KE seeks NEPRA nod for Rs68b write-offs

Utility defends claims; stakeholders voice concerns over consumer impact, call for regulatory framework

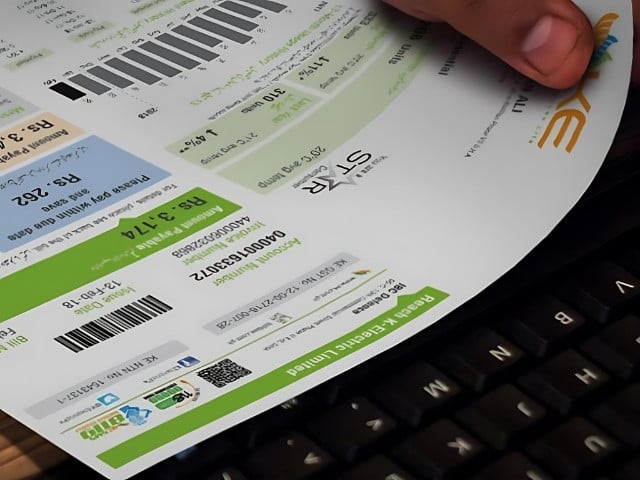

K-Electric's plea for Rs68 billion in write-off claims dominated a recent hearing convened by the National Electric Power Regulatory Authority (Nepra), highlighting the financial hurdles and operational complexities of managing Karachi's power supply. The claims span multiple fiscal years under the utility's Multi-Year Tariff (MYT) framework, underscoring challenges unique to the city's socio-economic landscape, according to a statement issued Tuesday.

The write-offs stem from Nepra's 2018 decision, which introduced a mechanism for recovery loss provisions. The utility reported Rs119 billion in bad debts in its audited accounts but sought Nepra's approval for Rs68 billion, citing rigorous internal and external verifications.

A focal point of the hearing was whether write-offs from FY2016, under a prior MYT regime, could be considered in the current tariff period. KE argued that these claims represent legacy liabilities rather than current receivables and maintained that Nepra's guidelines do not restrict claims to specific fiscal years. KE CEO Moonis Alvi called for policy consistency to ensure fairness, the statement noted.

Nepra scrutinised KE's recovery efforts, including disconnection drives, external agency engagements, and instalment payment schemes. While KE's recovery rate peaked at 95.4% in FY2022, macroeconomic instability and tariff hikes have since undermined these gains. Illegal reconnections and the city's dense socio-economic fabric continue to pose significant recovery challenges.

KE assured regulators that its claims exclude double-dipping, explaining that doubtful debt provisions were not factored into its operations and maintenance (O&M) costs under the MYT framework. The utility explained that the claims strictly pertain to unrecovered billed amounts verified through exhaustive procedures.

The enduring issue of illegal "hook" connections in unauthorised settlements also emerged during discussions. KE stated it had reduced hook connections from 4% to 0.2% but admitted that certain areas remain problematic due to a lack of regulatory enforcement. The utility clarified that write-offs relate exclusively to billed amounts and not to unbilled energy theft, which it handles separately.

Nepra officials raised concerns over verification mechanisms to avoid duplication and pressed for clarity on KE's disconnection and recovery policies. KE outlined its theft deterrence measures, such as aerial bundled cables, and defended its approach by citing international regulatory practices, which often allow similar provisions for utilities operating in complex urban environments.

Stakeholders expressed mixed opinions during the hearing. Some warned against passing write-off burdens onto consumers already facing steep electricity tariffs. Others advocated for a transparent and consistent regulatory framework to address legacy financial issues.

As the hearing concluded, KE reaffirmed its commitment to operational improvements and reiterated that its claims align with Nepra's stipulated conditions. The utility emphasised that the resolution of such claims is crucial for ensuring financial sustainability in Pakistan's power sector, according to the statement.

The outcome of Nepra's deliberations is expected to set a significant precedent for addressing fiscal challenges in the energy sector.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ