Repatriation jumps 115% YoY in April

Soars to $121.5m, down 23.1% MoM; hits $1.83b in 10MFY25

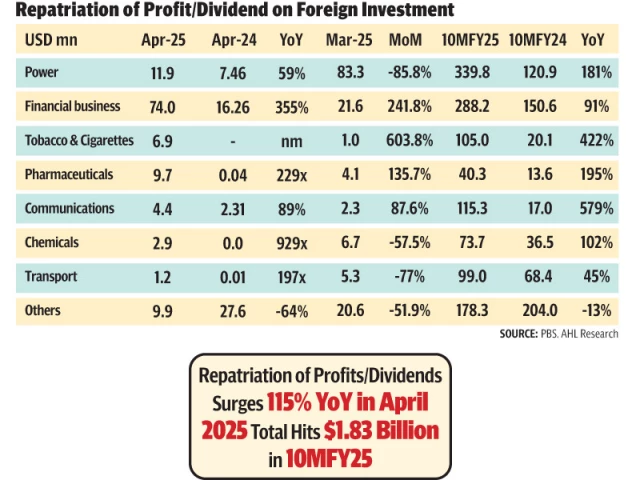

The repatriation of profits and dividends on foreign investments in Pakistan saw a significant increase in April 2025, rising by 115% year-on-year (YoY) to reach $121.5 million, according to data released by the State Bank of Pakistan (SBP).

Despite the strong YoY growth, the figure was down by 23.1% compared to March 2025, when the outflows stood at $157.9 million, according to Arif Habib Limited (AHL).

Cumulatively, during the first ten months of FY25 (July to April), total repatriation of profits and dividends amounted to $1.83 billion, marking a robust 107% YoY increase from $882.6 million recorded in the same period of FY24. This surge reflects improved investor confidence, a relatively stable currency environment, and easing foreign exchange restrictions, which have allowed multinational companies to remit earnings more freely.

In terms of sectoral performance for April 2025, the financial business sector led with $74.0 million in outflows, registering a 355% YoY and 216% month-on-month (MoM) increase. Communications followed with $4.4 million, up 89% YoY. The power sector recorded $11.9 million in repatriation, a 59% YoY increase, though this was a steep 85.8% drop from the previous month's $83.3 million. The pharmaceutical and over-the-counter (OTC) segment also performed strongly, with outflows of $9.7 million, up 229 times compared to the previous year. Other notable sectors included tobacco and cigarettes ($6.9 million) and beverages ($0.2 million), both of which saw notable recoveries from previous lows.

Head of Sales at Insight Securities, Ali Najib, said the surge was mainly driven by the financial business sector. This reflects improving investor confidence and FX accessibility. Notably, sectors like communications, food, and pharmaceuticals also saw substantial YoY increases, while oil and gas, cement, and others declined. Data indicates high volatility, peaking in May 2024 at $918 million, with subsequent moderation, he added.

Conversely, several sectors underperformed. Repatriation from oil and gas exploration plunged 92% YoY to just $0.1 million. The cement sector recorded no outflows during the month, down from $1 million in April 2024. The "others" category also declined by 64% YoY, with $9.9 million repatriated.

Over the 10MFY25 period, financial businesses topped the list with $288.2 million in total repatriation, followed by the power sector at $339.8 million, a massive 1816% increase from the prior year. The food sector also saw substantial growth, reaching $291.1 million in repatriation, up 1671% YoY. Other key contributors included communications ($94t.6 million), oil and gas exploration ($109.3 million), and tobacco ($105 million).

The monthly trend shows that repatriation peaked in May 2024 at $918 million, driven by improved macroeconomic indicators and a backlog of previously delayed remittances. Since then, the trend has moderated, with April 2025's $121.5 million reflecting a partial rebound in activity following a dip in the earlier months of the year.

Analysts attribute the rise in repatriation to the ongoing IMF programme, improved foreign exchange reserves, and easing restrictions on dollar outflows. The pace of future repatriations will depend on global interest rate trends, domestic economic stability, and investor sentiment.

Repatriation is an indirect indicator that foreign investors have confidence in Pakistan's economy and are ready to invest in the country. Growth for FY25 has been revised down to 2.6% due to weaker-than-expected performance in H1 and persistent global uncertainty. However, recent monetary easing is anticipated to support a rebound in economic activity in the second half of the fiscal year and beyond. Inflation projections for FY25 have also been revised downward, but temporary increases are expected in the near term due to adverse base effects.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ