A breach of trust

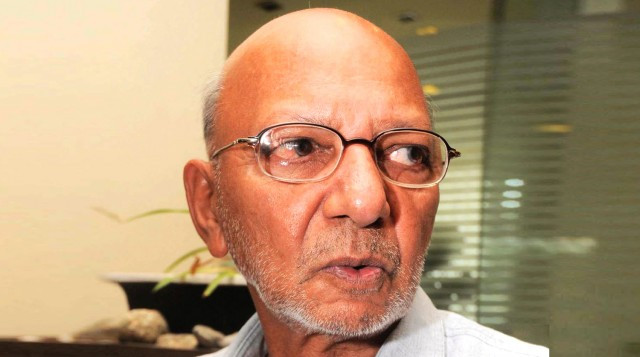

Anwar Hussain believes he made a mistake by not reading the small print but is certain that what the brokerage did was wrong.

A breach of trust

On July 17, 2008 Anwar watched dozens of angry investors protesting against plunging stock prices, ransack the exchange. But Anwar, who takes pride in his sensible and conservative investment style, was safe. Months later when the imposed floor on the indices was removed and trading resumed with share prices at much lower levels, Anwar was still afloat.

But in October 2009, he was not so lucky. He was blind-sided not by the market, but by his broker. A local brokerage house that Anwar had been investing through had pledged his shares in return for financing, without informing him.

The problem emerged when Anwar requested his broker to sell some of his shares. The broker advised him to continue holding the equity, telling him that there would be good news for him soon. After Anwar had watched the price of the same holding fall for a number of days, he insisted that the broker make the sale.

But to his surprise, the dealer persisted, and told him that he should wait longer. “I started wondering why Azee was reluctant for me to trade in these shares because their revenue is from commissions so they should have been happy to buy and sell for me. I decided to request Azee to immediately transfer all my shares held in their sub-account to my own CDC account,” said Anwar. In fact Anwar made similar requests on the 5th and then the 14th of November, but the broker paid no heed.

On 21st November, Anwar lodged a complaint with the KSE against the brokerage firm. But to his surprise, this did not compel the broker to transfer his shares to his sub-account. Documents received by ET show that the KSE management issued five notices to Azee Securities between December 2, 2009 and February 9, 2010. After a delay of 5 months, Azee Securities finally transferred Anwar Husain’s shares to his CDC account.

Anwar has now filed a complaint against his former broker with the SECP. But even he realizes that the brokerage firm was well within its legal right to pledge his shares without his knowledge. One of the clauses in the relationship agreement he had signed read, “The account holder hereby unconditionally and irrevocably authorize to pledge his/her/their book entry securities in favor of eligible pledgees”. “Having signed a contract without reading it first, I admit I made a grave mistake” acceded Anwar, “but I am sure that if not legally, then morally and ethically they are wrong”.

When contacted by ET, Director Azee Securities Ghazi Naseem only commented that “these shares have been returned to the client’s CDC account according to their request”. Similarly, when ET contacted the Customer Services & Investor Relations Department at KSE, the officer refused to identify himself but responded that “the shares have been transferred and a letter was sent to Mr. Husain on March 5th, 2010”. Explaining the delay, he added, “processing this complaint took time because there are some formalities that every institution must follow. We issued repeated reminders to Azee Securities”.

Anwar’s complaint is now pending with the SECP. But industry insiders say that Anwar Hussain’s debacle is not unique. According to Head of Sales at Al-Habib Securities Ali Khan, “there are thousands of investors that have been affected by the actions of some unethical brokers. Billions of rupees in losses were suffered by investors when the stock market crashed in 2009”. He says that the true extent of such losses cannot be known because “many clients were themselves investing black money and ill-gotten gains in the market, so when they lost their money they could not go file cases against brokers that pledged their shares without their permission”.

Nowadays, the market is abuzz about the introduction of a new leverage product for stock investors. Karachi Stock Exchange management, representatives of brokers, the Securities and Exchange Commission of Pakistan and the government are all engaged in dialogue to establish rules for this new product. Experts say there is an urgent need to ensure that the new product is more transparent and that clients should be made more aware of the use of their share holdings and funds by brokers. Ali Sheikh comments, “most importantly, customers should be linked directly to financiers. This way those who are lending funds will be able to decide themselves whether or not they want to provide financing to an individual”.

The words of Anwar Husain echoed the voice of innumerable small investors. He said, “KSE should monitor brokers and make rules that ensure that small investors are not left high and dry by the under-handed tactics of brokers. If people like me continue to suffer, no new product or service will revive investors’ confidence.”

Published in The Express Tribune, July 12th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ