agricultural losses.

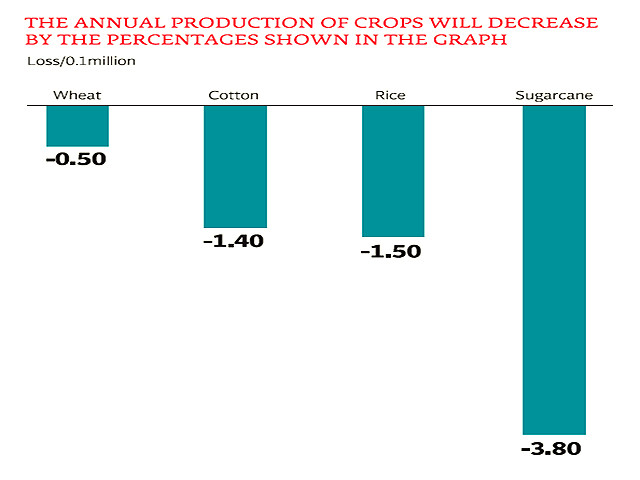

Agricultural output, particularly cotton, vegetables, sugarcane and livestock, for the fiscal year 2011 could be affected. Analysts are waiting for the release of official numbers by the Ministry of Agriculture. But initial estimates indicate that for every 0.1 million acres lost to floods, annual production of cotton would be lowered by 1.4 per cent, sugarcane production would decline by 3.8 per cent and rice would take a hit of 1.5 per cent.

Identifiable losses remain limited on the corporate front for now, but four oil and gas fields have shut down, but their closures are expected to have an insignificant impact on the earnings of the Oil and Gas Development Company (OGDC) and Pakistan Petroleum Limited (PPL) for the fiscal year 2011.

The Exploration and Production Sector

According to OGDC management, Qadirpur gas field is currently working and safe as the flood has not passed yet, likely to cross in next 24 to 36 hours. However, some fields like Chanda; located in Khyber-Pakhtunkhwa, Mela and Nashpa; between Punjab and Khyber-Pakhtunkhwa, are not working at the moment due to floods. Similarly, Bela which is being operated by Pakistan Oil Fields (POL) has stopped production.

Cement: Maple, DG Khan, Dandot and Cherat

With the intensity of the flood being highest in the northern areas, investor community is concerned that the high intensity flood may have damaged cement facilities located in K-P and Punjab. These include Maple leaf Cement, DG Khan Cement, Dandot Cement and Cherat Cement. These plants are working properly although some initial affect were seen affecting roads and other infrastructure.

Fertiliser companies and Refineries

Parco which is the largest refinery complex in Pakistan and located near Muzaffargarh, Gujrat is also near flood belt. According to our discussion, the plant is currently safe but there could be risk in case the flood changes its path.

Kot Addu Power: Risk nearby

As far as power installations are concerned, most of them are safe. However, Kot Addu power which is one of the largest IPP is currently at high risk, says Topline Securities’ analyst, Farhan Mahmood. This plant is actually five kilometres from Kot Addu. Currently, the plant is working however; there is a risk that the water may come inside the plant vicinity causing it to shut down. The flood is almost one kilometre away from the locality.

Published in The Express Tribune, August 5th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ