Consensus eludes revival of real estate sector

PM defers decision on tax relief for ailing sector

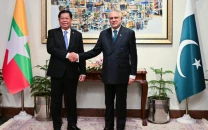

Prime Minister Shehbaz Sharif has deferred a decision on a tax incentive package to revive the real estate sector, as the issues of giving subsidy to boost construction activities and an amnesty on disclosing source of income remain undecided.

Once again, the tax authorities opposed the proposal from a businessman to give Rs50 million equivalent amnesty to first-time home, shop or office buyers due to a constant ban by the International Monetary Fund to give amnesty.

The housing sector task force met with Prime Minister Shehbaz Sharif on Friday and shared with him the recommendations to reduce property transaction taxes and abolish the federal excise duty; the government sources told The Express Tribune. Even a filer pays about 8% of the value of the property in taxes on the purchase of property.

There was a consensus on lowering the taxes by and large, but the key issues remained undecided, the sources added.

The FBR chairman backed the proposal to abolish the 3% federal excise duty and said that the "unjustified" levy has already been disputed by the taxpayers and the matter is also agitated in courts. The FBR is demanding 3% duty on homes that were built in the past and have been sold more than once which is beyond the scope of law.

The prime minister has tasked Minister for Economic Affairs Ahad Khan Cheema to fine tune the package, besides taking the IMF on board, said the sources.

The meeting discussed lowering taxes on property sale and purchase, abolishing federal excise duty, whether to give interest-rate subsidy to take loans for home construction and should the first-time buyer be given the Rs50 million worth amnesty on an unexplained income, according to the people privy to the discussions.

Some members of the task force expressed concerns that the incentive package may result in parking money in the real estate sector and can again fuel the speculative activities.

Arif Habib, Pakistan's one of leading businessmen, suggested that the first-time home buyer should not be asked the source of income of up to Rs50 million. However, FBR Chairman Rashid Langrial opposed the proposal and said that it would be tantamount to giving tax amnesty, which the IMF would not allow.

Due to the large size of the informal cash-based economy, the corporate sector and banks are reluctant to undertake major construction projects, explained Arif Habib. He said that his proposal did not strictly fall in the definition of the amnesty as it would be limited only to the first-time genuine buyers.

The large size of the informal economy is resulting in either declaring the values of the property at lower than actual price or the people use cash to avoid scrutiny.

The prime minister instructed that the government officials should sit with Arif Habib and aim at finding a solution. It emerged from the meeting that the business community would meet with the IMF next month to take up the Rs50 million amnesty scheme agenda for a discussion.

"It seems that there is a consensus on givig relief to the real estate sector," FBR Chairman Rashid Langrial said last week in a meeting of the National Assembly Standing Committee on Finance that had deferred the legal amendment requiring upfront disclosure of the source of buying the property.

The housing sector task force had been constituted by the prime minister after the real estate sector activities slowed down due to heavy taxes and the overall slugging economic growth. Pakistan's economy grew at only 0.9% rate in the first quarter of this fiscal year.

The prime minister expressed the desire that the real estate sector package should aim at promoting the construction and economic activities in the country.

The meeting discussed giving interest rate subsidies to enable the lower and middle-income groups to take bank loans for home construction. The Economic Affairs Minister has been asked to come up with the recommendations by next week.

Former prime minister Imran Khan had also given the interest-rate reduction subsidy for the lower middle-income group, which helped many to have their own shelter. The central bank has set the policy rate at 12% but the home loans are still very expensive ranging over 17%.

The prime minister has not yet made a move to lessen the fiscal woes of the salaried class, which paid Rs285 billion in income tax during July-January period of this fiscal year. The Rs285 billion payments are Rs100 billion more than the last year. This is also much more than the government's annual target of additional tax collection from the salaried class.

The National Assembly Standing Committee on Finance this week delayed the approval of an amendment bill, which proposed a ban on the purchase of properties without upfront disclosure of the source of the money for buying the asset. The delay in the approval of the Tax Laws Amendment Bill provided a major relief to the realty sector that could now undertake property transactions without the requirement of upfront disclosure of the source of the purchase.

The government official said that no relief package for the real estate sector has been finalized and the consultations with the provinces and the IMF have also not yet commenced.

The real estate sector largely remains unregulated. Vast fertile agricultural lands are converted into housing societies; many of those do not have regulatory approvals and are doing illegal business. There is also more availability of plots in the market than the actual demand due to very high prices.

There is also an issue of overselling of apartments and the plots and the solution to this is to allow the construction projects investment through escrow accounts.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ