Purchasing power: Inflation rises to 11.1% in February

Higher international oil prices, bad fiscal discipline blamed for the uptick in CPI.

International oil prices and the government’s deteriorating fiscal position have begun to take their toll on the purchasing power of the rupee, with inflation clocking in at 11.1% for the month of February, according to data released by the Pakistan Bureau of Statistics.

The consumer price index rose by 11.1% in February compared to the same period last year, a sharp rise over January, when inflation clocked in at 10.1%. The figure is expected to be even higher for the month of March, as the government’s actions on Wednesday to allow price rises in electricity and gas begin to take their toll on the cost of goods and services produced in the economy.

Core inflation – which measures inflation without the seasonally volatile food and energy prices – was also up for the month of February, clocking in at 10.6% compared to 10.2% in January. Core inflation is seen as a more reliable barometer of the purchasing power of the rupee and has been in double digits for the last seven months.

“The [rise in] inflation was fuelled by rupee depreciation and an increase in oil prices as almost all other factors remained neutral,” said Asad Sayeed, an economist at the Collective for Social Science Research, a Karachi-based think tank. He also said that the outlook on inflation was dismal.

International oil prices have been rising over fears of a potential conflict in Iran that may close off the Straits of Hormuz, through which almost a fifth of the world’s oil passes. Independent analysts who spoke to The Express Tribune said they see no let up in the price of oil on the global market in the coming months.

Another reason experts pointed to was the government’s failure to curb its deficit, which has led the government to simply print money to pay its bills, an inflationary act. During the first seven and half months of the fiscal year ending June 30, 2012, the federal government borrowed Rs674 billion from the State Bank of Pakistan – a macroeconomic euphemism for printing money – an amount that is higher than the government’s borrowing from the SBP during the entire fiscal year 2011.

The monthly average for inflation from July to February came out to 10.8%. The government is targeting an annual inflation rate of 12% or lower. In a written statement submitted to a parliamentary committee on Thursday, the State Bank of Pakistan expressed optimism that the government might just be able to meet that target, despite rising energy costs and a phasing out of the base effect that came with the rebasing of the CPI.

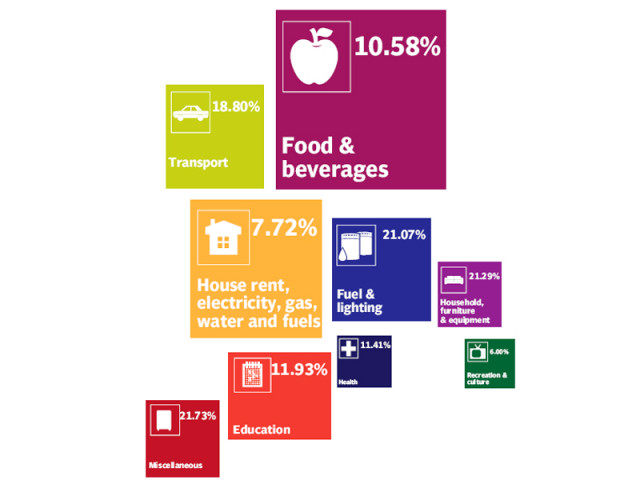

Food prices actually declined by an average of 0.8% during the month of February, but were up by about 10.6% compared to the same month last year. PBS does not break out energy prices separately, lumping them in with housing and water. That category saw an increase of 7.7% in February, compared to last year. Transportation costs, however, rose by an annualised rate of 18.8% in February.

Published in The Express Tribune, March 2nd, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ