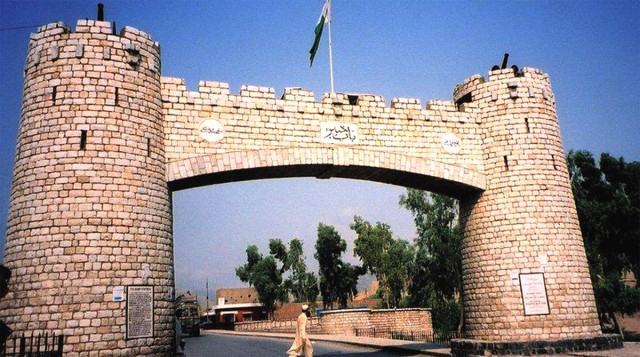

K-P pioneers Pakistan's first cashless economy with new digital payment system

Cashless Khyber Pakhtunkhwa" aims to modernize financial transactions by requiring all payments to be digital.

The provincial administration of Khyber Pakhtunkhwa (KP) announced that it has developed a strategy to launch a universal digital payment system, becoming the first province in Pakistan to establish a cashless economy for both business and financial transactions.

The “Cashless Khyber Pakhtunkhwa” initiative aims to modernize financial transactions by requiring all public and private payments, ranging from small business dealings to large-scale financial operations, to be conducted digitally.

The strategy includes a phased implementation, with specific responsibilities assigned to various government departments, institutions, and district administrations, all operating under set timelines.

In partnership with mobile wallet service providers, the system will be designed to work offline, ensuring accessibility in remote areas.

"The province has decided to launch a universal digital payment system for all types of transactions and business payments," the KP government said in a statement. "A detailed implementation strategy has been finalized."

As part of the initiative, the government will collect data on all commercial entities, including small shops, street vendors, and stalls at the village council level, ensuring their integration into the new digital framework.

Chief Minister Ali Amin Gandapur has ordered the immediate rollout of the system and directed the Chief Secretary’s Office to oversee compliance.

“KP will be the first province in Pakistan to introduce a cashless system,” Gandapur said. “This initiative will help promote the digital economy, enhance financial transparency, and eliminate fraud and corruption.”

Under the Cashless Khyber Pakhtunkhwa program, all businesses, public transport services, and commercial establishments will be required to display QR codes for digital payments. A robust regulatory framework will be implemented to ensure effective enforcement.

To assist businesses and citizens in transitioning to the new system, the KP administration has planned public awareness campaigns, training programs, and support services.

Gandapur emphasized that the digital payment system will not only foster fintech solutions and improve economic security, but will also facilitate better tax collection and create a more business-friendly environment in the province.

“The introduction of a digital payment system will encourage private investment and align KP with international digital financial standards,” he added.

COMMENTS (3)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ